Global Trends in Financial Transparency and Sustainability Reporting

With the global emphasis on sustainable development goals, the introduction of IFRS S1 and S2 standards has significantly enhanced corporate reporting transparency, requiring companies to disclose not only financial performance but also comprehensive non-financial information related to sustainable development. Sustainability professionals play a key role in this process, helping companies understand and implement new regulations, enhancing report credibility, and helping companies build competitive sustainable business models. These changes are not just about compliance, but also convey to the market how companies manage ESG risks and opportunities while enhancing long-term value.

Core Requirements of IFRS S1 and S2

IFRS S1 requires companies to disclose risks and opportunities related to Environmental, Social, and Governance (ESG) in annual reports, explain sustainability strategies, risk management measures and performance, and present their relationship with financial results.

IFRS S2 focuses on climate change, requiring companies to disclose greenhouse gas emission data, reduction targets, and implementation steps. Combined, they provide unified guidance for companies, helping integrate sustainability strategies and strengthen risk management while improving financial and non-financial transparency.

How to Address IFRS S1 and S2: Practical Strategies for Sustainability Professionals

- Data Collection and Report Preparation

Collect accurate ESG data: Help companies collect Environmental, Social, and Governance (ESG) data from various departments, ensure data accuracy and completeness, and update regularly to meet IFRS requirements.

Prepare clear and transparent sustainability reports: According to IFRS S1 standards, integrate sustainability information such as carbon emissions, reduction targets, and risk management into corporate annual reports, ensuring report content is simple and clear for stakeholders to understand. - Climate Change Response and Carbon Reduction Plans

Set carbon emission reduction targets: According to IFRS S2, companies need to set specific carbon reduction targets and develop action plans, such as improving energy efficiency and using renewable energy.

Collaborative implementation: Cross-departmental collaboration to incorporate carbon reduction measures into daily company operations to ensure target achievement. - Integration into Corporate Sustainability Blueprint

Strategic integration of sustainability: Combine sustainability goals with core business strategies, promote green innovation and sustainable supply chain management, and enhance corporate market competitiveness.

Continuous learning and adjustment: Keep up with the latest regulations and standards, participate in professional training, ensure corporate sustainability strategies align with international trends, and continuously improve corporate sustainability performance.

Corporate Response Solutions

- Promote cross-departmental collaboration

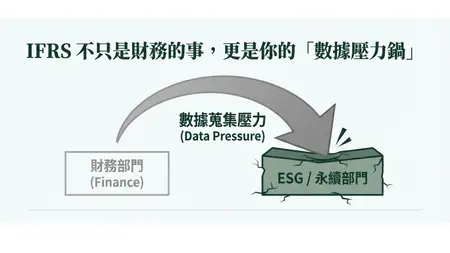

IFRS S1 and S2 involve multiple departments, and companies need to strengthen cross-departmental collaboration to ensure data sharing and consistency. Establishing a dedicated sustainability team or committee helps align sustainability goals with corporate strategy and drive policy implementation. - Resource allocation and budget planning

Implementing reporting requirements requires additional funding and manpower. Companies should plan resources based on financial conditions and sustainability needs, demonstrate return on investment to management, and balance short-term financial goals with long-term sustainable development. - Data consistency and digital tools

Sustainability professionals should help clarify data and establish unified formats to improve report transparency and trust. To address data inconsistency issues, companies should upgrade data management systems to ensure data is accurate and meets standards. For example, the Syber system provided by Sustaihub can comprehensively enhance corporate sustainability management.

Long-term Impact of IFRS S1 and S2

- Global Trend: IFRS S1 and S2 will become globally accepted sustainability reporting frameworks, driving companies to improve ESG transparency.

- Innovation and Investment: Companies will make more innovations and investments in climate change response, carbon reduction, and other areas to enhance sustainability.

- Continuous Learning: Sustainability professionals need to continue learning to keep up with the latest standards and ensure corporate competitiveness.

Key Role and Future Opportunities for Sustainability Professionals

With the implementation of IFRS S1 and S2 standards, the role of sustainability professionals will become more critical. They are not only executors following new regulations but also promoters and innovators of corporate sustainable development. In this rapidly changing environment, the ability to effectively master and respond to sustainability report requirements and integrate them with long-term corporate strategy will be key to corporate competitiveness.

Enhance Report Transparency and Efficiency: Sustaihub SaaS Services Help You Stay Ahead

Sustaihub's Syber Sustainability Management System provides the IFRS framework, helping companies effectively correspond to relevant indicators in data inventory to meet sustainability reporting requirements. The system has built-in audit processes to support companies in strengthening internal controls, ensuring data accuracy and consistency, and improving the efficiency of financial data collection, analysis, and disclosure. Through intelligent data integration and analysis, you can adjust report content in real-time to ensure compliance with the latest regulations and maintain competitive advantage amid regulatory changes. Try it now and seize the opportunity in sustainability management!