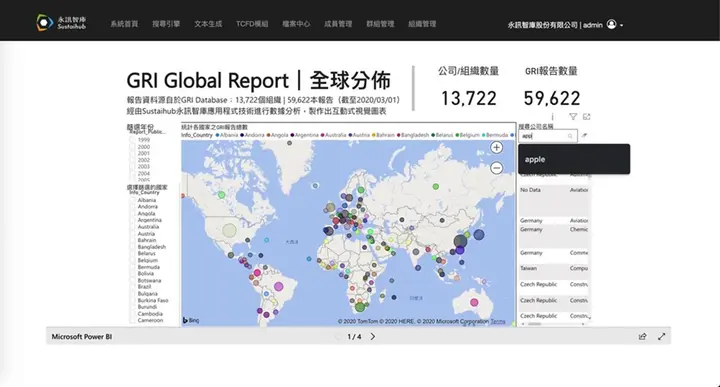

In response to the FSC's launch of "Corporate Governance 3.0 - Sustainable Development Roadmap" and international trends, more companies are preparing sustainability reports. From understanding GRI reporting standards, cross-departmental data collection and collaboration, content writing, to corporate sustainability goal setting, you may want to refer to industry peers or learn from benchmark companies. However, when searching for related content online, do you often find it difficult to directly locate the ESG cases and ESG reports you need for reference?

A common approach is to first go to a selected company's official website to download their sustainability report, then open the file and review the table of contents to find relevant reference information. However, this process often consumes significant time and effort, and you may not always find the data you need, which can be exhausting. If only there were ESG big data, an ESG database, or a sustainability management system to help—that would be wonderful.

How to Prepare an ESG Report? Leverage Big Data in ESG Databases!

Currently, domestic companies disclose ESG information through approximately 3 channels:

- Market Observation Post System

- Company websites or independent sustainability sections on their official sites

- Sustainability reports published by companies

(Image: Market Observation Post System)

On the "Market Observation Post System," you can view ESG report information for Taiwan listed companies and download complete PDF files. Taking annual sustainability reports as an example, each report is nearly a hundred pages, with some exceeding 200 pages, meaning reading just one report requires significant effort. Different companies present their ESG cases and reports in various creative ways—text, tables, charts, graphic designs—making it difficult for sustainability report staff to quickly find needed reference information or conduct industry comparative analysis. An ESG big data or ESG database could consolidate all published sustainability reports for easier querying and reference.

When planning corporate sustainability strategies, having other companies' sustainability goal assessments and strategies for reference or comparison allows quick access to relevant information or industry benchmarks through ESG big data and databases.

For example:

- Economic aspects: Corporate governance structure, how peers write SASB, how to identify and establish material topics, innovative business models, supply chain sustainability management, etc.

- Environmental aspects: ISO-related certifications, TCFD climate risks and opportunities, carbon neutrality goals, energy-saving and carbon reduction methods, circular economy, renewable energy usage ratios, etc.

- Social aspects: Great workplace cases, human rights policy development, how to conduct due diligence, which NGOs, charitable organizations, or relevant entities to reference when organizing internal ESG promotional activities, etc.

This is when you might wish for an ESG big data database that consolidates sustainability-related ESG data. Simply using "keywords" to search report content, you can instantly and precisely find the information you need—whether benchmark cases, award rankings, or industry news—with exact page numbers and immediate page display for real-time viewing. This not only serves as reference material for writing sustainability reports but also simplifies work time, ensuring more efficient and high-quality report production while providing reference for future sustainability strategic planning and continuous improvement.

Sustaihub was founded in 2019 by three founders who recognized pain points in CSR and ESG report preparation while also hoping to help companies with digital transformation. They independently developed the Syber Sustainability Management System and ESG Big Data Database.

The ESG Big Data Database collects corporate social responsibility reports and sustainability reports from domestic and international companies—whether paper-based, PDF format CSR reports, ESG reports, or sustainability reports. Users simply use keyword search to instantly and precisely find the report content information they need, even pinpointing the exact page number with immediate display, quickly providing the keyword information you're searching for.

Currently containing 10,000+ domestic and international corporate sustainability reports consolidated into the ESG Big Data Database, it provides search engine, analytical charts, potential risk assessment, and other functions to help companies make more sustainable business decisions.

