Climate-Related Financial Disclosures (TCFD): Risks, Opportunities, and Financial Impacts

Companies adopting TCFD must incorporate climate change risks and opportunities into their operational considerations when writing sustainability reports, assessing corresponding financial impacts to enhance climate resilience and seize sustainable development opportunities. Therefore, we will introduce "Climate-related Risks," "Climate-related Opportunities," and related "Financial Impacts" based on the "Recommendations of the Task Force on Climate-related Financial Disclosures" proposed by the TCFD working group, helping enterprises master the key points for each section.

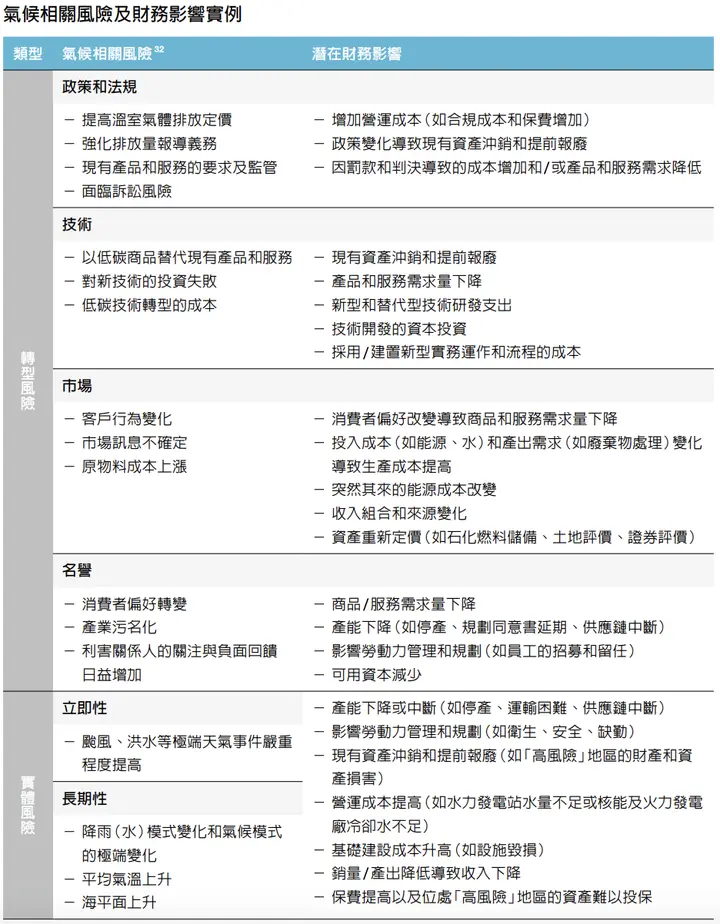

1. Two Types of Climate-Related Risks

In this section, TCFD categorizes climate risks that enterprises may face into "transition risk" and "physical risk." The former discusses risks arising from low-carbon transition to limit global warming to 2°C or even 1.5°C; the latter discusses climate change impacts and extreme weather events if global warming exceeds 2°C, which should be incorporated into the organization's existing risk management.

(1) Transition Risks Related to Low-Carbon Economy

1. Policy and Legal Risks: Climate adaptation policies, climate-related litigation or regulations, such as the EU's "Carbon Border Adjustment Mechanism (CBAM)," will impact high-carbon industries and change corporate operating costs.

2. Technology Risk: Low-carbon technologies, renewable energy technologies, etc. For example, when enterprises invest in renewable energy but R&D results are unsatisfactory, leading to sunk costs.

3. Market Risk: Supply and demand structure adjustments, changes in demand for goods or services. As society's carbon reduction awareness increases, investors or customers begin demanding low-carbon products, forcing enterprises to transform their products to maintain competitiveness.

4. Reputation Risk: Customer or community perception of whether the organization is committed to low-carbon transition. Companies indifferent to their "contribution to global warming" may be seen as ecological destroyers and selfish environmental destroyers.

