The Gap Between COP30 and International Emission Reduction Consensus

COP30, which concluded late last year, achieved a certain degree of consensus on climate adaptation issues. However, on core topics such as emission reduction pathways and fossil fuel phase-out, the overall outcomes remained conservative. Before the conference, the EU and many countries pushed for a clear roadmap for "phasing out fossil fuels," but the final agreement text did not include such language.

International consensus largely remained at "voluntary acceleration of climate action," reaffirming the direction of "gradual transition away from fossil fuels" proposed at Dubai COP28 in 2023. COP30 adopted Mutirão as its summit slogan—a word from the Tupi-Guarani language meaning "collective effort"—symbolizing that countries must still drive emission reduction through cooperation mechanisms without mandatory constraints, while attempting to limit global warming to within 1.5°C above pre-industrial levels.

Source: PBS News

A few substantive advances emerged in methane control. Seven countries—the UK, France, Canada, Germany, Norway, Japan, and Kazakhstan—signed a declaration committing to achieving "near-zero" methane emissions in the fossil fuel industry, demonstrating that international cooperation remains viable for specific high-impact gases.

NDC 3.0 and Global Emission Reduction Progress

2025 marks the tenth anniversary of the Paris Agreement, prompting the international community to review global warming control progress. Based on current emission trends and policy intensity, both the 1.5°C and 2°C warming control targets face significant challenges and are difficult to achieve.

Under the Paris Agreement, all parties must update their Nationally Determined Contributions (NDCs) every five years. Therefore, 2025 has become a critical point for countries to submit NDC 3.0. Taiwan's Ministry of Environment also proposed its "2035 NDC" in November 2025, setting targets of 28%±2% emission reduction by 2030 and 38%±2% by 2035, based on 2005 levels—second only to Japan in Asia, comparable to South Korea.

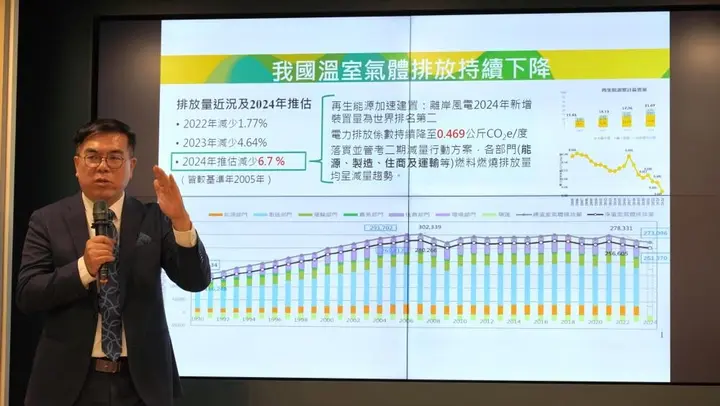

Source: Ministry of Environment, Climate Change Administration

Looking at actual performance, Taiwan's emission reduction achievements have gradually emerged. Compared to the base year, reductions were 1.77% in 2022, 4.64% in 2023, and an estimated 6.7% in 2024—showing significant improvement for three consecutive years, second only to Japan in Asia. However, a considerable gap remains to the 2030 target, and subsequent reduction intensity will need to increase further.

Globally, the gap is even more severe. According to the World Resources Institute (WRI), current NDC 3.0 submissions indicate only about 3.4 billion tons of additional CO₂e reduction by 2035 compared to 2030, leaving an approximately 27.8 billion tons CO₂e gap from the 1.5°C pathway.

The Real Impact of CBAM and Taiwan's Carbon Fee System

2025 is considered the "preview year" for Taiwan's carbon fee system. Enterprises were required to complete 2024 emission declarations by May last year without paying fees, aimed at helping enterprises familiarize themselves with the declaration process and assess potential cost impacts. Enterprises wishing to apply for preferential rates must submit and pass a "voluntary reduction plan" with the Ministry of Environment in advance.

Starting from 2026, enterprises will officially fulfill carbon fee payment obligations based on 2025 actual emissions and approved rates.

Source: Ministry of Environment, Climate Change Administration

Simultaneously, the EU Carbon Border Adjustment Mechanism (CBAM) will enter its charging phase in 2026. Previously only requiring declaration of embedded emissions, from 2026, high-carbon products such as steel, aluminum, cement, and fertilizers exported to the EU will need to purchase CBAM certificates to offset carbon costs, with certificate prices linked to EU ETS.