(Image: Compiled by Sustaihub)

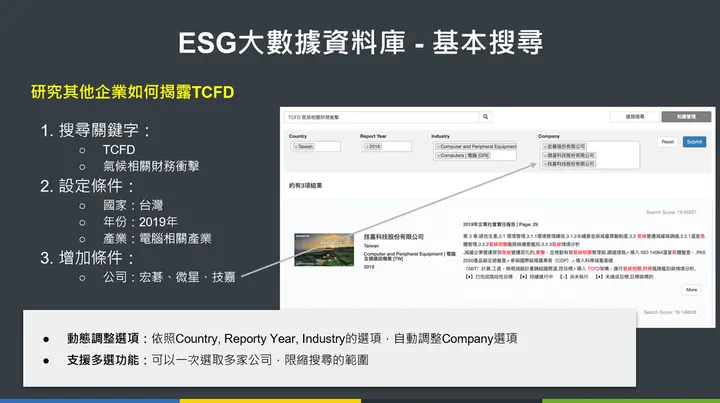

How can you try the ESG Big Data Database? No application needed—simply open the ESG Big Data Database on Sustaihub's official website for free online trial and search. Currently, only sustainability reports issued by domestic companies up to 2019 (inclusive) are available. For operation questions, you can also refer to our tutorial videos. Basic search methods are shown in the image below for quick understanding.

(Image: Compiled by Sustaihub)

International ESG Databases and ESG Case Sharing

If you want to learn about international ESG rating databases, you can visit the following websites:

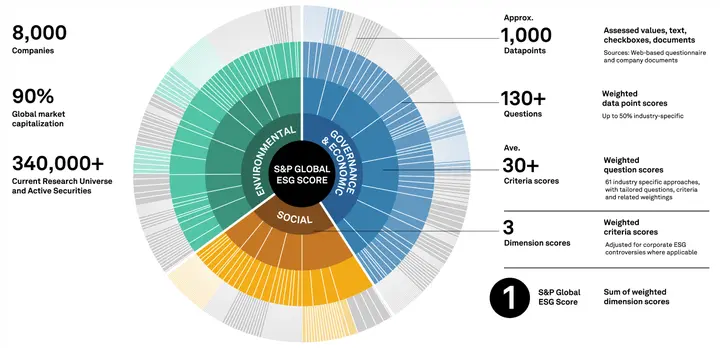

S&P Global (View DJSI score rankings)

MSCI ESG Ratings (View ESG ratings and climate targets)

IR Company Investor Relations Integration Platform (Integrates various ESG rating information)

(Image: S&P Global Website)

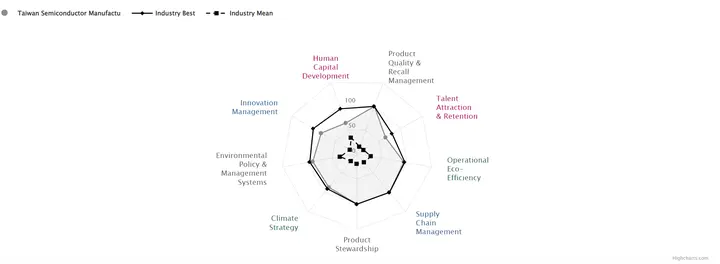

Through the S&P Global website, you can directly search international company names. The image below shows TSMC's DJSI score performance, displaying scores across the three ESG dimensions while showing Industry Best and Industry Mean to understand the company's ESG performance level within the industry.

(Image: S&P Global Website)

Besides ESG dimension scores, you can view industry ESG material topic scores. For the semiconductor industry, S&P Global focuses on product standards, supply chain management, talent attraction and retention, climate strategy, environmental policy and management systems, human capital development, innovation management, green operations, and product quality management. Radar charts present material topic scores for deeper understanding of sustainability issues semiconductor companies should prioritize.

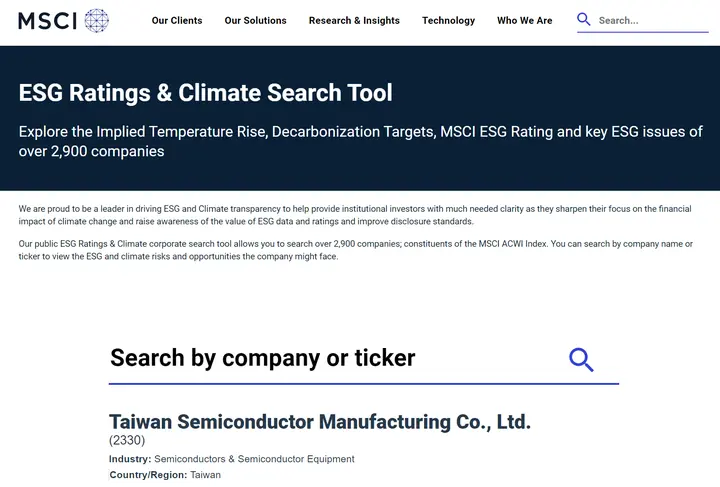

MSCI ESG Ratings

(Image: MSCI Website)

MSCI ESG analyzes corporate ESG ratings based on ESG risk management levels

MSCI ESG Research's ESG Ratings are designed to measure a company's resilience to financially material environmental, social, and governance (ESG) risks. MSCI uses a rules-based methodology to analyze corporate ESG ratings based on ESG risk management levels among industry leaders, laggards, and peers, ranging from Leaders (AAA, AA), Average (A, BBB, BB) to Laggards (B, CCC).

