Consultant Column

Popular Keywords:

There are 27 results for "Carbon Emissions".

Jan 07, 2026

From COP30 and NDC 3.0 to CBAM: How Can Enterprises Navigate Carbon Transition and Plan Actionable Net-Zero Pathways?

As global climate governance accelerates and carbon costs become increasingly internalized, enterprises no longer face just the question of 'whether to reduce emissions' but rather 'how to complete transformation ahead of time amid uncertain international consensus and increasingly clear regulatory frameworks.' This article explores international trends from COP30, NDC 3.0 emission reduction targets across countries, and the practical impacts of EU CBAM and Taiwan's carbon fee system, helping you understand the key aspects and strategic directions enterprises should focus on during carbon transition.

Dec 31, 2025

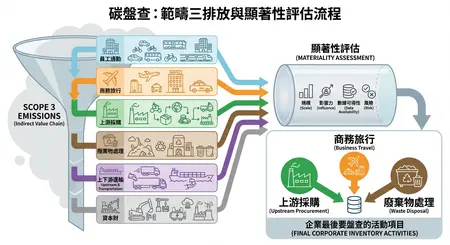

How to Conduct a Carbon Inventory 'Significance Assessment'? A Key Guide for Corporate Sustainability

當企業開始準備碳盤查時,多數承辦人第一反應往往是:蒐集資料、建表、計算。然而真正決定盤查品質與效率的不是「蒐集多少資料」,而是「找出哪些排放源值得蒐集」。這項步驟,被稱為碳盤查的顯著性評估(Significance Assessment)。

顯著性評估可視為整個盤查的方向盤,協助企業辨識高排放、高風險、高關注的核心活動,使後續資料蒐集更聚焦,也避免不必要的時間與人力投入。本文將帶你理解顯著性評估的目的、指標、操作方式,透過系統快速完成鑑別並串接到後續盤查流程。

Nov 19, 2025

Sustaihub Exhibits at Singapore FinTech Festival, Accelerating ESG in Sustainable Finance

The Singapore FinTech Festival (SFF) continues to demonstrate its powerful influence as a global financial innovation hub. The event brings together major regulatory authorities, multinational banks, investment funds, insurance companies, and technology enterprises from around the world, focusing on sustainable finance, AI applications, RegTech, data governance, and cross-border finance. This positions Singapore's FinTech ecosystem as highly strategic within the region.

Sustaihub attracted significant attention with its intelligent ESG solutions combining AI and SaaS technology, dedicated to creating the most comprehensive ESG digital transformation solutions. This year, with support from the Kaohsiung City Government, the company participated in the Singapore Fintech Festival and officially launched the new "Sustain AI Sustainable Finance Analytics Module".

Oct 08, 2025

How Are Japan and the EU Positioning Green Energy? Cross-National Comparison and Corporate Strategies (Part 2)

In the complex chess game of global energy transition, each country's strategic positioning is full of differences. Following the previous article's in-depth analysis of the important roles and development directions of the US and China in nuclear energy and natural gas, this article shifts its perspective to two key economies in Asia and Europe: Japan and the EU. We will explore how these two major blocs are formulating green energy deployment and energy transition pathways in response to their unique geographical, economic, and political environments. The article will also highlight the specific green energy strategies that Japanese and EU companies have adopted to ensure their leading position in global competition amid pressure for global net-zero emissions.

Sep 03, 2025

How is Green Electricity Defined Globally? A Complete Analysis of US and China Policies and Development (Part 1)

Despite broad global consensus on net-zero emission targets, there are significant differences among countries in defining "green electricity," reflecting their varying land resources, geopolitical considerations, and economic structures. The US tends to include nuclear and natural gas within the broader category of "clean energy," while China focuses on ultra-large-scale deployment of renewable energy. The EU, through its Sustainable Finance Taxonomy, defines nuclear and natural gas as "transitional" sustainable investments under strict conditions.

Aug 27, 2025

Carbon Trading & Carbon Rights! 5 Key Trends in International Trading Markets | 2025 ICAP ETS Report

2025 marks the 10th anniversary of the Paris Climate Agreement, yet global climate conditions are increasingly severe: the average temperature in 2024 exceeded pre-industrial levels by more than 1.5°C for the first time. Facing this challenge, Emission Trading Schemes (ETS) have become essential tools for countries to drive decarbonization. The "2025 Global Emissions Trading Status Report" published by the International Carbon Action Partnership (ICAP) provides global trend insights, covering 38 operational ETS systems worldwide. These systems cover 23% of global greenhouse gas emissions (approximately 12 GtCO₂e), affecting one-third of the global population and 58% of GDP. This report not only tracks global trends but also covers expanding emerging markets, price fluctuations in national ETS systems, how quotas generated by national ETS are used, and emphasizes the role of ETS in the net-zero transition.

Jul 23, 2025

Don't Know How to Conduct Carbon Inventory for Four Industry Types? Taiwan EPA Releases New Calculation Tools and Carbon Inventory Guidelines!

Following the policy direction of the expanded carbon inventory announcement in March this year, Taiwan's Ministry of Environment released greenhouse gas inventory guidelines for four industry types on July 14, covering service industries, transportation, medical institutions, and universities. Additionally, a carbon emission calculation tool was introduced to help businesses preliminarily calculate their carbon emissions. This update is great news for regulated businesses, significantly reducing the administrative costs required for inventory operations. This article will reveal all the details of this information.

Jun 25, 2025

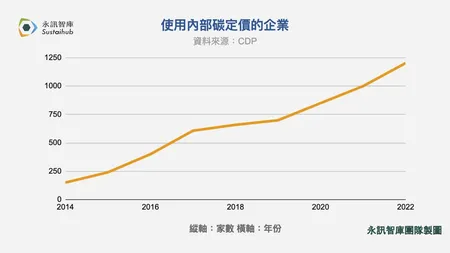

2025 Corporate Carbon Strategy Trends: Internal Carbon Pricing Drives Both Decarbonization and Competitiveness

As global attention to climate change continues to increase, businesses face not only external pressure but also the need for internal transformation. Internal carbon pricing serves as an important tool for corporate sustainable development, helping businesses consider carbon emission costs when formulating strategies, thereby driving the transition to a low-carbon economy. Despite its clear advantages, businesses face a series of challenges during implementation, including internal resistance, resource allocation, and market volatility. This article will explore how internal carbon pricing can help businesses succeed in green transformation and provide specific strategies and recommendations.