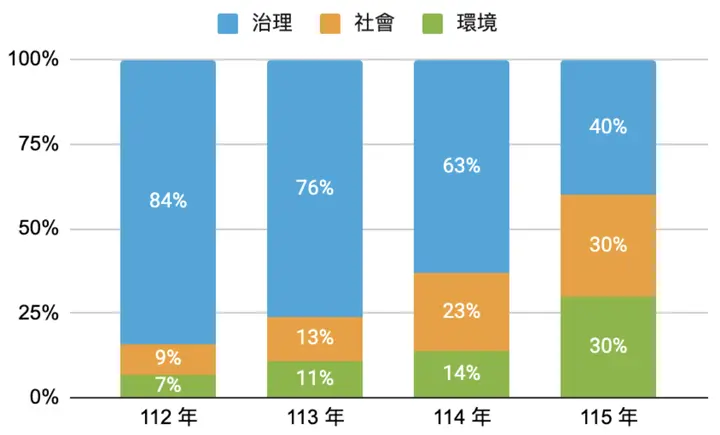

Taiwan Stock Exchange announced the 11th (2024) Corporate Governance Evaluation results at the beginning of this month. A total of 1,749 companies were evaluated, including 976 listed companies and 773 OTC companies. The regulatory authorities have adjusted multiple evaluation indicators for 2025, raising the sustainable development dimension weight to 49%; starting from 2026, the Corporate Governance Evaluation will be upgraded to ESG Evaluation. These changes indicate that companies need to plan ahead to continue achieving excellent results in evaluations.

Corporate Governance Evaluation Transforming to ESG Evaluation

To progressively guide companies to strengthen ESG information disclosure and sustainable transformation, the regulatory authorities decided to gradually incorporate environmental and social dimensions based on the current corporate governance evaluation framework. Taiwan Stock Exchange plans to officially rename the Corporate Governance Evaluation to "ESG Evaluation" when announcing the 12th (2026) evaluation indicators in Q4 this year, and announce the first ESG Evaluation results in April 2027.

2025 Evaluation Indicator Adjustment Highlights at a Glance

New Indicators

To guide companies to value shareholder value and actively communicate with shareholders:

- New indicator 1.5: "Formulate specific measures to enhance corporate value, report to the board of directors, and disclose relevant information in MOPS 'Corporate Value Enhancement Plan Zone'"

To encourage companies to strengthen greenhouse gas disclosure and implement decarbonization transformation to achieve net-zero sustainability goals:

- New indicator 4.27: "Disclose Scope 3 categories and annual emissions for the past year": Points awarded for disclosing 2024 Scope 3 annual emissions classified according to GHG Protocol or ISO14064-1, with data coverage noted (e.g., all facilities and subsidiaries)

- New indicator 4.29: "Implement internal carbon pricing": Must disclose pricing logic, encouraging companies to incorporate climate risks into financial and operational decisions

To encourage companies to value climate change issues and promote improved energy efficiency to reduce environmental impact:

- New indicator 4.28: "Formulate energy management plan," with obtaining energy management system standard certification listed as advanced bonus requirements

To promote companies valuing employee career development and interaction with employees:

- New indicator 4.30: "Formulate employee training and development plans to enhance employee career capabilities, and disclose training aspects, scope, content, and quantified inputs (such as hours, number of people, expenses, etc.)"

- New indicator 4.31: "Regularly conduct employee satisfaction surveys and disclose survey implementation (frequency, coverage rate, etc.) and improvement plan content"

To encourage companies to value consumer rights protection:

- New indicator 4.32: "Formulate personal data protection policy and disclose policy content, applicable subjects (at least including customers), responsible department, and implementation status (such as employee training hours)"

- New indicator 4.33: "Formulate consumer or customer rights protection policies and complaint procedures for issues such as customer health and safety, marketing, or labeling of products and services"

To encourage listed companies to establish sustainable development committees:

- New indicator 4.34: "Establish a board-level sustainable development committee with no fewer than three members, member qualifications should have corporate sustainability professional knowledge and capabilities, at least one director participates in supervision, and disclose its composition, responsibilities, and operations"

