What are IFRS S1 S2? Latest Regulations and Timeline

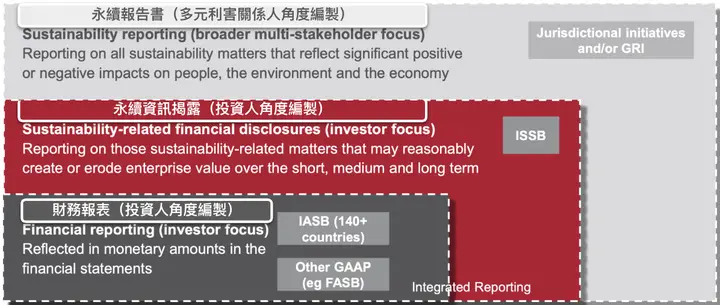

To meet investor needs and establish globally consistent sustainability disclosure standards, the IFRS Foundation announced the establishment of the International Sustainability Standards Board (ISSB) at COP26 in 2021, promoting the integration of sustainability disclosure with financial reporting to enhance information quality and comparability.

ISSB released the IFRS Sustainability Disclosure Standards in June 2023:

- S1 "General Requirements for Disclosure of Sustainability-related Financial Information": Requires disclosure of all sustainability risks and opportunities that may affect enterprise value.

- S2 "Climate-related Disclosures": Focuses on climate issues, following the TCFD framework and integrating SASB industry metrics.

The core purpose of IFRS Sustainability Disclosure Standards is to align sustainability information with traditional financial reporting, enabling investors to simultaneously assess enterprise financial performance and sustainability risks and transformation opportunities.

IFRS Sustainability Disclosure Standards integrate sustainability reports with financial statements

Source: IFRS Foundation, translated by Sustaihub

Target Companies and Timeline

Taiwan will implement in three phases based on capital, with all listed companies required to disclose under IFRS Sustainability Disclosure Standards by 2029:

- Listed companies with capital of NT$10 billion or more: Disclose 2026 information in annual reports from 2027

- Listed companies with capital of NT$5 billion or more: Disclose 2027 information in annual reports from 2028

- All other listed companies: Disclose 2028 information in annual reports from 2029

Listed companies IFRS Sustainability Disclosure Standards alignment timeline

Source: FSC (2023) Blueprint for Taiwan's Alignment with IFRS Sustainability Disclosure Standards

Location and Timing

The trend in sustainability reporting has shifted from voluntary to mandatory statutory reporting. The FSC will revise annual report preparation regulations, adding a sustainability information chapter that requires domestic listed companies to disclose relevant information according to IFRS Sustainability Disclosure Standards in a dedicated annual report chapter.

⚠️Special Note: Sustainability information disclosure deadline will be moved up to March 16, synchronized with annual financial statement announcements. Enterprises must pay special attention to ensure consistency between annual reports and sustainability reports published before August 31!

How Can Enterprises Identify Material Sustainability Topics According to IFRS Requirements?

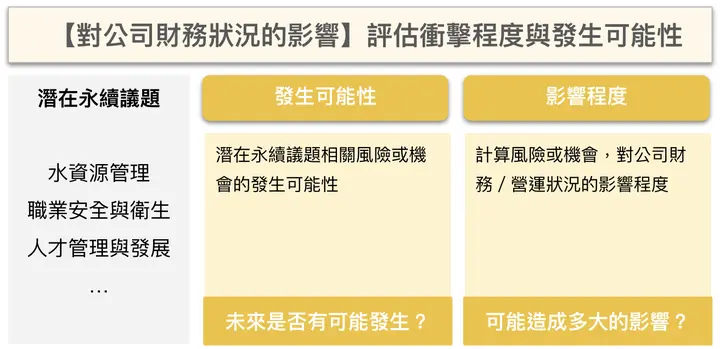

IFRS S1 materiality identification "requires quantifying the financial impact of sustainability topics." Companies must collect and analyze relevant financial data to assess impacts on revenue, costs, asset values, and cash flows. We'll use "technology talent shortage" as a case study:

When assessing the impact of potential sustainability topics (including their risks or opportunities), enterprises need to comprehensively consider "likelihood of occurrence" and "magnitude of impact." For example:

- Likelihood of occurrence: AI industry's demand for technology talent continues to increase, likely facing talent gaps in the future.

