As sustainability work enters the governance deepening phase, what challenges do companies really face?

Disclosure frameworks continue to update, ESG rating indicators are becoming increasingly detailed, and scrutiny from internal audits and third-party verification intensifies year after year. Yet sustainability departments struggle to grow proportionally in staffing. At this point, companies are realizing that the issue is no longer about "whether we can complete a report," but rather:

- Whether materiality decisions have consistent, traceable foundations

- Whether ESG data can accumulate across years, rather than being rebuilt annually

- Whether sustainability information is formally incorporated into internal control and governance processes

- Whether ESG rating (formerly: corporate governance evaluation) can be prepared in advance, rather than supplemented afterward

The Association of Chartered Certified Accountants (ACCA) survey focuses on internal control issues of sustainability data, indicating that "traceable, auditable, and trustworthy" has become the governance baseline for listed companies.

Looking ahead to 2026, the market expects sustainability disclosure to become more quantified and standardized. This feature release strengthens the sustainability performance management platform's support capabilities during the governance deepening phase, while reducing manual workload through sustainability AI tools.

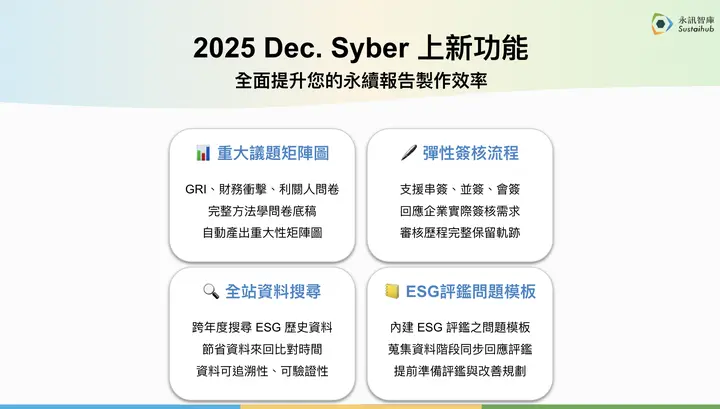

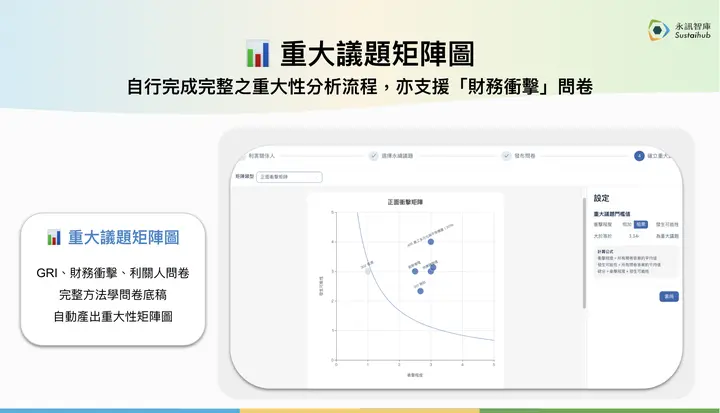

Feature 1 | Materiality Analysis Module: Complete GRI Materiality Analysis & Survey Templates

After sustainability governance matures, materiality analysis often becomes the most frequently questioned aspect in verification and evaluation.

Many companies have completed the analysis but struggle to clearly explain: Why were these topics determined to be material? Are the decision bases logically consistent?

The "Materiality Analysis Matrix Output" feature launched in December, combined with common material topic methodologies, helps companies complete the materiality identification process in a systematic way. The system supports simultaneous collection of the following three modules:

- Stakeholder concern levels

- Positive and negative impact levels of sustainability topics

- Financial impact levels of sustainability topics on the company

In operation, users can select common stakeholders based on organizational context, choose industry sustainability topics, and specify GRI topics to survey.

The system supports publishing internal and external survey questionnaires, including stakeholder concern levels, positive and negative impact assessments, and financial impact questionnaires. Finally, results are automatically compiled to establish material topics and generate impact matrix charts and material topic management guidelines that can be directly used in sustainability reports.

💡For listed companies, this is not just an efficiency improvement—it makes materiality analysis a verifiable and auditable governance process, significantly reducing the costs of supplementary documentation and repeated explanations.

Feature 2 | Flexible Approval Process: Formally Incorporating Sustainability Information into Internal Control and Corporate Governance Systems

As sustainability information begins to be scrutinized by boards, audit committees, and internal audit units, relying solely on informal confirmations or email exchanges can no longer support governance requirements.

The flexible approval process launched this time allows companies to design the most suitable review method based on topic nature and risk level:

- Sequential approval: Hierarchical review process, suitable for chapters requiring strict control

- Parallel approval: By role group, any member can represent the review

- Joint approval: Multiple reviewers at the same stage must all complete the review

Users can set chapters corresponding to review items, reviewers, and deadlines, with complete history records preserved.

💡For listed companies, this means sustainability data is no longer just report content—it's governance information formally incorporated into the internal control system, effectively supporting internal audits and third-party verification.

Feature 3 | New ESG Rating Suggested Questions: Supporting 2025 Latest FAQs

Supporting the Taiwan Stock Exchange's 2025 latest announced "ESG Rating" FAQ templates. For staff who have filled out evaluations for multiple years, the real challenge lies in "ensuring responses to every indicator and requirement."

The ESG Rating Suggested Questions feature added in December enables companies to cross-reference ESG rating indicator content during the data collection and report editing stages. The system provides corresponding suggested questions in collection forms and report editing screens, helping staff review disclosure completeness and plan sustainability improvement directions for the coming year in advance.

💡With sustainability AI tool assistance, companies can embed the evaluation perspective into daily operational workflows, gradually accumulating sustainability achievements.

Feature 4 | Site Search: Making Multi-Year ESG Data Truly Usable Governance Assets

As sustainability work accumulates year by year, companies often don't lack data—they "have too much data but can't find it."

When executives, verification units, or investors ask about past disclosure bases unexpectedly, sustainability staff often spend significant time searching through historical files, spreadsheets, and email records.

The site search feature launched supports rapid searching with direct links to data sources:

- Historical collection form responses

- Annual report chapters

- Internal comments and communication records

💡This site search feature upgrade further integrates with Syber AI sustainability tools, making search not just keyword matching, but helping companies perform more efficient ESG data management and application.

Extended reading: Syber Sustainability AI Agent Now Live: Automate Your ESG Information Management

The Value of Sustainability Performance Management Platform Lies in Supporting "Long-term Governance"

As sustainability work moves from disclosure to governance, companies need not just more features, but a sustainability performance management platform that can support them long-term.

Through systematized materiality analysis, searchable data, traceable approval processes, and early ESG evaluation perspective, this December feature release helps companies deepen sustainability governance.

Detailed feature operation instructions: Click 👉 Syber Help Center