Using TSMC as an example, with an MSCI ESG rating of AAA, it has the best industry performance, representing the most comprehensive ESG risk management, leading among 82 international semiconductor companies. On material topics, MSCI specifically identifies semiconductor industry material issues—TSMC is an industry ESG leader in corporate governance, business ethics, human capital development, and controversial sourcing, while MSCI hopes companies can provide more management actions on water resource management and green technology opportunities to explain how to effectively reduce risk impacts.

(Image: MSCI Website)

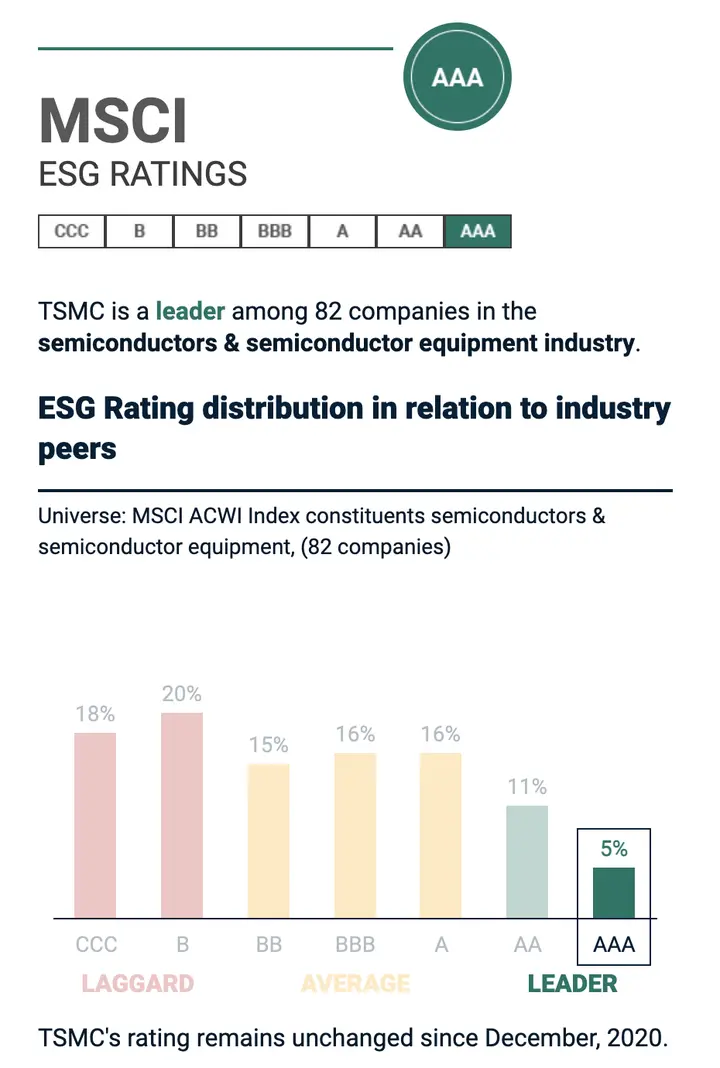

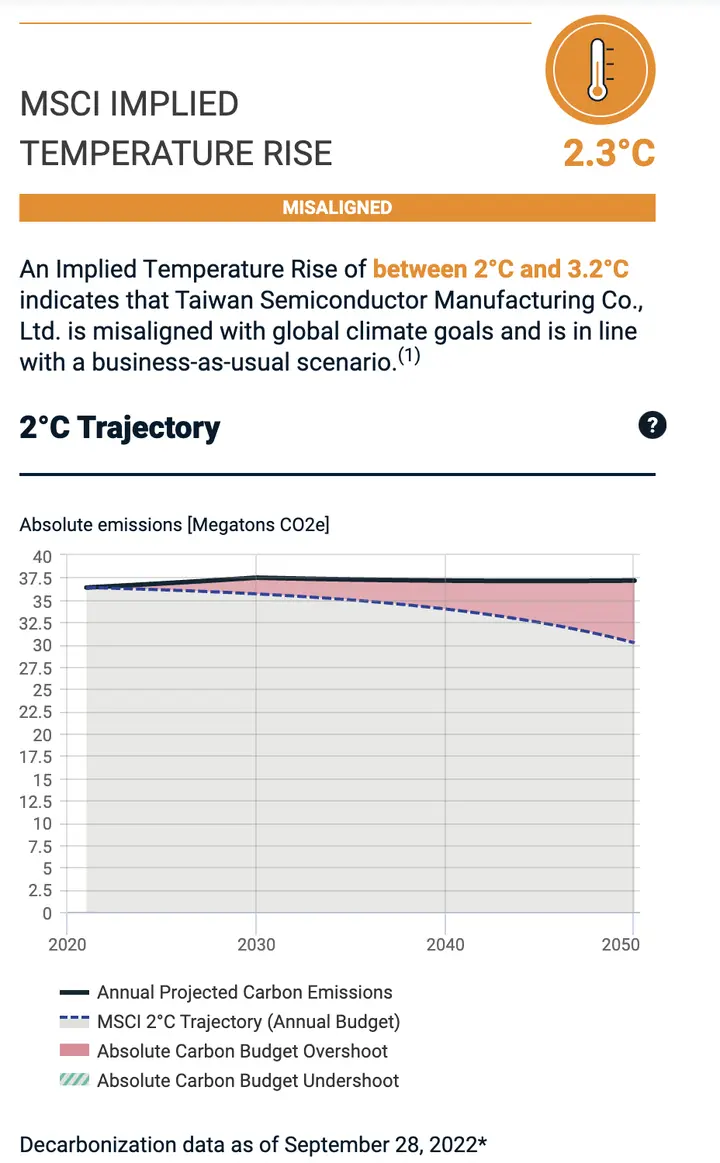

Additionally, MSCI calculates corporate decarbonization ambition based on their carbon reduction strategies. The current global consensus is to control global temperature rise to 1.5°C or below 2°C to avoid severe impacts from extreme weather events. MSCI analyzes corporate decarbonization pathways through calculation models and assesses whether their carbon reduction strategies align with global warming scenarios to help control temperatures within certain limits.

In the example below, TSMC's implied temperature rise is 2.3°C, slightly higher than the 2°C scenario. Other carbon reduction target information is also shown, including TSMC's 2050 carbon reduction goals, helping investors and the public better understand corporate decarbonization ambitions.