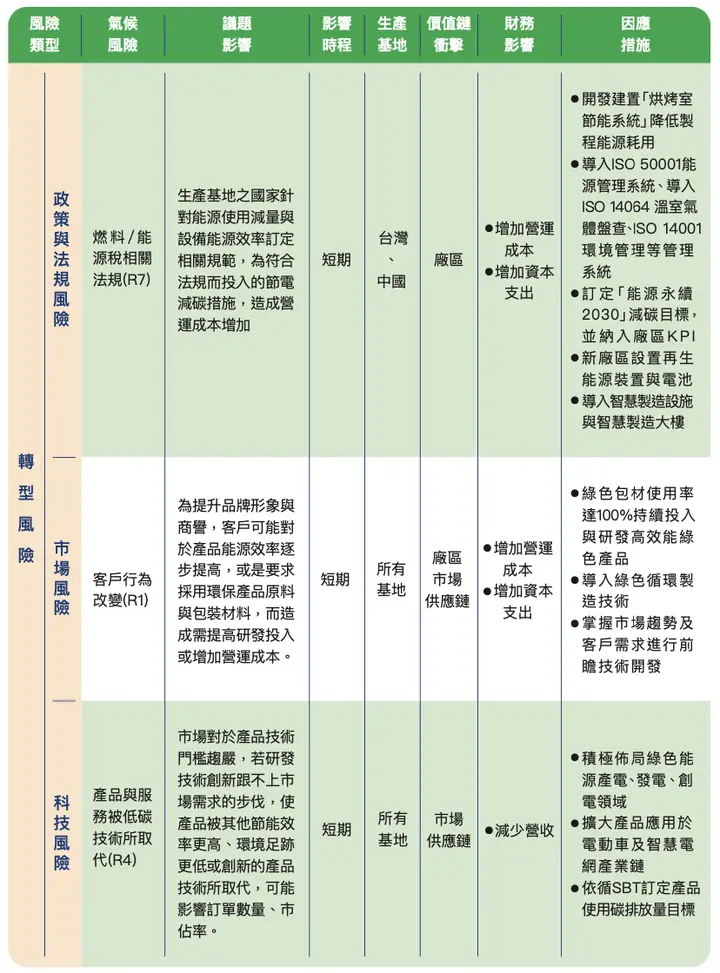

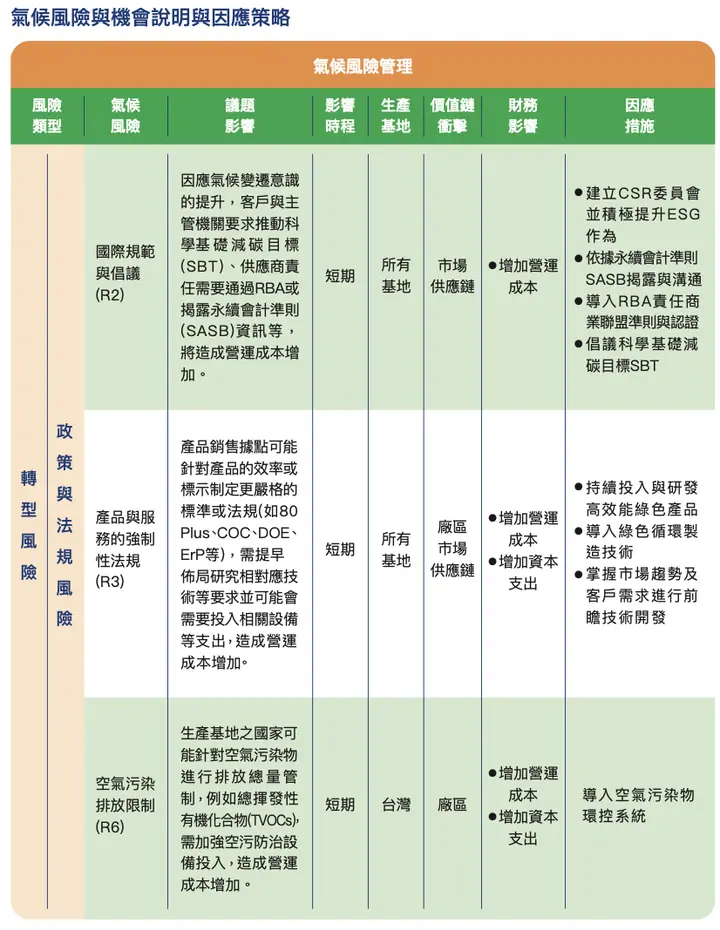

▾ Case Study: AcBel Polytech's "2020 Sustainability Report" identifies climate-related transition risks including "Policy and Legal Risks," "Market Risks," and "Technology Risks."

