Consultant Column

Popular Keywords:

There are 10 results for "Corporate Governance Evaluation".

Dec 24, 2025

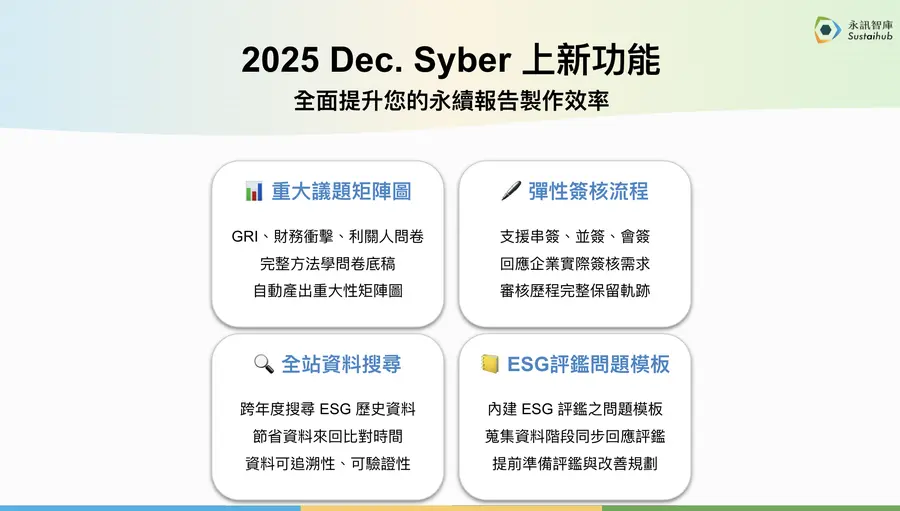

[December Syber Feature Update] Advanced Sustainability Governance: Enhancing Materiality, Verification & Internal Control Processes

對多數已成立永續專責部門的企業而言,永續報告早已不是陌生任務。

面對揭露標準、ESG 評鑑與內控要求年年增加,永續部門如何用永續績效管理平台與永續 AI 工具,讓重大性、查證與審核流程制度化?12 月新功能一次掌握。

Nov 12, 2025

TWSE ESG Evaluation System Officially Launched: Quick Guide to Key Updates

From the overall framework to the three dimensions of Environment (E), Social (S), and Governance (G), we bring you an in-depth analysis of this major institutional reform and key topics that companies should focus on.

Jul 09, 2025

ESG Reporting Errors May Lead to Penalties! Four Steps to Correct Data on ESG Digital Platform

Taiwan listed companies must complete ESG reporting annually. However, if errors are found after ESG information has been submitted and not corrected in time, companies may face fines of up to NT$1 million and reputational crisis. This article provides a complete analysis from penalties to the ESG information correction application process, helping ESG officers understand everything at once and reduce potential legal and reputational risks.

Jun 18, 2025

[2025 Latest] Complete Guide to ESG Filing: System Operations, Filing Timeline, and Common Report Deficiencies

If you are a domestic listed company, you must complete the sustainability report filing according to FSC regulations by the end of August 2025. This article will help you fully understand the latest ESG filing system, including digital platform functions, key timelines, and common error analysis, helping enterprises complete compliance tasks on time and painlessly.

Jun 05, 2025

From Disclosure to Decision-Making: How TWSE ESG Digital Platform Supports Corporate Sustainability Transformation

Facing the global sustainability wave and information disclosure trends, businesses and investors have increasingly urgent needs for ESG information. To help stakeholders more effectively grasp the sustainability pulse of Taiwanese companies and markets, the Taiwan Stock Exchange has launched the ESG InfoHub digital platform, integrating key sustainability data from official institutions to provide one-stop information inquiry and comparison functions.

May 21, 2025

Corporate Governance Evaluation Results Released! Countdown to ESG Evaluation Transformation: 2025 Latest Evaluation Items and Regulations at a Glance

The 11th (2024) Corporate Governance Evaluation results have been officially announced, and the evaluation system is about to transform. This article will help you quickly grasp the key points of the transition between old and new systems, as well as the new indicator content for the next corporate governance evaluation.

Mar 27, 2025

AI Digital Era: Are You Ready for ESG Digitalization?

Facing challenges such as increasingly stringent ESG regulatory requirements, rising difficulty in cross-departmental data integration, and complex and redundant report writing processes, if you are also wondering 'Can digital tools reduce the burden and improve efficiency?' This article provides a sustainability digital maturity self-assessment for your reference in evaluating whether your enterprise is ready to embark on ESG digitalization.

Dec 31, 2024

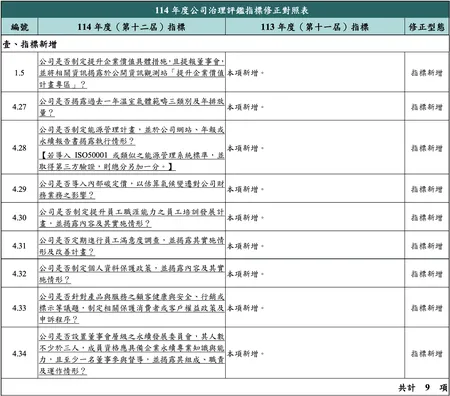

2025 Corporate Governance Evaluation Indicators Released: Sustainability Dimension Weighting Increased to 49%

The 12th Corporate Governance Evaluation significantly increases the 'Promoting Sustainable Development' dimension weighting to nearly 50%, with plans to officially transform into an 'ESG Evaluation' in 2026, demonstrating Taiwan's capital market's continued commitment to corporate governance mechanisms and sustainable development. This article explains the key modifications to this year's indicators to help enterprises prepare in advance and improve their evaluation performance.

Aug 29, 2022

ESG vs CSR: Understanding Sustainable Development and Corporate Social Responsibility

In recent years, ESG and CSR have become popular search terms, even appearing in Google's 2021 annual keyword queries. But what are they, how do they differ, and what's their relationship with corporate sustainable development? Let's break it down.

Apr 15, 2022

Introduction to TCFD and Its Four Core Elements

The Task Force on Climate-Related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) in 2015 to address climate change and the Paris Agreement, providing climate-related financial disclosure standards.

- 1