I. What is a CSR Sustainability Report?

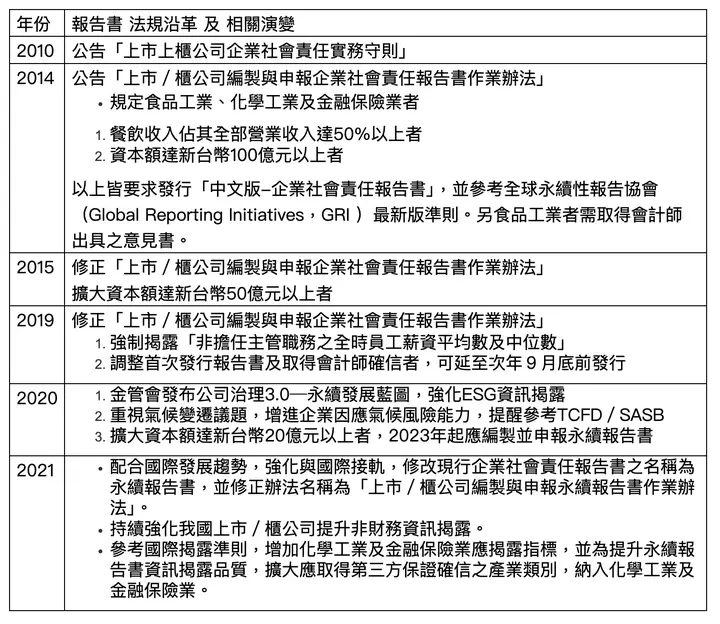

CSR reports originated as voluntary annual non-financial reports published by companies, requiring disclosure of important issues in environmental, social, and corporate governance aspects, though not mandatory like financial reports. The earliest domestic origin came from the Taipei Exchange (TPEx) in 2010 with the "Corporate Social Responsibility Best Practice Principles for TWSE/TPEx Listed Companies," where Article 30 directly states: Listed companies should prepare Corporate Social Responsibility Reports disclosing CSR implementation, with contents including:

- Institutional framework, policies, and action plans for implementing corporate social responsibility.

- Key stakeholders and their concerns.

- Performance and review of corporate governance implementation, sustainable environment development, and social welfare maintenance.

- Future improvement directions and goals.

Below is our summary of CSR report evolution to help everyone quickly understand the growing importance of sustainability reports.

II. What Frameworks and Standards Should Sustainability Reports Cover?

Starting from 2021, the FSC renamed CSR reports to "Sustainability Reports (or ESG Reports)." Whether called CSR reports or ESG reports, the main disclosure framework covers corporate actions and financial information across three dimensions: economic, social, and environmental, allowing all stakeholders including shareholders/investors, consumers, employees, and suppliers to clearly understand the company's operations, current sustainability achievements, and future plans. Companies are also encouraged to publish "English ESG sustainability reports, shareholder meeting handbooks, and annual financial reports," facilitating seamless integration with international enterprises when entering global markets.

According to "Corporate Governance 3.0" requirements, ESG reports from 2023 must reference three major standards: GRI Global Reporting Initiative, TCFD Climate-Related Financial Disclosures, and SASB Sustainability Accounting Standards Board. See the following descriptions:

1. GRI Global Reporting Initiative:

Current regulations require compliance with GRI Standards for preparation. GRI released the latest "GRI Universal Standards 2021" last year, with revisions including:

- GRI 1 Foundation:

- GRI 2 General Disclosures: Focuses on company employees, governance strategies, stakeholders, etc., streamlining disclosure items from the old version with minor structural consolidation and adjustments, directly incorporating "Human Rights Assessment" and "Due Diligence" into general disclosure indicators.

- GRI 3 Material Topics: Provides clear procedural guidance for organizations identifying material topics, helping organizations effectively identify and smoothly disclose material topic requirements.

These new standards became fully effective on January 1, 2023. GRI also released the first sector-specific disclosure standard for "Oil and Gas Sector." As of August 2021, 4 sector standards have been released: Oil and Gas, Coal, Agriculture and Fishing, and Mining, promoting related companies' gradual low-carbon economic transition. Future plans include standards for over 40 different industries including mining, agriculture, and fishing, enabling companies to produce corresponding reports based on industry characteristics and develop more appropriate corporate sustainability plans.