- Magnitude of impact: If talent is insufficient, product launch will be delayed, potentially resulting in order losses of approximately NT$80 million, and may increase recruitment costs by approximately NT$4 million.

After completing financial impact assessment, enterprises need to make judgments based on the definition of "material." "Material" refers to information that, if omitted, misstated, or obscured, could reasonably be expected to influence investor decisions. Enterprises can consider whether not disclosing such sustainability-related risks or opportunities would affect investors' valuation and investment decisions regarding the company.

IFRS S1 Sustainability Topic Materiality Assessment Explanation

Source: Compiled by Sustaihub Consulting Team

How Should Enterprises Align with IFRS Sustainability Disclosure Standards?

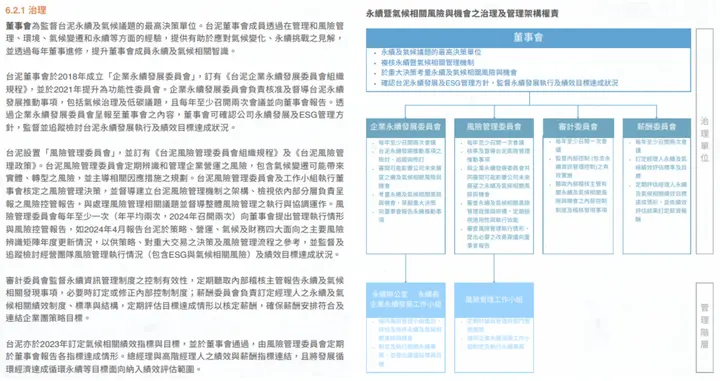

IFRS S1 - Governance

- Core content: Governance processes, controls, and procedures for monitoring and managing sustainability-related risks and opportunities.

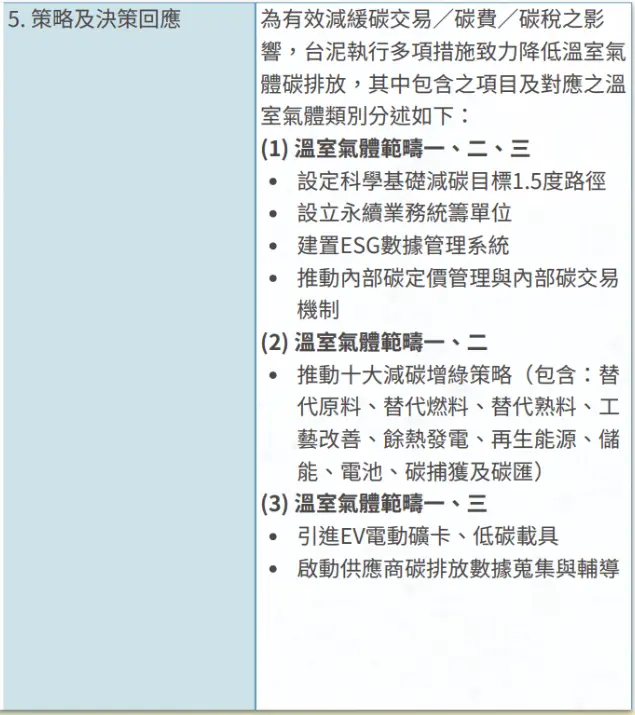

- Case study: Taiwan Cement established board functional committees "Corporate Sustainability Development Committee" and "Risk Management Executive Committee" as governance units responsible for sustainability management-related risks and opportunities, explaining authority attribution, communication mechanisms, promotion results, and strategic and risk management considerations.

