Trend 1: Global ETS Expansion and Emerging Markets

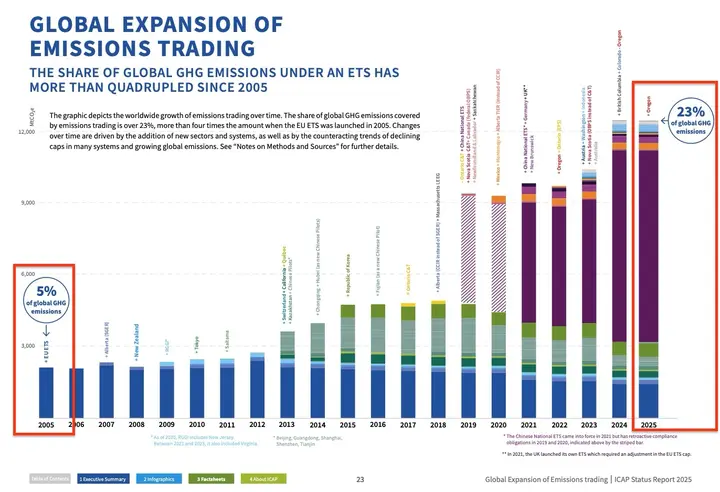

☝️The proportion of global carbon emissions covered by worldwide ETS increased from 5% in 2005 to 23% in 2025. Source: Emissions Trading Worldwide: ICAP Status Report 2025

The ICAP report shows that the global emission coverage rate (regulated carbon emissions) of national ETS expanded from 5% in 2005 to 23% in 2025. This increase in expansion rate mainly comes from emerging economies gradually incorporating ETS into their carbon management policies, such as China expanding to steel and cement industries, India adopting an intensity-based baseline-and-credit system for energy-intensive industries, and Indonesia launching an innovative "cap-tax-and-trade" model. The ETS expansion in these three emerging markets symbolizes the shift of global carbon pricing from developed countries to developing nations, also enhancing the diversity and inclusivity of ETS design.

In the chart above, the ETS with the highest emission coverage is the Chinese National ETS shown in purple, clearly exceeding half of all ETS; followed by the EU ETS in blue, and finally the Republic of Korea ETS in dark green. The following table is provided for readers' reference.

However, while these expansion actions can effectively manage carbon emissions in various countries, "price" is another indispensable consideration factor for ETS.

Trend 2: Price Dynamics of National ETS

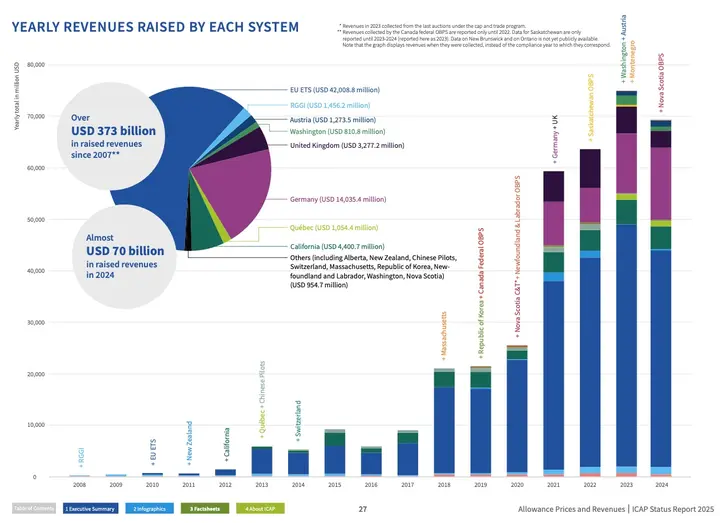

☝️Cumulative revenue from national ETS over the years. Source: Emissions Trading Worldwide: ICAP Status Report 2025

Global ETS revenue in 2024 fell to approximately USD 70 billion, a decrease of USD 4 billion from the previous year, mainly due to EU ETS prices dropping from a peak of nearly €100 per ton in 2023 to €67 per ton in 2024.