(2) Physical Risks Related to Climate Change Impacts

1. Acute Risk: Single immediate climate disaster events, such as heatwaves, droughts, heavy rainfall, abnormal high or low temperatures, and increasingly severe extreme weather events that may affect employee safety and health.

2. Chronic Risk: Long-term changes in climate patterns, such as increased frequency of floods, wildfires, and heatwaves due to global warming, causing enterprises to continuously increase their risk management costs.

▾ Case Study: AcBel Polytech's "2020 Sustainability Report" identifies and explains climate-related physical risks, primarily "Acute Risks."

2. Five Types of Climate-Related Opportunities

In this section, TCFD encourages enterprises to seize opportunities arising from climate change. For example, developing renewable energy to sell to third parties creates new business opportunities, or transforming traditional business models toward sustainable procurement and green supply chains to gain more favor and cooperation opportunities. The potential opportunities identified by TCFD can be divided into five categories:

(1) Resource Efficiency: Improving efficiency in production, materials, distribution, and energy use to reduce operating costs.

(2) Energy Source: Converting from coal, natural gas, oil, and other fossil fuels to low-carbon energy sources such as wind, solar, geothermal, and biomass.

(3) Products and Services: Developing low-carbon products or services, adopting green marketing to enhance corporate image and product competitiveness.

(4) Markets: Emerging new markets or products from which organizations seek more business opportunities.

(5) Resilience: The organization's adaptive capacity to climate change, including risk management and opportunity capture.

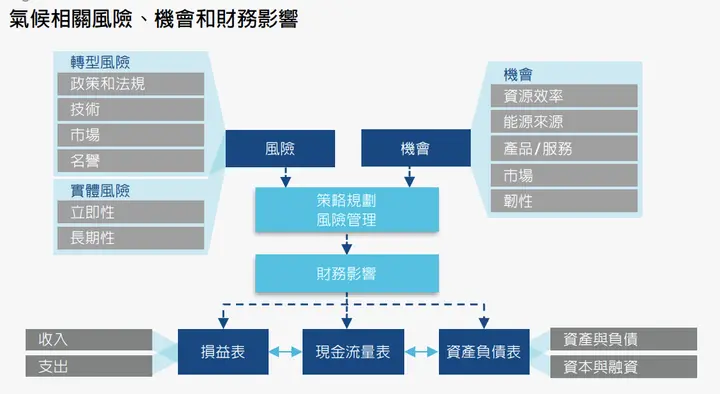

3. Financial Impacts

In this section, TCFD expects enterprises to explain the financial impacts of climate-related risks and opportunities, enabling investors, decision-makers, or other stakeholders to understand how these factors will affect the company's future financial position in income statements, cash flow statements, and balance sheets for wiser financial decisions. For example, when a company develops a low-carbon product that not only reduces carbon emissions throughout the product lifecycle but also lowers production costs, it has captured a climate-related opportunity. In practice, when enterprises disclose climate-related risks and opportunities, they simultaneously mention corresponding financial impacts, so this section doesn't need to be explained separately.