Source: Taiwan Cement 2024 Annual Report

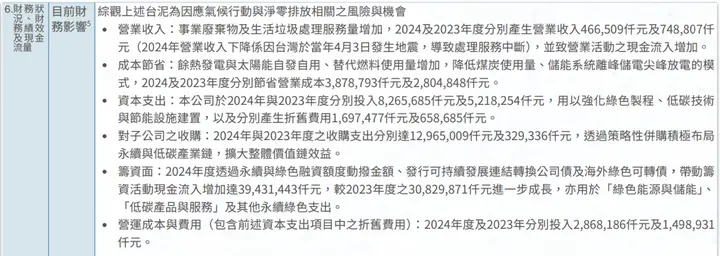

IFRS S1 - Strategy

- Core content: For material risks and opportunities, disclose current financial impacts, response strategies, and potential financial impacts.

- Case study:

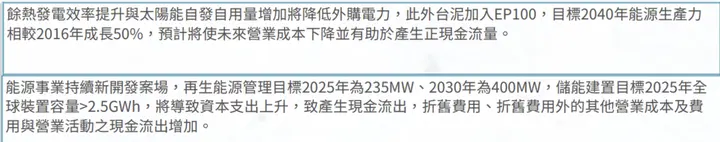

Taiwan Cement discloses "current financial impacts" for the material topic of "Climate Action and Net Zero Emissions."

Source: Taiwan Cement 2024 Annual Report

And explains the strategies and decisions Taiwan Cement has adopted for this issue.

Source: Taiwan Cement 2024 Annual Report

And for response measures, the expected short-term, medium-term, and long-term impacts on financial performance and cash flows.

Source: Taiwan Cement 2024 Annual Report

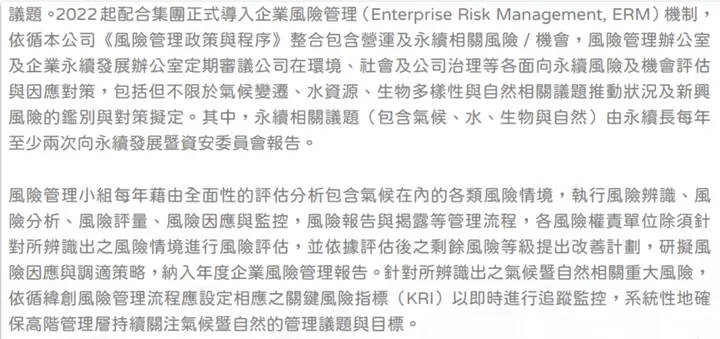

IFRS S1 - Risk Management

- Core content: Processes for identifying, assessing, prioritizing, and monitoring sustainability-related risks and opportunities.

- Case study: Wistron integrates into existing risk management mechanisms, designates relevant responsible departments to manage risks and opportunities, and regularly reviews and tracks.

Source: Wistron 2024 Climate and Nature Report

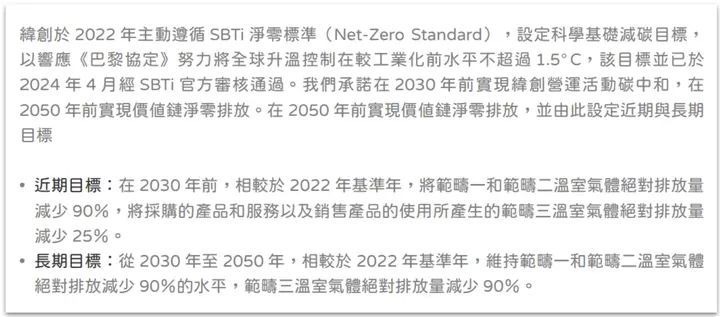

IFRS S1 - Metrics and Targets

- Core content: For material information, disclose performance, targets, and achievement status.

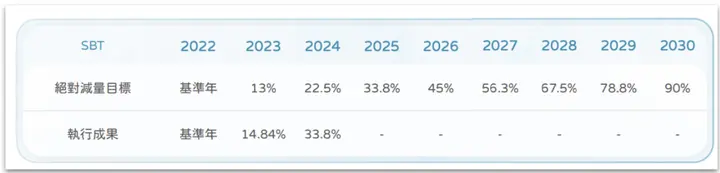

- Case study: Wistron clearly defines that the metric source is SBTi, explains using absolute emissions as a measurement indicator, sets a 2030 interim target of 90% reduction in Scope 1 and 2 absolute emissions, and explains annual execution results.

