Consultant Column

Popular Keywords:

There are 8 results for "Green Energy".

Oct 15, 2025

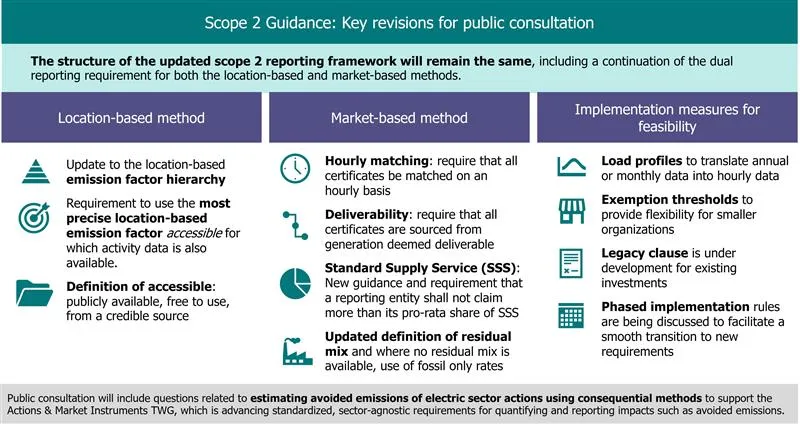

GHG Protocol September 2025 Update: Three Key Implications of Scope 2 Revisions for Corporate Electricity Accounting

The GHG Protocol has announced a revision to Scope 2 guidance, introducing 'hourly matching' and 'deliverability' principles. Future corporate electricity emission calculations will be more rigorous and transparent. This article analyzes the key impacts of this global electricity accounting transformation from three perspectives: revision background, major differences, and response strategies.

Oct 08, 2025

How Are Japan and the EU Positioning Green Energy? Cross-National Comparison and Corporate Strategies (Part 2)

In the complex chess game of global energy transition, each country's strategic positioning is full of differences. Following the previous article's in-depth analysis of the important roles and development directions of the US and China in nuclear energy and natural gas, this article shifts its perspective to two key economies in Asia and Europe: Japan and the EU. We will explore how these two major blocs are formulating green energy deployment and energy transition pathways in response to their unique geographical, economic, and political environments. The article will also highlight the specific green energy strategies that Japanese and EU companies have adopted to ensure their leading position in global competition amid pressure for global net-zero emissions.

Sep 03, 2025

How is Green Electricity Defined Globally? A Complete Analysis of US and China Policies and Development (Part 1)

Despite broad global consensus on net-zero emission targets, there are significant differences among countries in defining "green electricity," reflecting their varying land resources, geopolitical considerations, and economic structures. The US tends to include nuclear and natural gas within the broader category of "clean energy," while China focuses on ultra-large-scale deployment of renewable energy. The EU, through its Sustainable Finance Taxonomy, defines nuclear and natural gas as "transitional" sustainable investments under strict conditions.

May 21, 2025

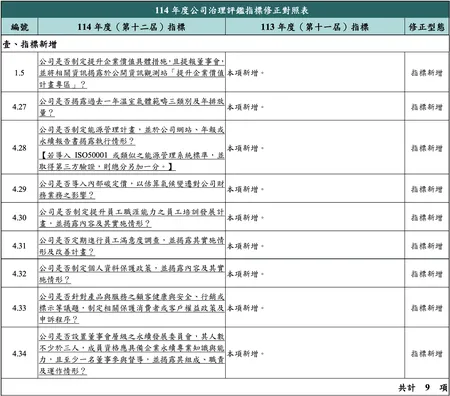

Corporate Governance Evaluation Results Released! Countdown to ESG Evaluation Transformation: 2025 Latest Evaluation Items and Regulations at a Glance

The 11th (2024) Corporate Governance Evaluation results have been officially announced, and the evaluation system is about to transform. This article will help you quickly grasp the key points of the transition between old and new systems, as well as the new indicator content for the next corporate governance evaluation.

Mar 30, 2025

Weekly ESG Trend Tracker: Latest Sustainability Updates 0324-0330

From March 24-30, 2025, the ESG field saw several important developments, particularly those with far-reaching impacts on Taiwan's listed companies. News such as the EU's proposal to simplify sustainability reporting rules, Apple and Foxconn's sustainability milestones, and Taiwan's green talent training program highlight the dynamic changes in global ESG trends.

Mar 13, 2025

What is CBAM? CBAM Postponed to 2027: Impact on Taiwanese Enterprises

EU CBAM delayed to 2027, how should Taiwanese enterprises respond? This article analyzes the CBAM mechanism, affected industries, and response strategies to help businesses grasp future carbon trading trends.

Feb 07, 2025

Trump Announces Paris Agreement Withdrawal Again, Yet It's the Perfect Opportunity for Taiwan Enterprises to 'Overtake' Major Players?!

On January 20, 2025, with the announcement of the US withdrawal from the Paris Agreement, global carbon reduction efforts faced significant impact. As the world's second-largest carbon emitter, the US's reduced commitment to climate agreements not only weakens the coordination of international cooperation but may also cause some countries and enterprises to relax their carbon reduction efforts. However, supply chain pressure has not diminished, especially as the EU and other regions maintain strict carbon emission management requirements, with global brands and purchasers still requiring supply chain partners to maintain high-standard carbon inventory capabilities.

Dec 31, 2024

2025 Corporate Governance Evaluation Indicators Released: Sustainability Dimension Weighting Increased to 49%

The 12th Corporate Governance Evaluation significantly increases the 'Promoting Sustainable Development' dimension weighting to nearly 50%, with plans to officially transform into an 'ESG Evaluation' in 2026, demonstrating Taiwan's capital market's continued commitment to corporate governance mechanisms and sustainable development. This article explains the key modifications to this year's indicators to help enterprises prepare in advance and improve their evaluation performance.

- 1