As capital markets continue to raise sustainability requirements, corporate sustainability reports and ESG ratings have become key indicators of long-term competitiveness. Facing the upcoming 2026 ESG rating reform, mere "regulatory compliance" is no longer sufficient. The new system is not just about disclosure format adjustments—it mandates upgrades in data governance, internal organizational collaboration, and long-term integration. Companies that rely on old response models will face declining rating rankings.

This article provides a consultant's perspective, looking beyond surface-level differences to address the three core impacts of the new system, offering specific, actionable response strategies to help your company turn challenges into strategic advantages in this new round of ESG competition.

Impact 1: Organizational Restructuring and Deepened Responsibilities in Sustainability Governance

The new system tightly binds corporate governance with sustainability, requiring boards to take direct oversight responsibility for climate risks and human rights due diligence, while emphasizing the sustainability unit's cross-departmental resource coordination capabilities. This effectively transforms sustainability goals from paper slogans into execution drivers, earning higher commitment scores in ESG ratings.

Consultant's View: Under the new system, boards are given more direct oversight responsibilities, particularly in reviewing and deciding on major sustainability risks (such as human rights and climate). Board members are encouraged to possess or pursue sustainability knowledge, changing the past model of merely receiving briefings. Additionally, the Chief Sustainability Officer must be granted sufficient cross-departmental authority to break down traditional data silos between departments, effectively responding to ESG rating requirements for oversight and engagement.

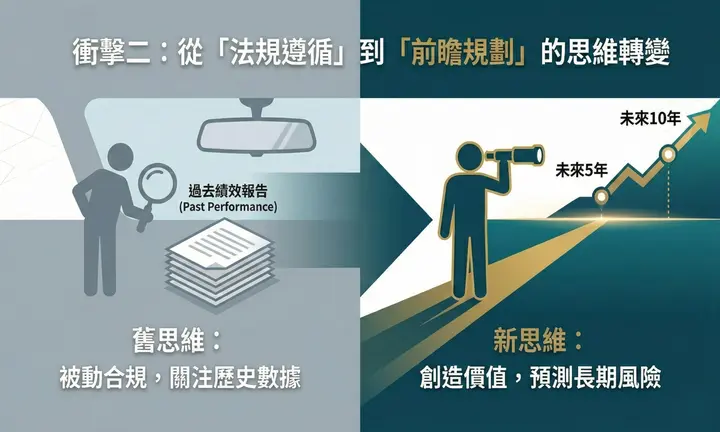

Impact 2: Mindset Shift from "Regulatory Compliance" to "Forward Planning"

The old system focused on retrospective indicators, examining "what was done in the past." However, the new system values forward-looking planning—how to create value in the future. Companies must demonstrate specific goal-setting and achievement pathways, or they will struggle to achieve high scores.

Consultant's View: Companies must view ESG as a core driver of corporate value creation, not merely passive risk management. Companies cannot only look at last year's performance and data; they must also forecast and plan for climate risks over the next 5-10 years, requiring companies to demonstrate strategic thinking with a long-term vision.

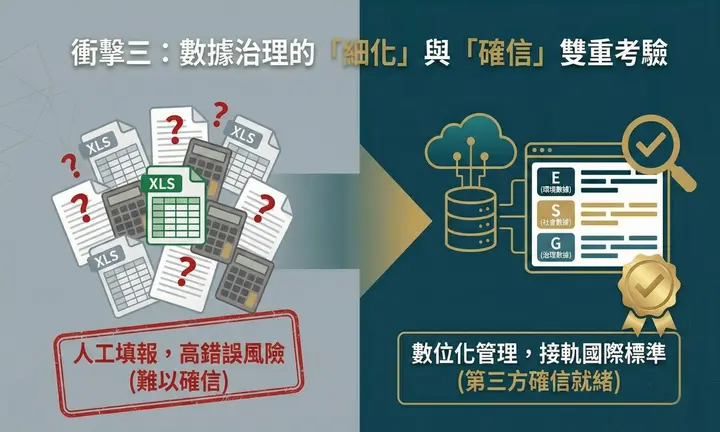

Impact 3: Dual Challenges of Data Governance "Granularity" and "Assurance"

While the old rating system valued information disclosure, requirements for data accuracy and verifiability were relatively loose. The new system closely aligns with international standards, particularly for quantitative indicators in Environmental (E) and Social (S) dimensions, pushing practitioners' work to a new level of difficulty.

Consultant's View: ESG ratings require not just providing data, but mandating companies to adopt specific quantification frameworks. If companies continue using old data collection and compilation processes (such as relying on Excel for manual reporting), they will face significant time costs and high error risks during third-party assurance. We recommend companies evaluate their current data management practices and implement digital management systems, applying standardized labeling to data from different sources including HR, operations, and finance, ensuring data definitions align with rating indicators. Additionally, companies should evaluate whether their existing risk management frameworks can accommodate IFRS-required scenario analysis. Finance departments should get involved early to systematically build estimation models that translate data and risks into "financial impact amounts."

Conclusion

The 2026 ESG rating reform is a comprehensive review of corporate fundamentals. Facing this transformation, only by re-examining data governance and organizational structure from a strategic height can companies turn crisis into opportunity. If you prepare now, your company will not only pass the rating but also earn long-term trust and premium valuation in capital markets.

If your company needs more in-depth gap analysis or data governance diagnostics for the new system, please contact Sustaihub. We will provide professional consulting services to help you gain a competitive edge in the sustainability race.