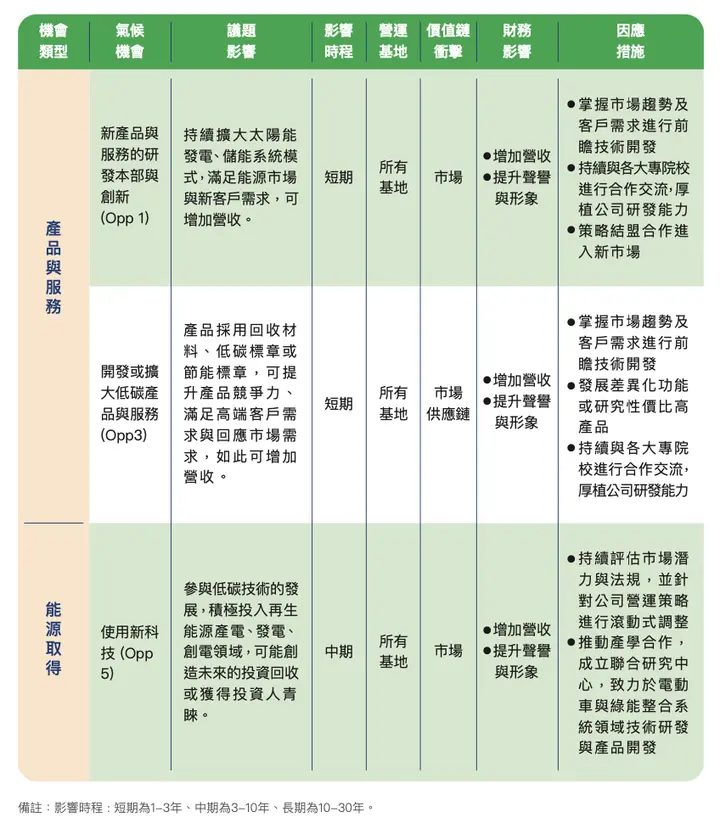

▾ Case Study: AcBel Polytech's "2020 Sustainability Report" identifies climate opportunities and explains related financial impacts, including "Resource Efficiency," "Products and Services," and "Energy Access."

Image source: TCFD "Recommendations on Climate-related Financial Disclosures" Official Chinese Version (2019)

Image source: TCFD "Recommendations on Climate-related Financial Disclosures" Official Chinese Version (2019)

Image source: TCFD "Recommendations on Climate-related Financial Disclosures" Official Chinese Version (2019)

