As global decarbonization trends accelerate, the EU Carbon Border Adjustment Mechanism (CBAM) has become a focal point for enterprises. CBAM will impose additional carbon fees on imports of high-carbon emission products, affecting global trade patterns. The EU began piloting CBAM in 2023, originally scheduled to take effect in 2026, but due to its complexity and to reduce financial risks, implementation has been proposed to be adjusted to 2027. As an export-oriented economy, many Taiwanese enterprises will face additional carbon costs, impacting their competitiveness. This article will explore how CBAM works, its impact on Taiwanese enterprises, and how businesses should prepare to mitigate risks.

What is CBAM? Understanding the EU Carbon Border Adjustment Mechanism

CBAM (Carbon Border Adjustment Mechanism) is an EU policy designed to promote global emission reduction goals, aiming to impose additional carbon fees on imported high-carbon emission products to ensure EU enterprises can compete with foreign enterprises under the same carbon pricing standards, preventing carbon leakage.

CBAM primarily targets high-carbon emission industries such as steel, cement, aluminum, electricity, fertilizers, and hydrogen. Enterprises need to calculate and declare carbon emissions during production, and importers must purchase CBAM certificates to offset carbon emission costs.

Impact of CBAM on Taiwanese Enterprises

High-carbon industries will face direct cost pressure

Taiwan's steel, cement, aluminum, and other industries exporting to the EU will be directly affected by CBAM, bearing additional carbon fees that may weaken competitiveness. Moreover, EU CBAM standards are becoming increasingly stringent, with more industries to be covered in the future.

Increased demand for supply chain management and carbon footprint transparency

Enterprises need to strengthen carbon inventory capabilities to ensure transparent carbon emission data across the supply chain to comply with EU reporting requirements. In the future, the EU may require importers to provide complete carbon footprint reports, and those who fail to comply will face trade barriers.

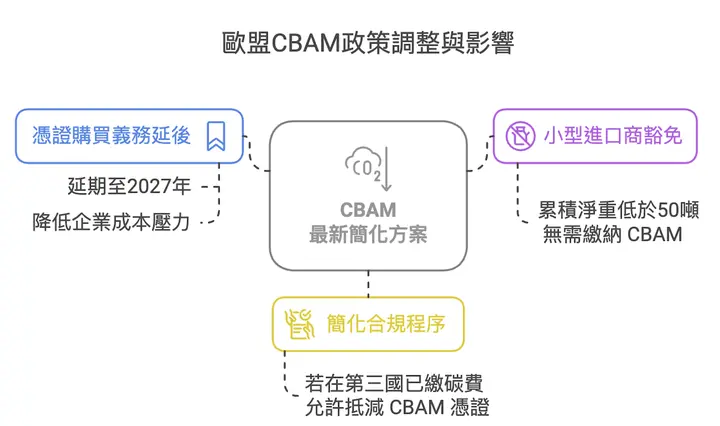

Latest CBAM Simplification Proposal

On February 26, 2025, the EU released the latest CBAM simplification proposal, aimed at reducing administrative burden for enterprises while ensuring the mechanism remains effective in preventing carbon leakage. Key changes in this adjustment include:

- CBAM Certificate Purchase Obligation Postponed to 2027

For CBAM launching in 2026, due to uncertainty among enterprises about the number of CBAM certificates needed, the EU has decided to postpone it to February 1, 2027, to reduce cost pressure from reporting and CBAM certificate payment. - Small Importer Exemption

A proposal to exempt enterprises with cumulative net weight of CBAM products below 50 tons annually from carbon tariffs. Enterprises below this threshold need not comply with CBAM requirements. This will exempt approximately 90% of importers (mostly SMEs) from compliance obligations while still covering 99% of relevant carbon emissions, ensuring environmental goals are not compromised. - Simplified Compliance Procedures

To offset CBAM certificates, enterprises are no longer limited to carbon fees from the product's country of origin. Enterprises may use carbon fees paid in third countries to offset CBAM certificates.

For example: If steel is imported from Country A and sold in the EU market, and the main raw materials for this steel were purchased by Country A from Country B, where carbon fees were already paid, enterprises can use those carbon fees paid in Country B to offset CBAM certificate costs.

A new legislative proposal is planned for early 2026, which may further expand CBAM's scope to cover more industries and products. This adjustment significantly reduces compliance costs for enterprises (especially SMEs) while maintaining CBAM's influence on global carbon emission reduction, ensuring the mechanism remains effective.

Note: The above information references the EU Commission's draft published on February 26, 2025. This draft may still change before approval.

Enterprise Strategies for Responding to CBAM

The core purpose of EU CBAM is to ensure that imported products' carbon emissions align with EU domestic production standards, preventing enterprises from gaining competitive advantages due to carbon cost differences. Therefore, enterprises that cannot provide transparent, accurate carbon data will be unable to enter the EU market and may even face high tariffs or trade restrictions.

Enterprises are recommended to start implementing in the following two directions:

- Enhance Carbon Inventory Capabilities

The first step for enterprises is to establish a complete carbon inventory mechanism, which not only enables timely response to customer requests but also helps enterprises comply with CBAM regulations, enhance corporate image, and reduce future penalties or additional costs due to incomplete data. - Reduce Carbon Footprint

Gradually invest in low-carbon production technologies, use green energy, and improve energy efficiency to reduce product carbon emission intensity, thereby reducing CBAM costs.

[Digital Tools] Helping Enterprises Enhance Carbon Inventory Capabilities and Quickly Respond to CBAM Requirements

Due to the complexity of carbon inventory data and information, if traditional Excel methods are used for calculations, any errors in formulas or carbon emission factors may affect the accuracy of carbon inventory data, thereby reducing data credibility.

Sustaihub's DCarbon Cloud Carbon System can automatically calculate enterprise carbon emissions and incorporates generative AI to assist in rapidly generating GHG inventory reports, effectively helping enterprises reduce report production costs by 30% and production time by 50%.

Additionally, when carbon inventory systems are integrated with enterprise energy management systems, it can significantly enhance enterprise carbon management efficiency, ensuring data is real-time and accurate, improving enterprise monitoring and decision-making capabilities. Sustaihub's DCarbon Cloud Carbon System is deeply integrated with FarEasTone EMS system, pioneering Taiwan's first one-stop solution combining EMS, carbon inventory, and generative AI, providing enterprises with efficient, intelligent carbon management services.

🌱 Sustaihub DCarbon Cloud Carbon System

✔ Six-step guidance: Complete inventory operations without experience.

✔ Intelligent calculation: Accurately calculate carbon emissions, reduce manual errors

✔ Report automation: Generate inventory reports that comply with EPA and FSC requirements

Carbon inventory is not only a necessary step for compliance but also an important milestone for enterprises to achieve sustainable operations. Sustaihub's DCarbon Cloud Carbon System helps you easily solve carbon inventory challenges and enhance industrial competitiveness! Apply for a 14-day free trial now to learn more about carbon management solutions and help your enterprise seize opportunities in the decarbonization era!

Fill out the form to get a 14-day free trial now!