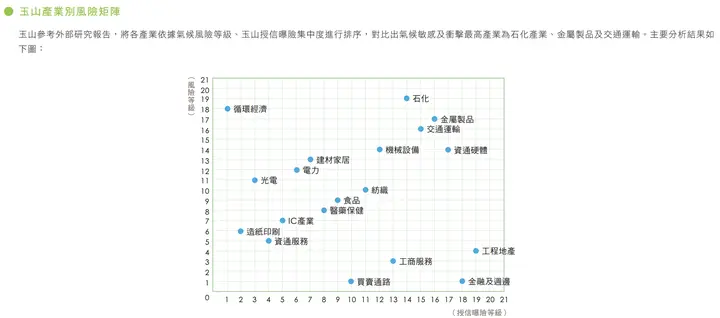

Introduction to TCFD and Its Four Core Elements

The Task Force on Climate-Related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) in 2015 to address climate change and the Paris Agreement, providing climate-related financial disclosure standards. Its purpose is to provide professional disclosure recommendations on climate change risks and opportunities, ensuring climate issues are incorporated into business and investment decision-making, and further helping investors, decision-makers, and other stakeholders understand organizations' significant risks to more accurately assess climate-related risks, opportunities, and financial impacts.

This framework provides disclosure recommendations through the Task Force on Climate-Related Financial Disclosures (hereinafter "the Task Force"), identifying the impact of climate-related risks and opportunities on corporate financial conditions through "strategic planning" and "risk management." It applies to organizations across countries and types. The Task Force recommends that when applying this framework, information should be disclosed in main (publicly available) annual financial filings.

Why Should Companies Adopt TCFD? Key Regulations and Sustainability Trends

TCFD has been endorsed by approximately 3,300 companies globally, including Google's parent company Alphabet in the US, Europe's largest insurance company Allianz SE from Germany, Philips from the Netherlands, HITACHI from Japan, Samsung from Korea, and three of the Big Four accounting firms—KPMG, Deloitte, and PwC. In Taiwan, over 90 companies have also endorsed it, including TSMC, Cathay Financial Holdings, China Airlines, Evergreen Marine, Tung Ho Steel, Taiwan Cement, Sinyi Realty, Formosa Taffeta (textiles), and Wistron, with supporters found across various industries.

How significant is the TCFD framework in Taiwan? According to the "Taiwan and Asia-Pacific Sustainability Report Status and Trends" survey, over 600 sustainability reports were published by Taiwan enterprises in 2020, with approximately 231 companies responding to TCFD. In other words, over one-third of companies producing sustainability reports have begun prioritizing TCFD. The top three industries citing TCFD most frequently are: financial services, computer peripherals, and semiconductors. Additionally, six Taiwan companies have begun publishing independent TCFD reports, including TSMC, Tung Ho Steel, Formosa Taffeta, China Airlines, Fubon Financial Holdings, and First Financial Holdings, demonstrating TCFD's significant role in corporate sustainability development.

The reasons for TCFD's importance include its widespread acceptance domestically and internationally as a key framework for risk management and strategic planning in modern enterprises. Additionally, Taiwan's Financial Supervisory Commission and Taiwan Stock Exchange have begun taking action! Furthermore, for companies wishing to participate in awards such as the Taiwan Corporate Sustainability Awards (TCSA) hosted by the Taiwan Institute for Sustainable Energy (TAISE), incorporating TCFD into sustainability reports is essential. Details are provided below.

1. Taiwan-Related Policies/Administrative Orders (Regulations)

In early 2020, the "Regulations Governing the Preparation and Filing of Sustainability Reports by Listed Companies" required companies obligated to prepare sustainability reports to disclose identification, management, and assessment of climate-related risks and opportunities. In August of the same year, the Financial Supervisory Commission launched "Corporate Governance 3.0 - Sustainable Development Roadmap," strengthening ESG information disclosure for listed companies and introducing TCFD as a standard for sustainability report preparation. This means that from 2023, domestic listed companies with capital of NT$2 billion or more must follow the TCFD framework for relevant information disclosure when preparing sustainability reports.