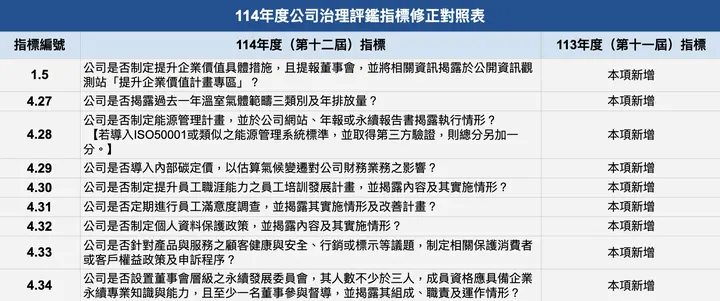

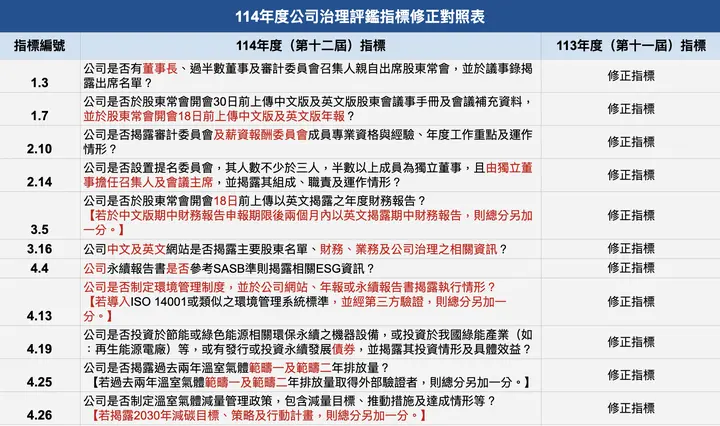

Revised Indicators

To continuously improve differentiation, consolidate indicators of similar nature, and adjust indicator wording to comply with domestic regulations and practices:

- Revise indicator 1.3 to "Chairman, majority of directors, and audit committee convener personally attend regular shareholders' meetings," and delete indicator 1.4

- Revise indicator 1.7 to "Upload Chinese and English versions of shareholders' meeting handbook and supplementary materials 30 days before regular shareholders' meeting, and upload Chinese and English annual reports 18 days before," and delete indicator 1.8

- Revise indicator 2.10 to "Disclose audit committee and remuneration committee member professional qualifications and experience, annual work priorities, and operations," and delete indicator 2.13

- Revise indicator 3.5 to "Upload annual financial reports disclosed in English 18 days before regular shareholders' meeting," and change indicator 3.6 "Disclose interim financial reports in English within two months after the Chinese interim financial report filing deadline" to advanced bonus requirements

- Revise indicator 3.16 to "Company Chinese and English websites disclose major shareholder list, financial, business, and corporate governance related information," and delete indicators 3.17 and 3.18

- Revise indicator 4.4 original advanced bonus requirement "Sustainability report references SASB standards to disclose related ESG information" to basic scoring requirement

- Revise indicator 4.19 to "Invest in energy-saving or green energy related environmental sustainability machinery and equipment, or invest in Taiwan's green energy industry (such as renewable energy power plants), or issue or invest in sustainable development bonds, and disclose investment status and specific benefits"

- Revise indicator 4.25 to "Disclose greenhouse gas Scope 1 and Scope 2 annual emissions for the past two years" with advanced bonus requirement revised to "Obtain external verification of greenhouse gas Scope 1 and Scope 2 annual emissions"

- Add indicator 4.26 "Disclose 2030 carbon reduction targets, strategies, and action plans" as advanced bonus requirements

How Should Companies Respond to Upgraded Disclosure Requirements?

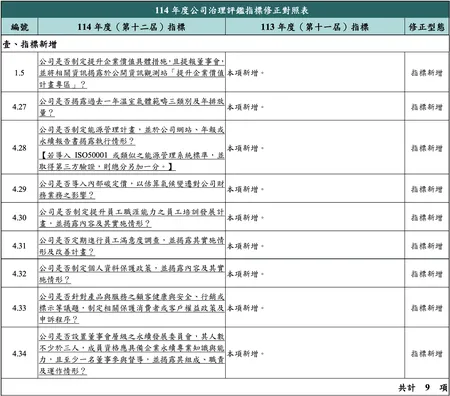

The 2025 corporate governance evaluation has revised a total of 9 new indicators, 11 revised indicators, and 14 deleted indicators. As sustainable development weight gradually increases and companies will face ESG evaluation in the future, content that companies need to disclose is no longer limited to one evaluation or one report. Sustainability reports, corporate governance evaluations, supply chain questionnaires, and international ratings are independent but highly overlapping in content.

If data is not integrated at the source, companies may face rework and additional labor costs. Therefore, using systematic management can achieve multiple applications from one data collection.

Leverage Digital Tools for Multiple Applications from One Data Collection

Sustaihub Syber Sustainability Management System supports multiple domestic and international frameworks, with three key features to help companies comply:

- Support for multiple frameworks: Provides the latest domestic and international regulatory frameworks and content including GRI, SASB, TCFD, Corporate Governance Evaluation, IFRS S1 & S2, etc.

- Flexible response to needs: Can upload custom frameworks such as supplier questionnaires and DJSI questionnaires according to corporate needs to inventory various requirements.

- Efficient multiple applications: Data can correspond to multiple international standards, achieving one input with multiple applications, improving data inventory efficiency.

Through Syber Sustainability Management System, store and classify all corporate sustainability-related data in a structured manner without spending extensive manpower and time re-inventorying and collecting related data, helping to reduce overall operation time, improve internal efficiency, and provide comprehensive support for sustainable development as the best sustainability report collaboration platform.

👉 Apply now for trial of Syber Sustainability Management System, start your digital sustainability journey

Through digitalization, AI and cloud integration, Syber Sustainability Management System helps you transcend traditional limitations, making your sustainability reports more persuasive and better able to demonstrate corporate spirit, becoming your assistant in promoting sustainable development.

Sources:

TWSE / Corporate Governance Center

TWSE / Listed Company Sustainable Development Action Plan and ESG Recent Promotion Measures

TWSE /2025 (12th) Corporate Governance Evaluation System Revision Summary

Reference: 11th (2024) Corporate Governance Evaluation Results