*For detailed standards and guidelines, refer to the GRI website

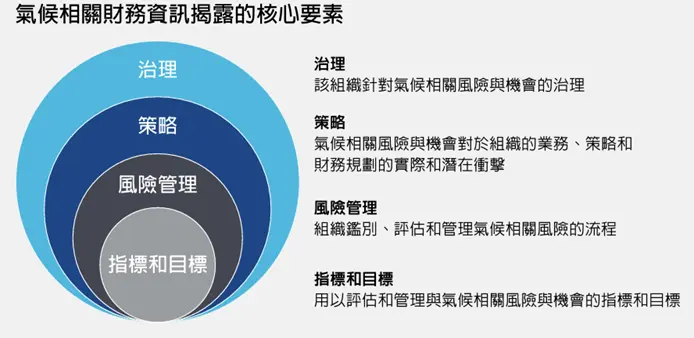

2. TCFD Climate-Related Financial Disclosures

The Task Force on Climate-related Financial Disclosures (TCFD) was established in 2015 by the Financial Stability Board (FSB) to develop consistent voluntary climate-related financial disclosure recommendations and more accurately assess climate-related risks and opportunities. Through four core elements of organizational operations—Governance, Strategy, Risk Management, and Metrics and Targets—it establishes a reporting framework and guidelines for implementing climate action, helping investors and decision-makers understand corporate significant risks.

3. SASB Sustainability Accounting Standards Board

Traditional corporate financial reports often lack complete information on long-term value creation. To bridge the gap in investor enterprise valuation, the San Francisco nonprofit "Sustainability Accounting Standards Board (SASB)" was established in 2011. By developing more comprehensive disclosure standards combining qualitative and quantitative sustainability information with ESG indicators, it primarily discloses sustainability-related information for investors while identifying material factors that may affect financial performance, enabling companies to more comprehensively demonstrate sustainability performance and value.

4. Other Voluntary Reference Standards: SDGs, Global Compact, ISO 26000, TNFD

For example, given that economic development often accompanies large-scale resource destruction, companies will also reference the Taskforce on Nature-related Financial Disclosures (TNFD) to present financial risks related to natural climate change, helping investors and government agencies better understand the company and providing reference for future investment decisions.

According to Sustaihub's ESG Big Data Database statistics, several domestic companies have already adopted the latest GRI 2021 standards in their 2021 Sustainability Reports released this year. We will continue sharing specific content and implementation results from these companies—stay tuned for our professional articles.

Tips:

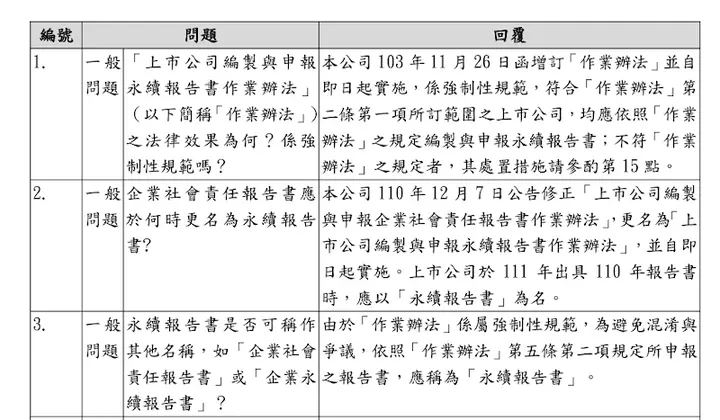

When corporate staff are responsible for writing sustainability reports for the first time or annually, remember to first read or review the "Operating Procedures for Listed Companies to Prepare and File Sustainability Reports" to understand regulatory requirements. You can also refer to the FAQ thoughtfully provided by authorities for immediate assistance.

(Image source: TWSE Corporate Governance Center)

III. How to Prepare ESG Reports More Efficiently?

We've compiled three key tips for companies writing sustainability reports to help improve efficiency and content completeness.