4. Four Steps to Implement TCFD

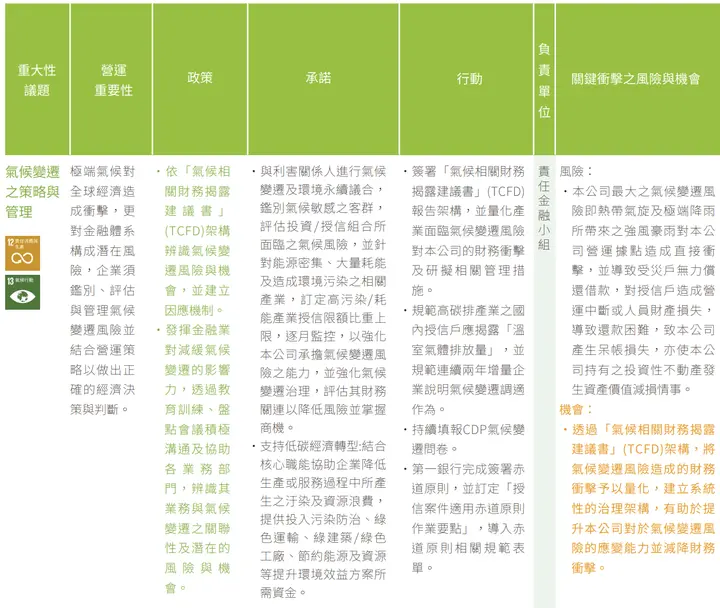

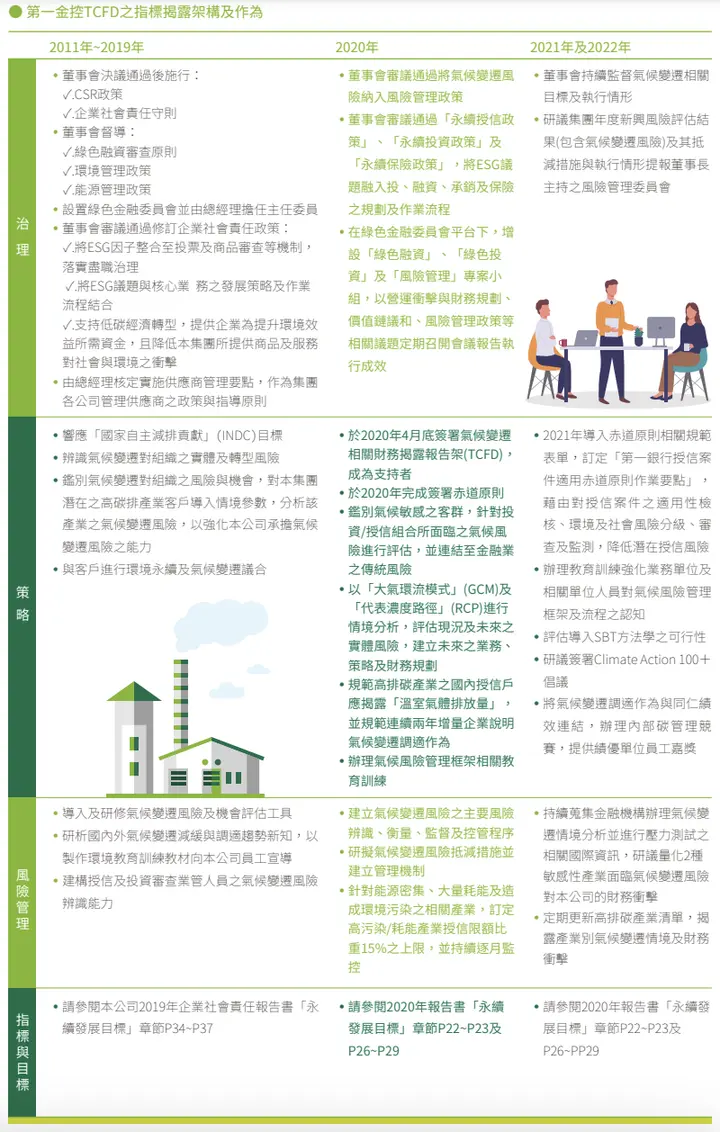

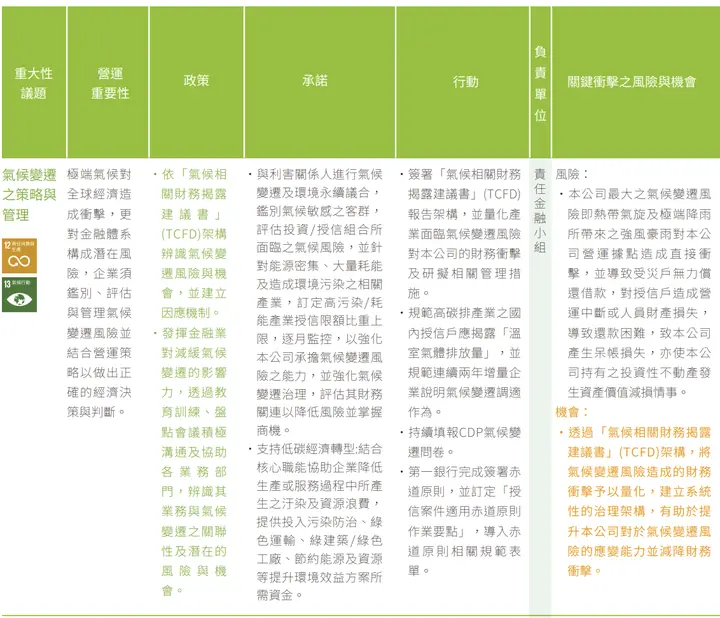

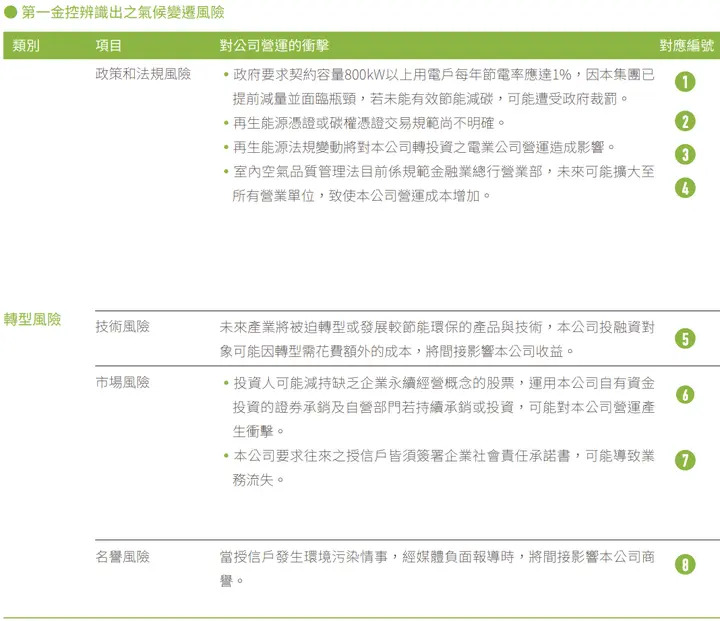

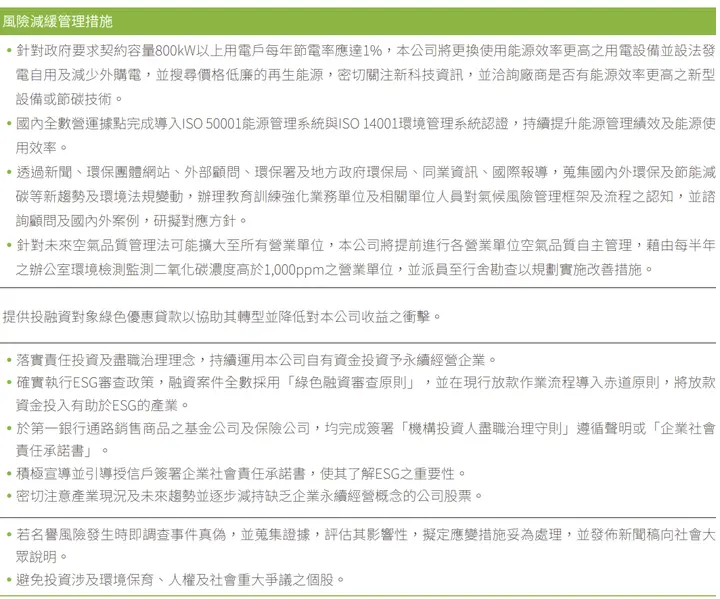

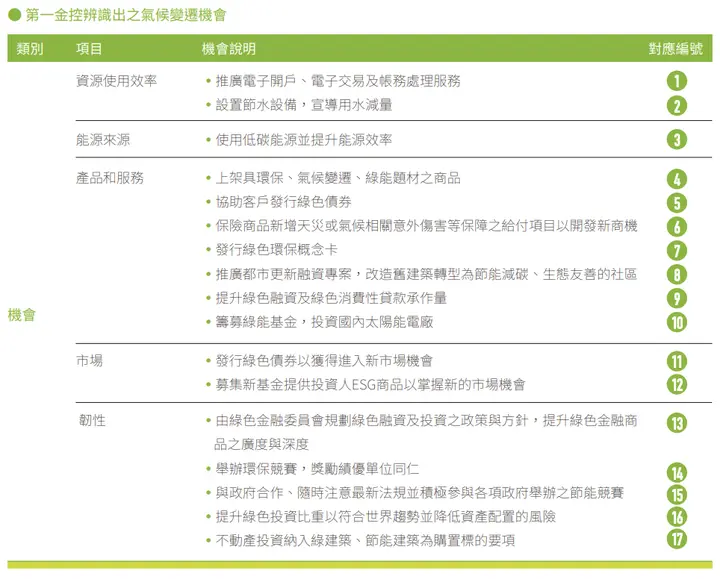

By now, you may be wondering how to correctly integrate TCFD into your sustainability report. In this section, we use "First Financial Holding," whose TCFD report was verified by the British Standards Institution (BSI) and received Level-5 highest rating, as well as Platinum level in the Sustainability Report Award, to demonstrate how to integrate TCFD into sustainability reports. Here are four key tips:

Tip 1. State in the report writing principles: We will follow TCFD recommendations to write this report!

Tip 2. Explain the TCFD responsible unit

Tip 3. Integrate TCFD into climate change-related material topics as policy guidelines

Tip 4. Fully disclose climate issue framework, including: risk management process, four core elements, and climate risks and opportunities the enterprise may face.

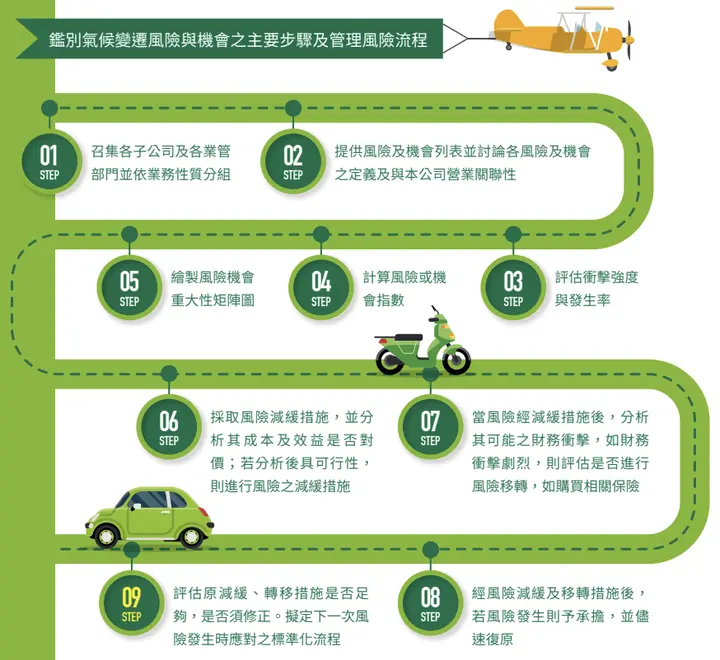

▴ Climate change risk management process

▴ TCFD four core elements disclosure

▴ Right side shows TCFD's metrics and targets from the four core elements

▴ Climate change risk disclosure

▴ Climate change opportunity disclosure

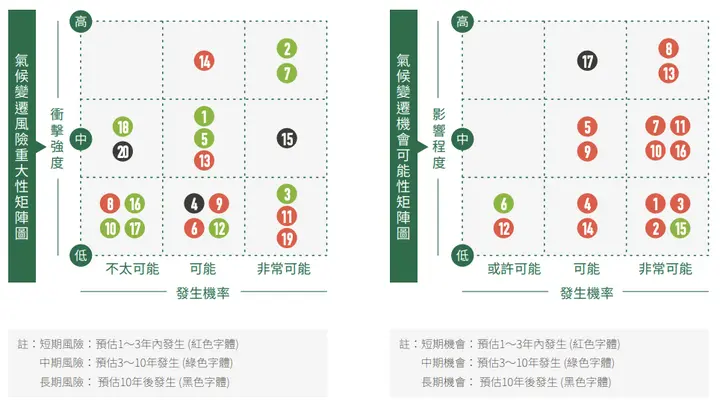

▴ Climate change risk materiality and opportunity probability matrix

In summary, we can see that First Financial Holding not only mentions adopting TCFD as an information disclosure standard in their report but further follows the guidance framework of "Recommendations on Climate-related Financial Disclosures" to detail the management process, organizational participation, relevant assessments, and strategic goals for climate change risks and opportunities, comprehensively integrating TCFD from simple to complex throughout the report.

Finally, two important points to note when implementing TCFD: First, organizations should collect forward-looking financial impact information that aids decision-making. Second, organizations should pay close attention to risks and opportunities faced during the transition to a low-carbon economy. In summary, throughout the information disclosure process, you only need to adhere to these two important TCFD characteristics and explain each key point mentioned in this article one by one.

In the next article, we will introduce TCFD's Scenario Analysis and Climate-Related Issues, where simulation and assessment help enhance enterprises' ability to predict future risks and improve climate adaptability.

References:

AcBel Polytech 2020 Sustainability Report: https://www.acbel.com/csr-report-download

First Financial Holding 2020 Sustainability Report: https://csr.firstholding.com.tw/tc/csr_report.html

TCFD "Recommendations on Climate-related Financial Disclosures" Official Chinese Version (2019): https://assets.bbhub.io/company/sites/60/2020/10/TCFD-Recommendations-Report-Traditional-Chinese-Translation.pdf