Source: Wistron 2024 Climate and Nature Report

Source: Wistron 2024 Climate and Nature Report

How Can Enterprises Quickly Find Disclosure Cases?

When preparing sustainability reports or disclosing sustainability-related information, enterprises often want to reference benchmark companies' disclosure methods. Sustaihub provides the free tool Sustain AI to help enterprises quickly and precisely find cases from peers and benchmark companies through keywords.

For example, if you want to find "which enterprises have disclosed their SBTi reduction methods, strategies, and results in sustainability reports," you can enter "SBTi" as a keyword in Sustain AI.

Sustain AI will help you identify "which enterprises have disclosed relevant content on certain pages" in their filed reports.

You can then download the report and directly flip to those pages, accelerating your search for benchmark cases.

Source: Sustaihub Official Website

What Preparations Can Enterprises Make to Align with IFRS S1 S2?

1. IFRS Sustainability Disclosure Standards Implementation Plan

To help enterprises smoothly implement IFRS Sustainability Disclosure Standards, TWSE requires enterprises to formulate their own implementation plans, which must be submitted to the board of directors and filed with TWSE and TPEx. The regulatory authority has released "Implementation Plan Reference Example" for enterprise reference.

2. IFRS Sustainability Disclosure Standards Alignment Portal

Drawing on Taiwan's past experience promoting IFRS accounting standards, the FSC established the "Promoting Taiwan's Alignment with IFRS Sustainability Disclosure Standards" project team in August 2023. Through various working groups, they conduct standard translation, produce practical examples and guidance, adjust relevant regulations, and strengthen promotion.

The regulatory authority established the "IFRS Sustainability Disclosure Standards Alignment Portal" to provide enterprise learning resources:

- IFRS Sustainability Disclosure Standards Traditional Chinese Version

- IFRS Alignment Practical Guidance and Examples

- Regulatory Authority Course Video Learning Channel

3. Seeking External Consultant Assistance

You can engage professional consultants for training, gap analysis and strategic planning recommendations, materiality identification, data inventory and financial impact assessment to help establish internal processes, train personnel, and ensure disclosure content meets IFRS S1/S2 requirements.

IFRS S1 S2 Implementation Countdown! Sustaihub Provides Complete IFRS Sustainability Disclosure Standards Implementation Services

Listed companies facing the new IFRS S1/S2 regulations must prepare comprehensively from awareness to implementation. Sustaihub provides complete and flexible consulting services to help you quickly align with international trends.

1. IFRS S1 S2 Training

If you're still unfamiliar with IFRS requirements, we've designed systematic courses to help you:

- Quickly grasp core requirements and disclosure priorities of IFRS S1/S2

- Understand the connections between governance, strategy, risk management, metrics, and targets

- Strengthen response capabilities through industry case sharing

2. IFRS S1 S2 Gap Analysis

Through data interviews, we help you inventory your sustainability disclosure status, analyze gaps with IFRS S1/S2 standards, and provide specific improvement recommendations.

3. IFRS S1 S2 Materiality Assessment

Through workshops and assessment processes, we help enterprises:

- Identify and assess sustainability topics

- Produce specific lists of material risks and opportunities

- Quantify the impact of sustainability topics on revenue, costs, and cash flows

4. ESG Information and Data Collection

We provide IFRS-specific data collection forms and process establishment to help enterprises:

- Establish systematic information collection mechanisms

- Ensure cross-departmental data consistency and verifiability

- Strengthen subsequent audit and report preparation efficiency

Welcome to contact us to learn more about our services!

Transparent Sustainability Disclosure Enhances Enterprise Competitiveness

Through the above explanation of IFRS Sustainability Disclosure Standards, enterprises should better understand the standard requirements and ensure disclosure content meets global investor expectations!

During the transition period for alignment, enterprises still face the complexity of international sustainability reporting frameworks. Sustaihub's reporting management system can customize connections to required GRI, SASB, TCFD, IFRS S1/S2 and other international frameworks. Click to see how ESG digitalization can help solve your report management challenges.