(Image: MSCI Website)

IR Company Investor Relations Integration Platform

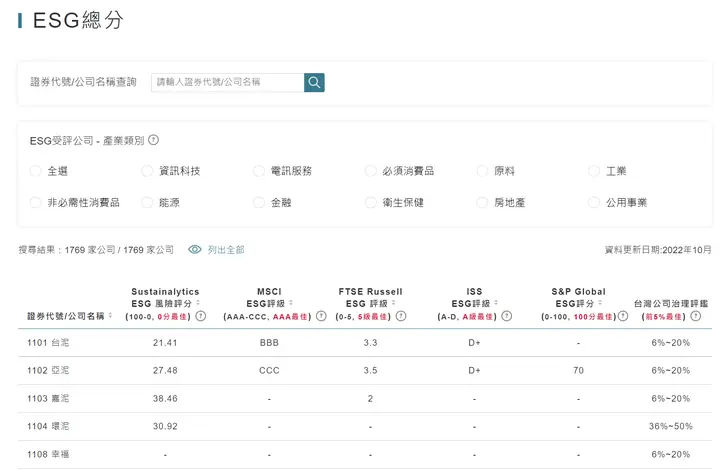

The "IR Company Investor Relations Integration Platform" provided by Taiwan Depository & Clearing Corporation integrates FTSE Russell, ISS ESG, MSCI, S&P, Sustainalytics, and corporate governance rating data, making it convenient for investors or companies to retrieve all ESG rating data at once and quickly analyze and compare benchmark companies' or competitors' ESG performance.

(Image: IR Company Investor Relations Integration Platform)

Above is a sharing of must-bookmark ESG database lists for ESG practitioners—from Market Observation Post System, ESG Big Data Database, S&P Global, MSCI ESG Ratings, IR Company Investor Relations Integration Platform. As global attention to ESG trends grows annually, various ESG databases continue to be developed, providing ESG data analysis from different perspectives. We will continue sharing more ESG data resources with everyone.

If you want to learn more about our Syber Sustainability Management System, apply for a trial now to experience Sustaihub's powerful sustainability services. Our professional consulting team will help companies quickly implement the system, making sustainability report preparation more efficient and higher quality.

For more information about our products and services, please contact us.

(02) 7753-8680

LINE@: 567hggve