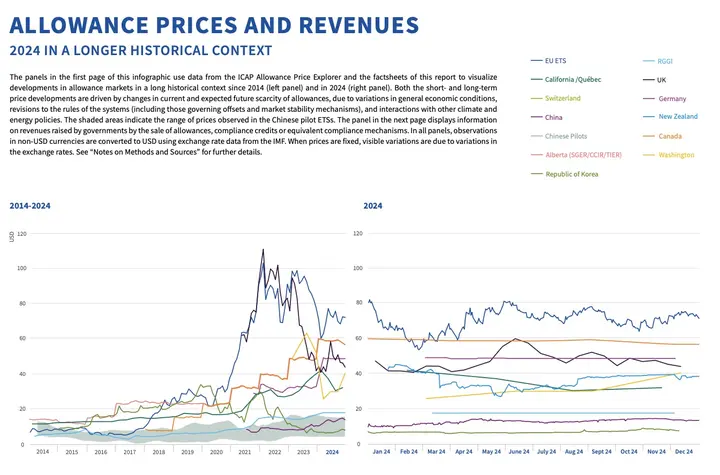

☝️Price change chart for ETS emission allowances. Source: Emissions Trading Worldwide: ICAP Status Report 2025

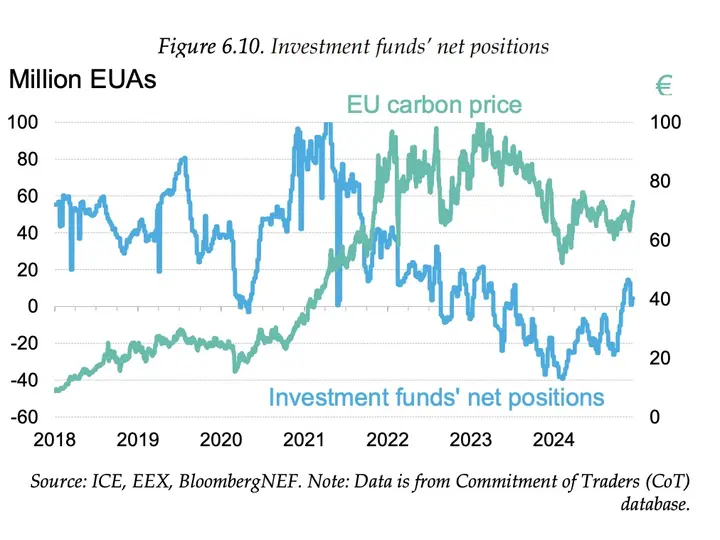

☝️Market trading price change chart for EU Emission Allowances (EUA) in EU ETS. Source: 2025 State of the EU ETS Report

The price changes in EU ETS are related to multiple factors:

- Declining power sector demand: Renewable energy growth reduces fossil fuel demand.

- EU policy reforms leading to oversupply: Recently completed EU reforms like RePowerEU (2023-2026) originally planned to release 267 million EUA units, but only 87 million EUA units were auctioned in the first two years, which has already caused market oversupply, leading to excess allowances and driving down prices.

- Economic slowdown and reduced industrial activity: Following supply chain disruptions from the Russia-Ukraine war, high prices and weak European economic recovery have reduced industrial demand.

However, trading systems in Germany and Canada adopt fixed/hybrid mechanisms, providing greater stability.

Supplementary Explanation: Carbon Credits vs. Carbon Allowances

- Carbon Allowances: Refers to the carbon emission quotas allocated to enterprises or countries in emission trading systems. Simply put, it's "the right to emit carbon." Enterprises can use these allowances to emit carbon; if they exceed their allocated quota, they need to purchase more allowances for compliance.

- Carbon Credits: Refers to carbon reduction certificates generated by purchasing external carbon reduction projects (such as tree planting, renewable energy projects, etc.). Enterprises can purchase these carbon credits to offset part of their own emissions.