Simultaneously, to strengthen corporate attention to climate issues and disclosure following the TCFD framework, the Taiwan Stock Exchange has added TCFD-related indicators to the "Corporate Governance Evaluation Indicators," which are weighted items. Therefore, for companies seeking regulatory compliance and improved corporate governance evaluation scores, adopting TCFD now would be a wise decision.

Image source: Taiwan Stock Exchange Corporate Governance Center "9th Corporate Governance Evaluation Introduction and Scoring Guidelines for FY2022"

2. Industry Award Requirements

According to the latest key evaluation criteria for the Taiwan Corporate Sustainability Awards by the Taiwan Institute for Sustainable Energy, one criterion—"Implementation and Information Disclosure of Major Sustainability Standards"—encourages adopting TCFD's four core elements for climate-related financial information disclosure. However, simply declaring "We support TCFD" won't earn high scores. Companies must disclose information regarding the four elements (Governance, Strategy, Risk Management, and Metrics and Targets), specifically explaining related implementation methods, strategies, and results, or even publishing independent annual TCFD reports—these are the keys to achieving high scores in the TCFD domain.

TCFD Four Core Elements: Governance, Strategy, Risk Management, Metrics and Targets

Image source: TCFD "Recommendations of the Task Force on Climate-related Financial Disclosures" Official Chinese Version (2019)

TCFD's Four Core Elements

To help investors and stakeholders understand how reporting organizations assess climate-related risks and opportunities, the Task Force has proposed four core elements as the reporting framework:

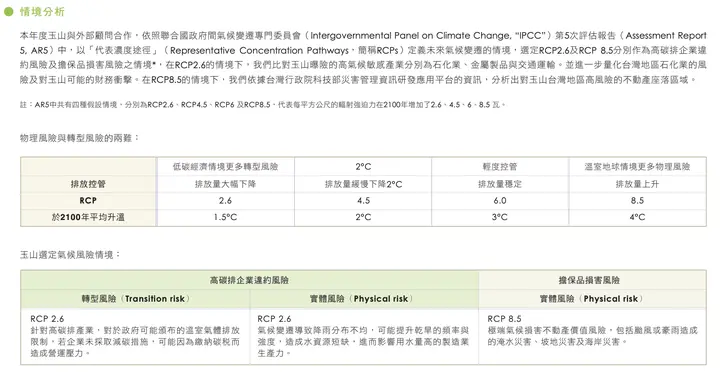

Governance: Whether climate issues receive organizational attention and how the organization manages climate-related risks and opportunities, including board oversight and management assessment and decision-making. For example, Nan Shan Life Insurance's "2020 Sustainability Report" indicates that the Board of Directors is the highest responsible unit for climate change-related risk management, while the Risk Management Committee and Corporate Sustainability Committee under its jurisdiction are responsible for regularly monitoring the implementation of climate change-related risks and opportunities.

▾ Risk management framework disclosed in Nan Shan Life Insurance's "2020 Sustainability Report"