Although enterprises can apply for partial offsets through proof of carbon price payment in Taiwan, given the significant price difference between Taiwan's carbon fee and EU carbon prices, most export-oriented enterprises will still bear additional costs, creating real pressure on product pricing and market competitiveness.

Three Key Aspects of Enterprise Transformation and Strategic Planning

With limited progress in international emission reduction consensus but continued escalation of regulatory tools, enterprises need to proactively plan transformation pathways rather than passively respond to policy requirements. Based on international trends and consulting experience, enterprises are advised to focus on the following three aspects:

1. Establish Carbon Data Governance Mechanisms

Under CBAM and carbon fee systems, carbon data is no longer just disclosure information—it directly affects enterprise costs and profits as an "endogenous financial risk." Without a sound data governance framework, multiple risks may arise:

- Rising Carbon Costs: When unable to provide third-party verified actual emission data, enterprises may be forced to adopt highly unfavorable default values, amplifying carbon costs.

- Scope Expansion and Data Integration Difficulties: As inventory scope gradually expands, manual compilation can no longer support decision-making and risk assessment needs.

Increased Traceability and Auditability Requirements: Emission factors and calculation logic must be traceable, otherwise it will be difficult to respond to CBAM and other subsequent declaration and verification requirements.

2. Product Design and Supply Chain Decarbonization

Most product carbon emissions come from raw materials and upstream supply chains. Taiwan's industries are at key nodes in global supply chains, and supply chain decarbonization has become a core condition for export competitiveness.

Enterprises are advised to re-examine procurement and product design decisions from a "Total Cost of Ownership (TCO)" perspective. While low-carbon materials may have higher initial costs, when carbon fee reductions and CBAM certificate costs are factored in, long-term overall costs and market competitiveness may actually be more advantageous.

3. Leverage Government Resources for Transformation

For SMEs with relatively limited resources, government subsidies are important leverage for driving "digital × low-carbon" dual-axis transformation, including:

Digital transformation subsidies for enterprises with fewer than 30 employees: Up to NT$100,000, applicable for cloud system implementation, AI, or carbon inventory training.

Source: Ministry of Economic Affairs

- R&D and Process Upgrade Programs: Through SBIR, CITD, and other programs, support new product development, process optimization, and energy-saving equipment implementation.

Industry Alliance Programs: Encourage large enterprises to lead SME suppliers in jointly addressing supply chain carbon footprint issues.

Just Transition Cannot Be Ignored

Source: Gemini

During transformation, enterprises must also pay attention to just transition issues. Under the Climate Change Response Act, the National Development Council coordinates just transition to ensure the transformation process does not excessively impact workers and vulnerable groups. Enterprises should pay special attention to:

- Workforce Transition: In coordination with industrial restructuring, work with the government to promote retraining and help workers acquire skills needed for low-carbon industries.

- Rights of Vulnerable Groups: Assess the external impacts of transformation policies, focusing on workers, indigenous peoples, and rural communities.

- Social Communication Mechanisms: Through transparent data disclosure and stakeholder participation, reduce transformation resistance and build social trust.

In summary, although international climate governance still shows gaps and uncertainties in consensus building and implementation strength, enterprises face regulatory systems and cost mechanisms that have already been implemented across countries, along with Taiwan's institutionalized and long-term policy direction on carbon fees and emission reduction targets. The carbon costs and compliance pressures enterprises bear will gradually increase over time.

In this context, emission reduction is no longer just a passive response to regulations—it is a critical business issue affecting enterprise cost structures, product competitiveness, and market positioning. If enterprises continue to handle carbon management through short-term responses or fragmented projects, they will struggle to withstand the transformation risks from simultaneous pressure of CBAM, carbon fees, and supply chain requirements. Conversely, establishing carbon data governance mechanisms early, identifying specific emission reduction pathways, and incorporating low-carbon strategies into product design and supply chain decisions will not only help reduce future compliance costs but also secure more resilient competitive positions in international markets.

Overall, proactive planning for emission reduction and net-zero transformation is no longer just a demonstration of environmental responsibility—it is a necessary choice for enterprises to enhance operational stability and long-term value in an era of uncertainty.