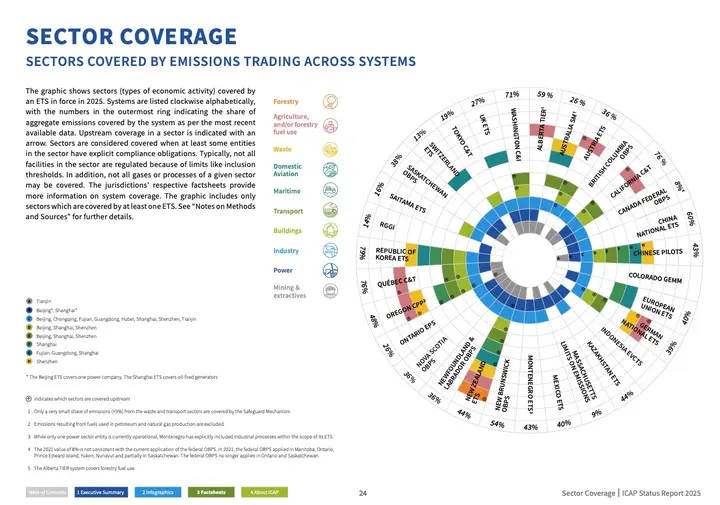

Trend 3: Sector Expansion

☝️Sectors covered by national ETS. Source: 2025 State of the EU ETS Report

This report also points out that ETS is expanding its sector coverage: in addition to traditional power and industry, maritime shipping, buildings, road transport, and waste management sectors are being added. EU ETS reforms are expected to cover double emissions by 2027, and Canada also plans to add upstream oil, gas, and natural gas emissions. This trend reflects the evolution of global ETS from core industries to broader economic activities.

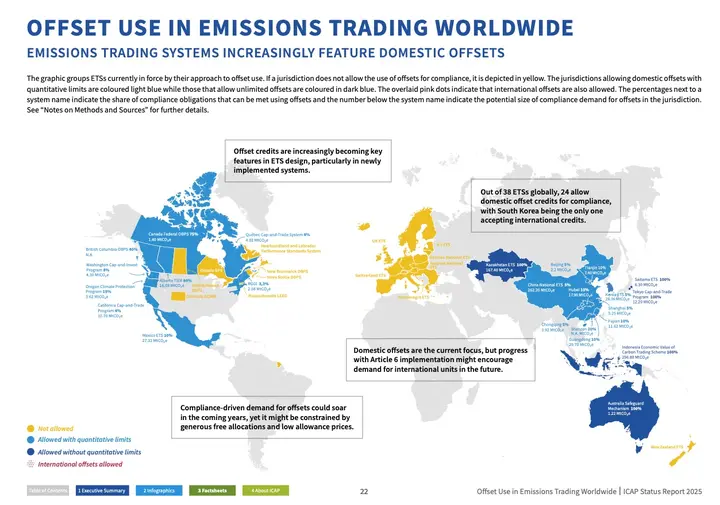

Trend 4: Application of Offset Mechanisms

☝️Scope of offset mechanism applications recognized by countries. Source: 2025 State of the EU ETS Report

First, an Offset Mechanism means that enterprises can generate Carbon Credits by investing in domestic or international emission reduction projects (such as tree planting or renewable energy), and use these credits to offset their own carbon emissions that cannot be reduced. This not only reduces emissions but usually also lowers costs. However, these emission reduction projects need rigorous verification to avoid greenwashing.

Returning to the main topic, among the 38 operational ETS globally, 24 allow domestic offsets, and South Korea is the only country accepting international offsets. Light blue in the chart indicates offset limits, such as California allowing only 4% carbon offset and China at 5%; dark blue indicates unlimited offset quotas, such as Australia and Kazakhstan; yellow indicates no offsets accepted, such as the EU and New Zealand.

However, although most systems currently focus on domestic offsets, as carbon prices and market sizes expand, challenges to these systems will prompt further thinking on how to address future opportunities and risks.

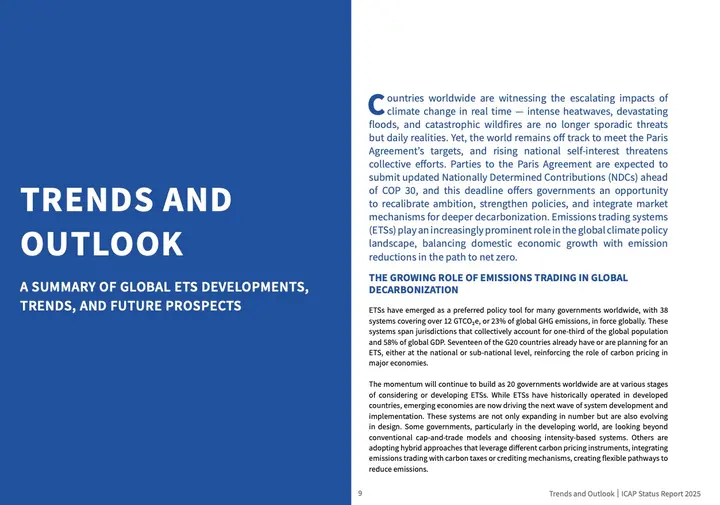

Trend 5: Opportunities Facing Challenges

☝️ICAP summary of ETS trends and future. Source: 2025 State of the EU ETS Report

The future carbon emission trading system (ETS) will face the following three major challenges: First, carbon market fragmentation—different standards for carbon credits between countries limit cross-border trading, and international offset market demand is limited. Second, free allowances and low carbon allowance prices—some countries still provide abundant free allowances, meaning entities can emit a certain percentage of carbon without paying, which suppresses corporate motivation to reduce emissions. Finally, carbon leakage and competitiveness issues—as emission limits gradually tighten, how to prevent enterprises from relocating production to low-standard regions (carbon leakage) due to cost pressures from carbon management policies becomes an important challenge.

To address these challenges, Taiwan enterprises should prioritize the following measures for proactive deployment:

- Build solid understanding of carbon allowances and carbon trading

Deeply understand the operational mechanisms of emission trading systems (ETS), master core concepts of carbon allowances and carbon trading, and distinguish between primary (internal emission reduction) and secondary means (carbon trading or others) of decarbonization. If resources allow, collaborate with domestic and international carbon market experts, regularly conduct training to enhance practical capabilities and address carbon market fragmentation challenges.

- Focus on improving carbon inventory data quality

Enterprises should prioritize establishing standardized carbon management systems, accurately recording and tracking all emission data, and maintaining data reliability through third-party verification. Otherwise, they may mistakenly purchase additional carbon allowances/credits, losing valuable funds.

- Promote internal emission reduction and external market preparation

Enterprises can consider establishing internal carbon pricing mechanisms, treating carbon emissions as costs, and setting specific emission reduction targets (e.g., 20% reduction by 2030). Then achieve internal emission reductions through improving energy efficiency, upgrading equipment, and introducing smart management systems, enhancing future carbon market competitiveness. Meanwhile, continuously monitor carbon trading and offset markets, assess carbon leakage risks (e.g., relocation to Southeast Asia), and formulate regional cooperation or CBAM response strategies to ensure competitiveness.

Conclusion

As the global carbon market expands, emission trading systems (ETS) are becoming important tools for driving low-carbon transition, with overall mechanisms maturing over time. Despite challenges such as market fragmentation, carbon leakage, and free allowances, ICAP's recommendations help promote international cooperation and market integration. In the future, strengthening quality standards for carbon credits and designing effective carbon border adjustment mechanisms will further advance global emission reduction goals.

For carbon trading or carbon offsets, the first step is still accurate calculation of carbon emissions. Sustaihub's DCarbon system helps enterprises easily master ISO 14064 organizational carbon inventory. Simply input relevant activity data and select corresponding factors to generate complete carbon emission inventories with one click, simplifying carbon management processes and helping you quickly achieve compliance requirements.

Fill out the form now to start your free trial🔥!

References

- Emissions Trading Worldwide: ICAP Status Report 2025, ICAP, 2025/04/08

- 2025 State of the EU ETS Report, BloombergNEF, ERCST, etc., 2025/05/21