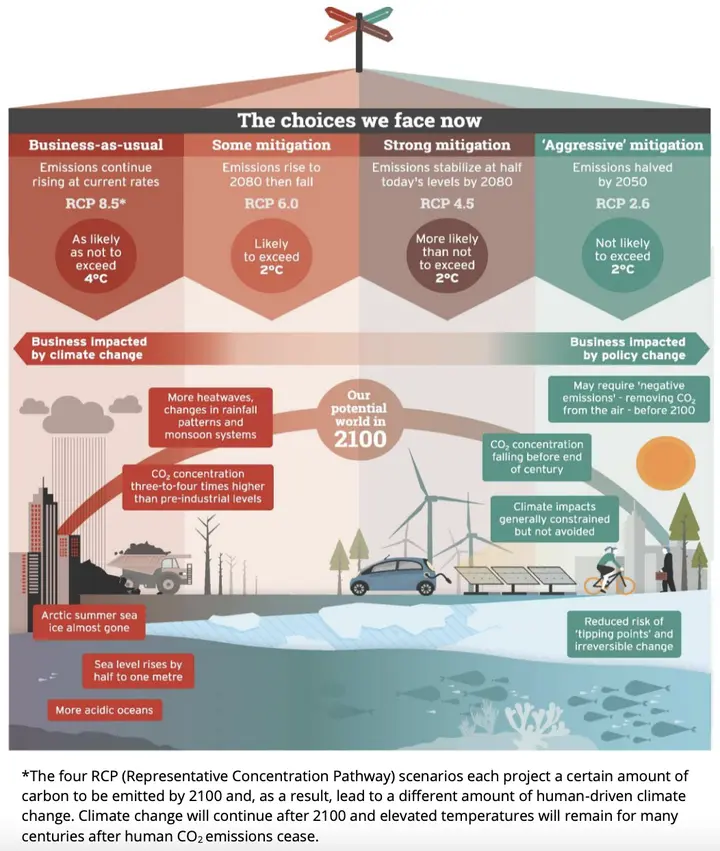

Strategy: Investors and other stakeholders can understand how climate issues affect the organization's short-term (within 1 year), medium-term (1-11 years), and long-term (11-81 years) business, policies, and financial planning, used for future performance forecasting. For example, AcBel Polytech's "2020 Sustainability Report" climate change management strategy identifies and explains climate risks and opportunities with medium to high critical impact on the organization, including transition risks, physical risks, resource utilization opportunities, product and service opportunities, and energy access opportunities, along with related issues, impact timeframes, value chain impacts, financial impacts, and response measures.

▾ Climate risks and opportunities explanation and response strategies from AcBel Polytech's "2020 Sustainability Report" (partial screenshot for reference).

Risk Management: Investors and other stakeholders need to understand how organizations identify, assess, and manage climate-related risks (for example, how climate risks are integrated into existing risk management processes) to evaluate the organization's overall risk profile and management activities. For example, Nan Shan Life Insurance's "2020 Sustainability Report" explains that its risk management first has the Board of Directors set risk appetite, then the Risk Committee sets risk limits, followed by regular monitoring of key risk trend changes through risk management tools, which includes climate change-related risks.

Metrics and Targets: Investors and other stakeholders need to understand how organizations measure and monitor their climate-related risks and opportunities to more effectively assess risk-adjusted potential returns, ability to fulfill financial obligations, climate-related exposure, and progress in managing and adapting to risks, or even for cross-organizational or cross-industry comparisons. For example, AcBel Polytech's "2020 Sustainability Report" climate change metrics and targets section explains that the organization uses greenhouse gas emissions and intensity, resource utilization, and green procurement as indicators for measuring climate risk impact; additionally, it has introduced SBTi methodology to set greenhouse gas reduction targets for Scopes 1-3.

▾ Climate change metrics and targets from AcBel Polytech's "2020 Sustainability Report".

After the above explanation, you should now understand TCFD's importance to enterprises. At the same time, you likely understand that the "four core elements" will be the key narrative focus when applying TCFD. This not only involves participation from the board of directors and management but also concerns the impact of climate issue information disclosure on stakeholders. Therefore, how to bring positive impacts to the company through TCFD is worth careful consideration by enterprises.

To be continued…

Next, the following article will introduce "two major types of climate-related risks" and "five major types of climate-related opportunities," and explain how to disclose climate-related financial impacts, taking you deeper into understanding what climate risks exist, what climate-related opportunities are available, and what potential financial impacts they may cause.

References:

[1] 7th Presentation: Taiwan Sustainability Reports Exceed 600 for the First Time, Transparent ESG Information Disclosure (https://csrone.com/topics/6811)

[2] Financial Supervisory Commission "Corporate Governance 3.0 - Sustainable Development Roadmap" (https://www.fsc.gov.tw/fckdowndoc?file=/%E5%85%AC%E5%8F%B8%E6%B2%BB%E7%90%863_0-%E6%B0%B8%E7%BA%8C%E7%99%BC%E5%B1%95%E8%97%8D%E5%9C%96.pdf&flag=doc)

Taiwan Stock Exchange Corporate Governance Center "9th Corporate Governance Evaluation Introduction and Scoring Guidelines for FY2022"

TCFD "Recommendations of the Task Force on Climate-related Financial Disclosures" Official Chinese Version (2019): https://assets.bbhub.io/company/sites/60/2020/10/TCFD-Recommendations-Report-Traditional-Chinese-Translation.pdf

Nan Shan Life Insurance 2020 Sustainability Report: https://www.nanshanlife.com.tw/public_promotion/subject/CSR/report.html

AcBel Polytech 2020 Sustainability Report: https://www.acbel.com/csr-report-download