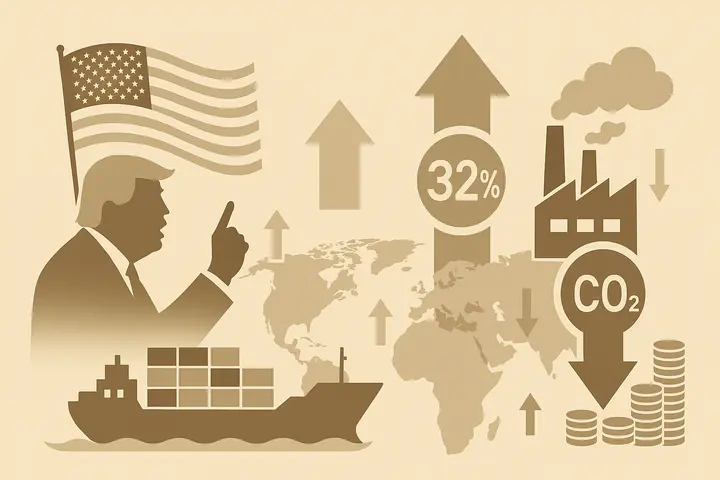

In April 2025, the Trump administration unveiled a global tariff policy that shook world markets, including imposing up to 32% reciprocal tariffs on Taiwan. However, just 13 hours after the reciprocal tariffs took effect, the policy made a U-turn—announcing a 90-day suspension for most countries, with tariffs uniformly reduced to 10% during this period. This major policy event with rapid adjustments in a short time highlights the high volatility, high risk, and high uncertainty of international trade and carbon policies.

In such times, what enterprises should do is not wait for policy stability, but plan ahead and adjust flexibly. This article will analyze the structural signals behind this tariff storm and propose how enterprises can strengthen survival resilience and export competitiveness through decarbonization and net-zero actions.

01 | Rising Global Policy Uncertainty: Tax Today, Withdraw Tomorrow, No One Knows

This "reciprocal tariff" event is one of the most dramatic policy reversals in modern international trade history:

- April 2, 2025: Trump announced 10% universal tariffs on 185 countries globally, with additional reciprocal tariffs up to 32% on trade deficit countries like Taiwan.

- Early morning April 9, 2025: Tariffs officially took effect.

- Same day afternoon: Trump announced "90-day suspension," maintaining 125% punitive tariffs only on China; other countries without retaliation could temporarily apply 10%.

This sudden U-turn caught markets and enterprises off guard. Enterprise-estimated cost structures, pricing strategies, and raw material scheduling instantly became invalid, supply chains chaotic, and customer responses confused. This is the concrete manifestation of "policy risk"—even mature developed economies cannot guarantee policy stability and consistency.

02 | New US Carbon Tariff Proposal: Evolved Green Protectionism Emerges

Not only are traditional tariffs aggressive, but the US is also formally deploying carbon tariffs. In April 2025, Republican Senators Bill Cassidy and Lindsey Graham proposed the Foreign Pollution Fee Act (FPFA), advocating for "carbon pollution fees" on foreign goods with carbon emissions higher than the US average, initially covering carbon-intensive industries such as aluminum, steel, cement, hydrogen, glass, and fertilizers.

Compared to the EU CBAM's unified tax rate, the US version adopts product carbon intensity tiered taxation, with estimated taxes on Chinese and Russian goods potentially exceeding 100%, while taxes on North American neighbors may range from 0% to 100%. This differentiated system reveals three strategic intentions:

- Combat carbon dumping from loosely regulated countries;

- Build a carbon advantage moat for US domestic manufacturing;

- Provide stable revenue sources to sustain tax cut policies.

In other words, the US has upgraded carbon tariffs from environmental tools to a composite leverage for industry and fiscal purposes.

03 | CBAM Only Delayed, Not Cancelled: Global Decarbonization Rules Still Taking Shape

Meanwhile, the EU CBAM system was originally scheduled to formally levy certificates in 2026, but due to complexity and market pressure, it was recently announced to be delayed until February 2027. The following simplification measures are being promoted:

- Exemption thresholds for 90% of small importers;

- Introduction of default value systems to reduce reporting burden;

- Exclusion of indirect emission calculations for some industries;

- Relaxation of certificate reservation ratios to reduce capital pressure.

But these are not abandonment, but "giving you time to prepare." The EU has clearly stated that CBAM will align with EU ETS, strengthen data verification and carbon footprint comparison, and gradually expand coverage.

At this stage where global net-zero governance is rapidly forming but regulations are not yet finalized, the only response strategy is "advance preparation".

04 | Taiwanese Enterprises Face Double Risks: Tariffs Plus Carbon Fees, Pressure from Both Sides

Taiwan currently has over 23% of its exports going to the US, and a large volume of high-carbon, high-tech products exported worldwide. In this storm, enterprises will simultaneously face:

- Tariff risk: If negotiations fail in the next 90 days, 32% reciprocal tariffs may "return" at any time.

- Carbon fee risk: Taiwan's carbon fee officially began collection in 2025. Although it has been recognized by EU CBAM as a deductible item, due to the currently low carbon price level (estimated starting at NT$300/ton), the actual deductible amount still needs to be determined based on EU calculation methods to be announced, posing potential cost risks for enterprises exporting high-carbon products.

- Data risk: CBAM requires product-level carbon emission information, and many SMEs have not yet established inventory processes. Data errors will directly affect the tax base.

Carbon and tariffs no longer operate independently but are gradually converging as the core axis of new global trade logic.

05 | Survive First, Then Advance to Net-Zero: Decarbonization is the Key to Enterprise Resilience Against Uncertainty

"Facing this tariff and carbon fee storm, the primary goal for enterprises is survival."

But how to survive? Enterprises cannot wait for policy clarity but must take action to lead the future.

Enterprises can start with these three points:

1. Establish carbon footprint data sovereignty before policies arrive

Inventory now, apply tomorrow. Enterprises should proactively implement product carbon footprint (ISO 14067) and organizational inventory (ISO 14064-1) processes to build internal carbon databases.

2. Build flexible export risk models

When tariffs fluctuate dramatically and carbon fee mechanisms are not yet in place, enterprises without multiple scenario analyses can only passively face market risks.

3. Leverage government and external resources

The Ministry of Environment has launched a NT$10 billion Green Growth Fund, encouraging "large companies leading small ones" to build domestic green supply chains. The Chinese National Federation of Industries has also called for strengthening talent training, expanding overseas markets, assisting industry upgrades, and providing training resources for industries facing digital transformation, AI applications, and net-zero transformation.

The key question is: Have you proactively joined this transformation journey?

Conclusion | Carbon Tariffs Are Not a Policy Issue, But a Survival Issue

When carbon costs have shifted from "internalizing externalities" to "international taxation," enterprises can no longer use past ESG thinking to face future trade realities. Europe is pushing, Asia is watching, and the US has made its move—global carbon borders are gradually forming, and truly export-competitive enterprises will be those who can provide credible carbon data, reduce carbon risks, and quickly respond to policy divergences.

The next round of globalization competition is no longer about who is cheaper, but who is lower carbon. Start now, or make up the test later.

References: