Background

What Is the Shipping Carbon Fee?

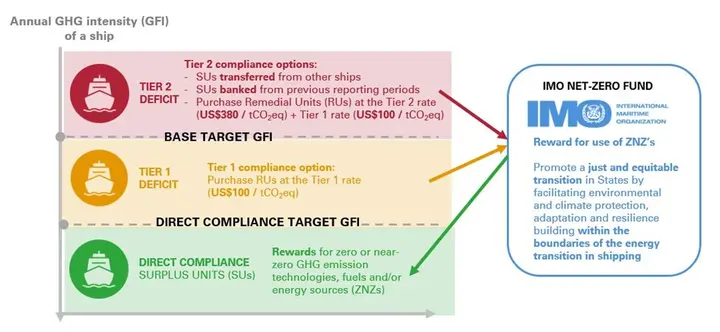

The Shipping Carbon Levy is a "carbon pricing mechanism" designed to charge the international shipping industry for carbon dioxide emissions. According to Reuters, the draft indicates that in the future, large vessels exceeding annual emission limits must purchase emission permits to offset excess emissions. These funds will be used to:

- Support the shipping industry's transition to low-carbon or zero-carbon fuels (such as ammonia and green methanol);

- Help developing countries enhance their green transition capabilities;

- Establish a global "IMO Net-Zero Fund."

The shipping industry accounts for approximately 3% of global CO2 emissions, with 80% of global trade relying on maritime transport. As trade volumes continue to grow, without decarbonization mechanisms, this proportion could rise to 10% by mid-century. Therefore, carbon pricing is seen as a key tool for driving energy transition and technological innovation.

Reasons for Postponement

This decision to postpone the vote by one year stems from multiple political and economic struggles.

- Opposition from the US and Saudi Arabia: US President Trump called the carbon fee a "global green scam tax," emphasizing it would raise transportation and commodity prices. The US also used diplomatic pressure to warn that supporting countries might face tariff retaliation or visa restrictions.

- Push from the EU and developing countries: The EU hopes to establish a globally consistent decarbonization system to prevent shipping emissions from falling into a "tax vacuum." Some island nations like Vanuatu consider the postponement an "unacceptable delay" for climate action.

- Economic concerns of oil-producing nations: Saudi Arabia, UAE, and Qatar worry that carbon fees will increase fuel costs, impacting energy export interests.

Some Asian countries adopted reserved positions: China, Japan, and South Korea did not maintain their original supportive stance in the final vote, choosing to vote for postponement or abstaining, reflecting the delicate balance between political pressure and industry interests.

Supporters' View: Postponement Is a Pragmatic Decision

For countries and industries that supported postponing the vote, this is not a "setback" but rather a strategy of "seeking consensus first, speed second."

1. Economic Impact Requires Careful Assessment

Carbon fees will directly increase shipping costs, subsequently raising global logistics and prices. For energy-exporting countries and import-dependent nations, this could trigger inflation and trade imbalances. The one-year postponement allows time to assess different countries' capacity to bear costs, avoiding widening wealth gaps.

2. Technology and Infrastructure Not Yet Mature

Supply chains for green fuels like ammonia and methanol are still in early stages. If carbon fees are implemented hastily, shipping companies may lack alternatives and can only passively bear costs. Postponement gives the industry more time to establish refueling stations, supply chains, and ship retrofit technologies.

3. Negotiation Process Needs to Be More Inclusive of Developing Countries

Many developing countries worry that carbon fee funds will ultimately flow to advanced nations. Supporters argue that clear "Net-Zero Fund" distribution principles should be established first to ensure funds fairly support low-income countries.

Opponents' View: Postponement Is a Climate Setback

Conversely, countries and environmental organizations advocating immediate carbon fee adoption generally believe this postponement "weakens the international community's climate action resolve."

1. Global Decarbonization Progress Slowed

The shipping industry has massive emissions but has long been excluded from any global carbon mechanism. A one-year delay means hundreds of millions of tons of emissions continue "tax-free," drifting further from the 2050 net-zero goal.

2. Political Forces Interfering with Technical Issues

The EU and environmental organizations criticize the US for threatening other countries with trade retaliation, politicizing climate policy and undermining the fairness of multilateral negotiations. This move may affect the trust foundation of future climate talks.

3. Unclear Investment Signals for Businesses

The carbon fee originally expected to take effect in 2028 could have provided companies with clear investment directions, such as developing low-carbon fuels and updating fleets. The postponed vote leaves shipping companies and investors in uncertainty again, delaying the green transition timeline.

Global Impact: Implications of Shipping Carbon Fee Postponement for the Market

Despite the decision postponement, global shipping still faces increasingly severe decarbonization pressure.

- EU: Has included shipping in the EU ETS since 2024; vessels at European ports must pay carbon emission allowances.

- Asia: Japan, South Korea, and China are promoting their own shipping decarbonization standards.

- Corporate level: Major shipping companies like Maersk and NYK have voluntarily adopted low-carbon fuels, with some companies even setting internal "carbon prices" as cost assessments.

In other words, although the IMO postponed the vote by one year, the global market's decarbonization trend has not stopped. This year-long buffer period will serve as a crucial observation window. IMO needs to propose specific plans before 2026, including:

- Carbon fee rates and calculation methods;

- Revenue distribution and fund operation mechanisms;

- Differentiated responsibility designs for different economies.

In this tug-of-war, the ultimate key is not who wins the political narrative, but whether the world can find a balance between fairness and action. Because for a continuously warming planet, time is the most expensive cost.

References

Udn. US pressure works, global shipping carbon fee vote postponed by 1 year 2025.10.19

Reuters. UN shipping agency strikes deal on fuel emissions, CO2 fees 2025.04.11

IMO. The IMO Net-Zero Framework - FAQs

IMO. IMO approves net-zero regulations for global shipping 2025.04.11

BBC. Global breakthrough to tackle shipping emissions 2025.04.11

Trump, D. J. (2025, October 21). [Post on Truth Social].

Wilhelmsen. EU Emissions Trading System (EU ETS) and FuelEU Maritime Compliance

"IMO Net-Zero Framework" vote postponed by one year, shipowners continue to "wait" 2025.10.18

Maersk. All the way to net zero | Decarbonising shipping

NYK Group Progress Report 2024

EDF. Raising anchor: The urgency of energy transition in maritime shipping 2023.04.18