Tip 1: Gain Support from Senior Management

Writing reports often requires collecting information from various departments and cross-departmental communication. Without strong support from senior management, many department heads won't prioritize this, leading to difficulties and obstacles in data collection, obtaining incorrect information requiring rework or recalculation, consuming significant time. Additionally, deadlines may pass with departments still unwilling to provide relevant materials, causing delays in sustainability report preparation and publication. Sustaihub's consulting team has years of professional experience in guiding corporate report writing and timeline planning, and can assist with planning and training.

Therefore, when launching a "New Year Sustainability Report Project," be sure to invite senior management to participate in the kickoff meeting and announce the planned timeline, which will significantly improve preparation efficiency.

Tip 2: Present Report Content Objectively

When preparing sustainability reports, faithfully present overall corporate performance objectively without deliberately emphasizing only positive information. Government and investors reviewing sustainability reports want to see actual actions across economic, social, and environmental dimensions. Over-embellishment not only violates ESG principles but may also cause reputational and business partnership damage if discrepancies with reality are discovered later. Furthermore, honestly disclosing negative information and explaining potential stakeholder impacts while outlining improvement plans can actually attract investor favor. Consider using these websites to search for past regulatory violation records:

- Labor Law Violation Query System

- Regulated Pollution Source Data Query System

- Penalty Cases - Financial Supervisory Commission

- Transparent Footprint

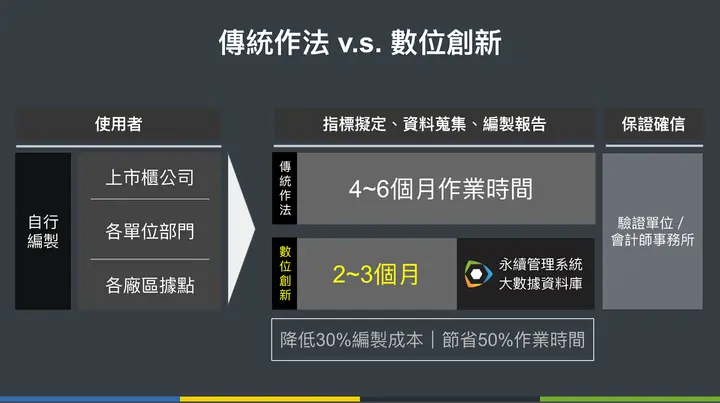

Tip 3: Leverage Sustainability Management Tools to Improve Efficiency

When preparing sustainability reports, companies typically spend significant manpower and time collecting data, calculating outputs, writing drafts, and handling editing and layout, while carefully cross-checking report structure and standard indicators to produce compliant content. The back-and-forth email confirmations with various departments, sometimes with version discrepancies due to email timing, require additional time for verification. First-time report preparers face even more challenges due to inexperience with regulations and standards, or lack of professional consulting support, requiring significant effort for exploration and research.

(Image: Compiled by Sustaihub)

Specialized sustainability management system tools can precisely track relevant industry indicators while enabling online collaborative editing and data analysis. Taking Sustaihub's Syber Sustainability Management System as an example, it not only archives routinely disclosed data to save manual editing and proofreading time, but also uses the ESG Big Data Database keyword search function to quickly find CSR/ESG report references from the same industry or previous years. Professional consultants discuss with companies to develop suitable application solutions, effectively simplifying work time and enabling more efficient sustainability report production. This allows comprehensive data integration across years for more effective sustainability management goal-setting and implementation of corporate sustainable development.

Looking for CSR Report Examples? Visit Professional ESG Consultant "Sustaihub" Website

For more information and services about CSR/ESG reports, visit the Sustaihub website to apply for a trial. We offer the most comprehensive ESG database analytics and professional consulting services, along with the Syber Sustainability Management System to help companies prepare sustainability reports complying with the latest GRI standards. With keyword search functionality, we help you save 50% of preparation time and manpower costs, enabling more efficient corporate sustainability report completion while focusing on more sustainable business decisions.

Feel free to contact us anytime.