Consultant Column

Popular Keywords:

There are 72 results for "Sustaihub".

Apr 23, 2025

Must-Read Before Filing! 13 Common ESG Report Deficiencies Identified by Regulatory Authorities, with Report Examples

TWSE and TPEx regularly review corporate sustainability reports. All listed companies are subject to review at least once every five years. Failure to disclose according to regulations may result in required corrections, improvement requests, or even impact on corporate governance ratings.

Apr 16, 2025

Tariff Policies Change Overnight! Learning Corporate Decarbonization Survival Rules from Trump Tariffs

Trump's tariff policy U-turn reveals the nature of policy risk. Facing the upcoming implementation of carbon tariffs led by CBAM, only enterprises that are well-prepared can maintain competitiveness amid change.

Apr 09, 2025

Relaxing Sustainability Reporting Requirements? Changes EU Omnibus Package Will Bring to CSRD and CBAM

The newly proposed EU Sustainability Simplification Omnibus Package aims to simplify corporate sustainability reporting. Regulations proposed for relaxation include the Corporate Sustainability Reporting Directive (CSRD), Carbon Border Adjustment Mechanism (CBAM), and more. Here's a comprehensive overview of the key changes:

Mar 27, 2025

AI Digital Era: Are You Ready for ESG Digitalization?

Facing challenges such as increasingly stringent ESG regulatory requirements, rising difficulty in cross-departmental data integration, and complex and redundant report writing processes, if you are also wondering 'Can digital tools reduce the burden and improve efficiency?' This article provides a sustainability digital maturity self-assessment for your reference in evaluating whether your enterprise is ready to embark on ESG digitalization.

Mar 21, 2025

[2025 Carbon Fee Guide] How Enterprises Can Reduce Carbon Fees from NT$300 to NT$50 Through Voluntary Reduction Plans

With the Climate Change Response Act officially in effect, the carbon fee system has become one of the operational costs that Taiwanese enterprises must take seriously. Companies subject to government-regulated carbon fee collection, including power, gas supply, and manufacturing industries with annual direct or indirect greenhouse gas emissions reaching 25,000 metric tons of CO₂e, will need to pay carbon fees of up to NT$300 per ton of CO₂e. Facing carbon fee pressure, the key for enterprises to reduce payment amounts lies in proposing and passing a 'Voluntary Reduction Plan,' which qualifies them for preferential rates of NT$50 or NT$100 per ton. This article explains how systematic planning and reporting for voluntary reduction plans can not only legally save expenses but also help enterprises with long-term net-zero planning.

Mar 13, 2025

What is CBAM? CBAM Postponed to 2027: Impact on Taiwanese Enterprises

EU CBAM delayed to 2027, how should Taiwanese enterprises respond? This article analyzes the CBAM mechanism, affected industries, and response strategies to help businesses grasp future carbon trading trends.

Mar 07, 2025

Perfecting Sustainability Information Management Internal Controls: How Can Companies Meet New Regulations and Ensure Compliance?

Facing new sustainability information internal control regulations, how should companies respond? From establishing internal control mechanisms to integrating audit plans, ensure sustainability information compliance and enhance corporate competitiveness.

Feb 26, 2025

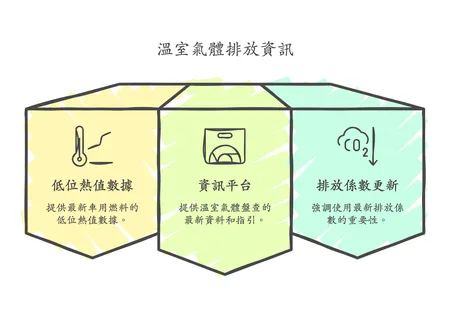

Ministry of Environment's Latest GHG Emission Factors Now Online - Avoid Using Outdated Version 6.0.4!

Facing increasingly stringent environmental regulations, using correct emission factors in GHG inventories is crucial for ensuring corporate carbon inventory data is compliant and accurate.

Feb 12, 2025

SASB Standards Chinese Version Now Available! Master the Latest SASB Standards and Reporting Requirements

The IFRS Integration Zone has published the Chinese version of SASB Standards, covering 15 industries including semiconductors, hardware, insurance, and processed foods (as of January 10, 2025)

Feb 07, 2025

Trump Announces Paris Agreement Withdrawal Again, Yet It's the Perfect Opportunity for Taiwan Enterprises to 'Overtake' Major Players?!

On January 20, 2025, with the announcement of the US withdrawal from the Paris Agreement, global carbon reduction efforts faced significant impact. As the world's second-largest carbon emitter, the US's reduced commitment to climate agreements not only weakens the coordination of international cooperation but may also cause some countries and enterprises to relax their carbon reduction efforts. However, supply chain pressure has not diminished, especially as the EU and other regions maintain strict carbon emission management requirements, with global brands and purchasers still requiring supply chain partners to maintain high-standard carbon inventory capabilities.