The Taiwan Stock Exchange released the "2025 (12th) Corporate Governance Evaluation Indicators," comprising four major dimensions with 70 indicators. A total of 9 new indicators were added, 11 modified, 14 deleted, and 4 indicator types adjusted. The evaluation period covers January 1 to December 31, 2025, with results expected to be announced by the end of April 2026.

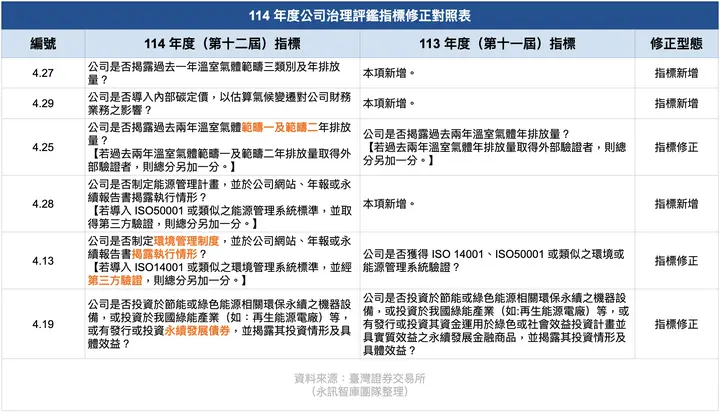

Key Indicator Modifications

【Environmental Dimension】

To encourage companies to strengthen greenhouse gas disclosure and implement carbon reduction transformation to achieve net-zero sustainability goals:

- New Indicator 4.27: "Disclose Scope 3 greenhouse gas categories and annual emissions over the past year"

- New Indicator 4.29: "Implement internal carbon pricing"

- New advanced bonus requirement: "Disclose 2030 carbon reduction targets, strategies, and action plans" (Indicator 4.26)

- Modified Indicator 4.25 to: "Disclose Scope 1 and Scope 2 annual greenhouse gas emissions over the past two years," with the advanced bonus requirement modified to: "Obtain external verification of Scope 1 and Scope 2 annual emissions"

To encourage companies to address climate change issues and improve energy efficiency while reducing environmental impact:

- New Indicator 4.28: "Establish an energy management plan," with obtaining energy management system certification listed as an advanced bonus requirement

- Modified Indicator 4.13 to: "Establish an environmental management system," with obtaining environmental management system certification changed to an advanced bonus requirement

- Modified Indicator 4.19 to: "Invest in energy-saving or green energy-related environmental sustainability equipment, invest in Taiwan's green energy industry (such as renewable energy plants), or issue or invest in sustainable development bonds, and disclose investment status and concrete benefits"

【Social Dimension】

To promote companies' attention to employee career development and communication with employees:

- New Indicator 4.30: "Establish employee training and development plans to enhance career capabilities, and disclose content and implementation status"

- New Indicator 4.31: "Conduct regular employee satisfaction surveys and disclose implementation status and improvement plans"

To encourage companies to protect consumer rights:

- New Indicator 4.32: "Establish personal data protection policies and disclose content and implementation status"

- New Indicator 4.33: "Establish policies and complaint procedures to protect consumer or customer rights regarding product and service health and safety, marketing, or labeling issues"

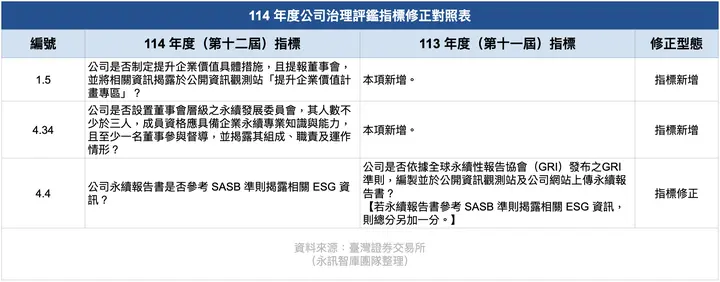

【Governance Dimension】

To guide companies to value shareholder value and actively communicate with shareholders:

- New Indicator 1.5: "Establish concrete measures to enhance corporate value, report to the board of directors, and disclose relevant information in the 'Corporate Value Enhancement Plan Section' on the Market Observation Post System"

To encourage listed companies to establish sustainability development committees and nomination committees:

- New Indicator 4.34: "Establish a board-level sustainability development committee with at least three members who possess corporate sustainability expertise and capabilities, with at least one director participating in supervision, and disclose its composition, responsibilities, and operations"

To continuously improve differentiation and align with domestic regulations and practices:

- The original advanced bonus requirement for Indicator 4.4, "Sustainability reports reference SASB standards to disclose relevant ESG information," has been modified to a basic scoring requirement

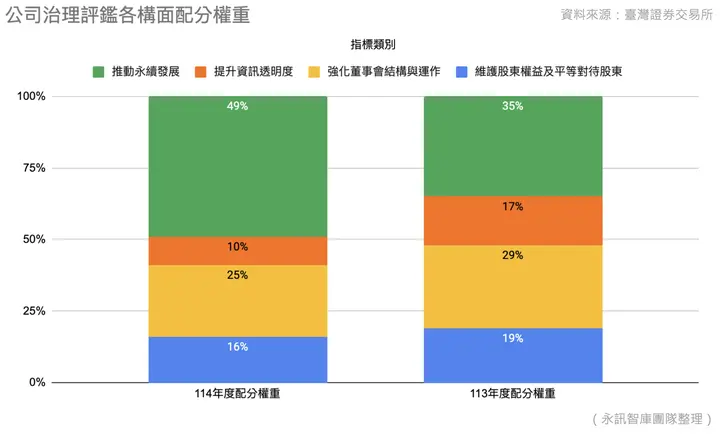

Weighting Adjustments

To guide companies to prioritize sustainable development and considering indicator changes, the "Promoting Sustainable Development" dimension weighting has been increased from 35% to 49%, the "Protecting Shareholder Rights and Treating Shareholders Fairly" dimension decreased from 19% to 16%, the "Strengthening Board Structure and Operations" dimension decreased from 29% to 25%, and the "Enhancing Information Transparency" dimension decreased from 17% to 10%.

From 2026: Corporate Governance Evaluation Transforms to ESG Evaluation

To more comprehensively assess listed and OTC companies' performance across all ESG dimensions and provide investors with ESG investment decision references, the Taiwan Stock Exchange has planned to transform the current "Corporate Governance Evaluation" into an "ESG Evaluation" starting in 2026. To ensure smooth transition, this year's evaluation adds 7 environmental and social indicators and increases the "Promoting Sustainable Development" dimension weighting to nearly 50%, demonstrating Taiwan's capital market's determination to promote sustainable transformation. Enterprises should respond to these changes early, not only to improve evaluation scores but to take this opportunity to comprehensively review and enhance their sustainable governance capabilities.

Discover Digital Enterprise Management to Strengthen Sustainability Competitiveness!

Sustaihub's digital sustainability development consulting team is dedicated to exploring how to effectively achieve corporate sustainability management goals!

Through the Syber Sustainability Management System, the optimal collaboration platform for ensuring sustainability information accuracy, all corporate sustainability-related data is stored and classified in a structured manner, eliminating the need to spend extensive manpower and time re-inventorying and collecting relevant data, helping reduce overall operational time.

Source: Corporate Governance Center / Corporate Governance Evaluation Section