In response to global sustainability trends and investment market demands, the Taiwan Stock Exchange has officially released the "ESG Evaluation," which will replace the original "Corporate Governance Evaluation" starting from 2026.

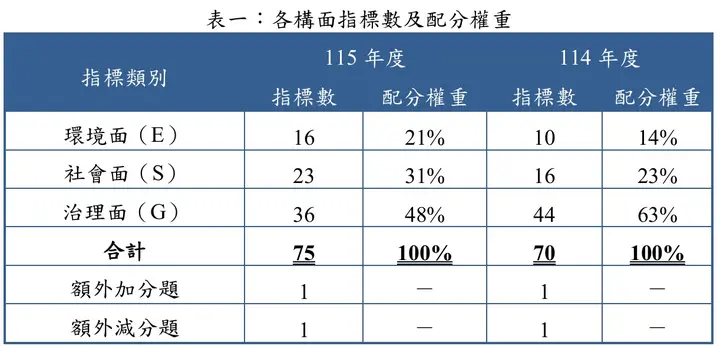

The new system continues the existing evaluation framework and process while expanding coverage to three major dimensions: Environment (E), Social (S), and Governance (G), with a total of 75 indicators to comprehensively examine listed companies' performance across all aspects of sustainable development.

This evaluation system aims to establish a market culture of sustainable value and help investors more effectively grasp companies' ESG performance as an important reference for sustainable investment decisions. It also hopes to guide companies through the evaluation mechanism to implement sustainable governance, strengthen information disclosure transparency, and gradually align with international sustainability evaluation standards (such as SASB, TCFD, ISSB).

The following will provide an in-depth analysis of this major institutional reform and key topics that companies should focus on from the overall framework and the three dimensions of Environment (E), Social (S), and Governance (G).

Source: TWSE Corporate Governance Center

Evaluation Framework

The biggest change in this ESG evaluation is the comprehensive adjustment of the evaluation framework. The TWSE has integrated the four dimensions used in the original "Corporate Governance Evaluation"—"Protecting Shareholders' Rights and Treating Shareholders Equally," "Strengthening Board Structure and Operations," "Enhancing Information Transparency," and "Promoting Sustainable Development"—into three major dimensions: "Environment (E)," "Social (S)," and "Governance (G)," making the evaluation system more aligned with the mainstream international ESG framework.

In terms of weighting design, the TWSE has also adjusted the proportions of the three dimensions: Environment accounts for 21%, Social 31%, and Governance 48%. This update includes 12 new indicators, 17 revised indicators, 7 deleted indicators, and 5 adjusted question types. From the scoring and content, it can be observed that the ESG evaluation still centers on the "Governance" dimension while balancing environmental management and social responsibility. Governance, as the institutional foundation for corporate sustainability, remains key to evaluation scores; while the increased weight of environmental and social topics also reflects the trend of evaluation focus gradually moving toward integrating overall ESG performance.

Environment (E): Focus on Resource Efficiency, Biodiversity, and Natural Carbon Sinks

In the Environment dimension (E), this adjustment includes splitting the original water resources and waste indicators, and adding waste management, circular economy, energy, biodiversity, and natural carbon sink items. Overall, the evaluation focuses more on resource use efficiency and natural capital management, while responding to international trends by focusing on biodiversity conservation and natural carbon sink topics. The direction is consistent with the latest GRI framework and TNFD (Taskforce on Nature-related Financial Disclosures) development trends.

Detailed update items as follows (Source: Taiwan Stock Exchange Corporate Governance Center):

- Split "Water Resources" and "Waste" related indicators: For example, revised E-4 to "Establish water reduction management policy"; E-5 revised to "Disclose water consumption for the past two years."

- Added waste management and circular economy indicators: Added E-6 "Establish and disclose circular economy or waste management policies and related actions," E-7 "Disclose total waste weight for the past two years."

- Added energy use disclosure indicator: E-9 "Disclose energy use status for the past two years."

- Added biodiversity and natural carbon sink indicators: E-14 "Establish and disclose biodiversity policy or commitment and explain implementation status," E-15 "Establish and disclose strategies and measures for promoting natural carbon sinks and explain implementation status."

- Strengthened supplier environmental management disclosure: Added E-16 "Disclose supplier management policy requirements and implementation status on environmental topics."

Social (S): Deepening Human Rights Protection

In the Social dimension (S), this update covers deepening human rights topics, investor engagement mechanisms, startup investment, family-friendly measures, and adds advanced bonus conditions such as strengthening supplier management indicators. Overall, the evaluation places more emphasis on deepening human rights protection and extending supply chain labor rights, encouraging companies not only to protect employee rights but also to implement human rights management for upstream and downstream partners.

Detailed update items as follows (Source: Taiwan Stock Exchange Corporate Governance Center):

- Deepening human rights protection and human rights due diligence: Revised S-1 "Establish and disclose human rights policy content and responsible unit," added S-2 "Establish and disclose human rights due diligence process and implementation status."

- Added investor engagement disclosure indicator: S-6 "Disclose investor engagement status and important content of investor questions and company responses."

- Support innovative startups: Added S-11 "Disclose investment in domestic innovative startups."

- Promote family-friendly/marriage and childbirth measures: Added S-17 "Disclose implementation status and effectiveness of family-friendly or marriage and childbirth workplace environment measures."

- Strengthen human resources statistics transparency: Added S-23 "Disclose employee turnover rate by gender and age for the past two years, and explain trends and reasons for changes."

Established advanced bonus requirements: Such as S-16 bonus item for employer pension contributions exceeding legal requirements. Split supplier management social dimension indicators: Revised S-15 "Disclose supplier management policy requirements and implementation status on occupational safety and health, labor rights, information security or privacy protection topics."

Governance (G): Continuing Existing Regulations, Continued Focus on Sustainable Governance Functions

In the Governance dimension (G), changes are relatively limited, mainly following existing regulations and corporate governance evaluation framework, such as female director ratio, board operations, and information transparency. The overall direction continues the spirit of past corporate governance evaluation, emphasizing sound governance structure and continuous improvement.

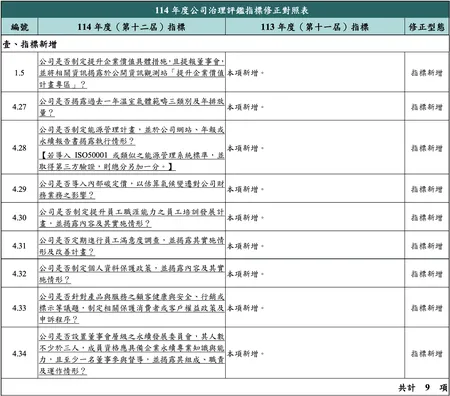

Detailed update items as follows (Source: Taiwan Stock Exchange Corporate Governance Center):

- Board structure revision: Revised G-15 to "Company independent directors' consecutive tenure does not exceed three terms"; and changed original "Company board members include at least one director of different gender" to a bonus item (G-11) rather than a basic scoring item.

- Treasury stock buyback disclosure requirements upgraded: Added G-25 "Treasury stock buyback purpose is for employee transfer with average execution rate of 90% or above, or disclosure of daily actual execution status during the period upon expiration or completion."

- Strengthened sustainable governance mechanism: Added G-30 advanced bonus requirement "Having a Chief Sustainability Officer (or equivalent position) to execute sustainable development affairs and regularly report implementation status to the board."

- Improved sustainability information disclosure quality: Added G-33 advanced bonus requirement "Industry indicator information disclosed with reference to SASB standards, obtaining third-party assurance or guarantee."

- Indicator wording and question type adjustments: Including revised G-1 (remuneration policy and performance linkage disclosure), G-5 (shareholder meeting online broadcast or recording disclosure), G-13 (disclosure of kinship or same-company internal relationships among directors), and deletion or consolidation of some indicators with lower practical differentiation.

Future Outlook: Evaluation Development Direction and Recommendations for Companies

As "Corporate Governance Evaluation" officially transforms into "ESG Evaluation," it not only symbolizes a major milestone in Taiwan's sustainable development governance but also shows that Taiwan is accelerating alignment with international standards. Under the new framework, in addition to governance continuing as the core, environmental and social responsibility have officially been incorporated into key areas of the government evaluation system, indicating that policy expectations for corporate sustainability actions are gradually becoming comprehensive and institutionalized. In the future, the gap between international and Taiwan's sustainability information disclosure and management practices is expected to gradually narrow.

Furthermore, integrating environmental and social topics into the original governance evaluation system also means that future evaluation directions will move toward deep integration and long-term tracking rather than independent assessments of multiple dispersed topics. This framework may also become an important reference template for the government and industry when setting indicators for other sustainability topics in the future.

Recommendations for Companies:

- Assess current status and gaps: Companies are advised to first assess current indicator performance and system gaps according to the latest ESG evaluation framework, especially new indicators in the environmental and social dimensions.

- Focus on governance optimization: In the short term, strengthening internal governance systems (such as board functions, information disclosure quality, risk management mechanisms) should remain the primary goal as the foundation for advancing environmental and social strategies.

- Medium to long-term integration planning: Gradually introduce cross-departmental ESG management mechanisms to link sustainability goals with corporate strategy, laying the foundation for higher-level integrated evaluations in the future.

Companies should also continue to monitor updates and trend developments in international sustainability frameworks, such as ISSB, GRI, and TNFD standards, and prepare data disclosure and management mechanisms in advance. By grasping global trends early and internalizing them into corporate strategy, companies can not only reduce future adjustment costs but also demonstrate foresight and competitiveness under sustainability evaluations and international investor attention.