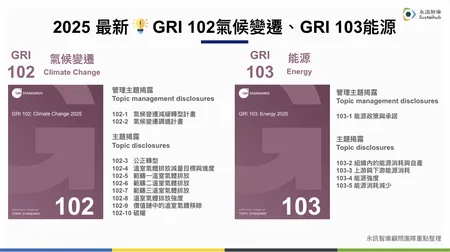

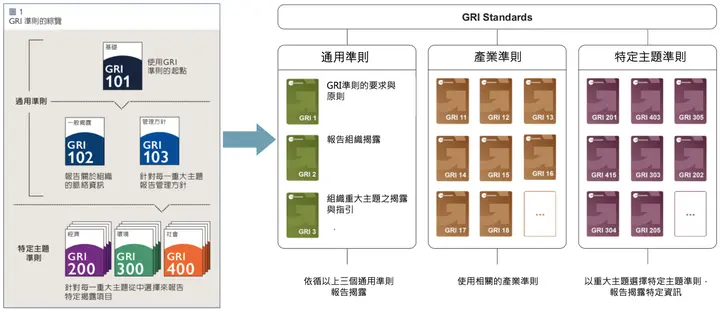

GRI 2021 Update

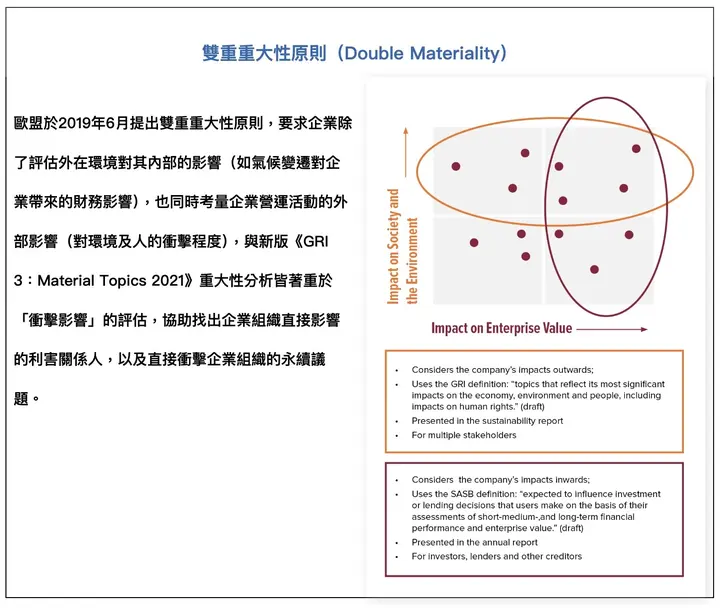

What's Different Between the New and Old Versions? Impact-Based Materiality Analysis

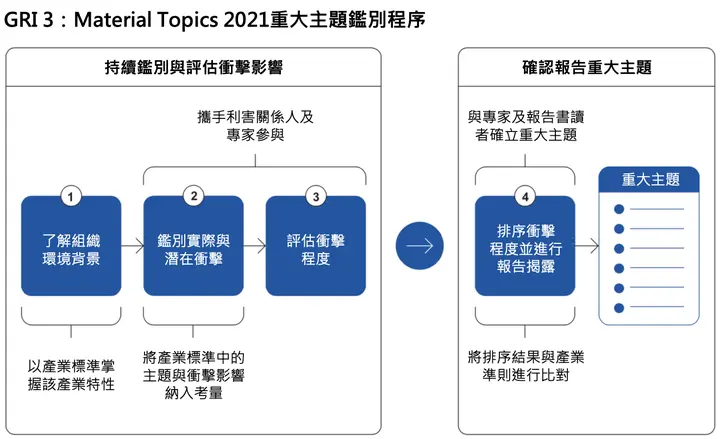

Compared to the GRI 2016 version, which identified material topics based on "stakeholder concern level" and "impact on environmental, economic, and social aspects," the new GRI 2021 places greater emphasis on organizations and stakeholders assessing "the significance of actual and potential impacts on the economy, environment, and people (including human rights)."

The analysis process is now divided into four major steps: understanding the organization's context, identifying actual and potential impacts, assessing the significance of impacts, and prioritizing impacts for reporting disclosure. The first three steps are routine sustainability impact identification for reporting organizations, while step four involves prioritizing material topics when preparing reports. Organizations must follow these four steps to regularly assess operational impacts and disclose management approaches in sustainability reports.

Reference international standards and GRI Sector Standards, engage with stakeholders and experts, routinely identify and assess actual and potential impacts across the value chain and operations, and prioritize impact significance as material topics when preparing sustainability reports.

1. Understanding Organizational Context — Gathering Sustainability Topics Relevant to the Organization

Organizations can examine their activities, business relationships, sustainability context, and stakeholders to compile sustainability topics related to their operations.

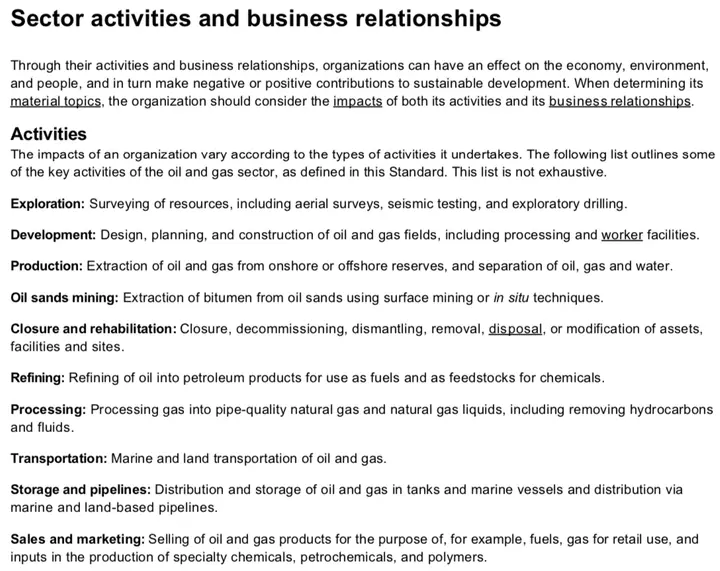

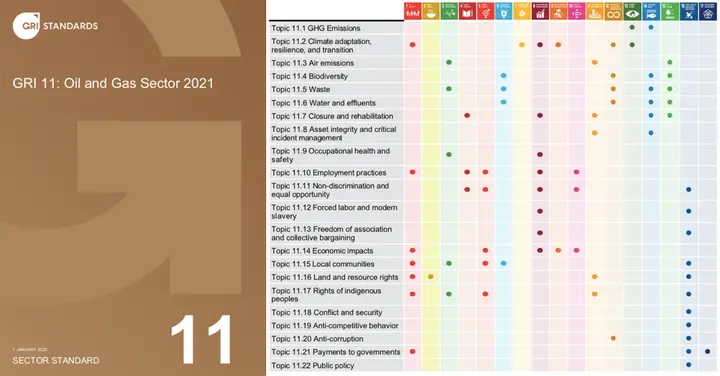

GRI 11: Oil and Gas Sector 2021

Common operational activities in the oil and gas sector include exploration and production, refining, storage and transportation, and sales and marketing. Organizations should consider the actual and potential positive and negative impacts of these activities.

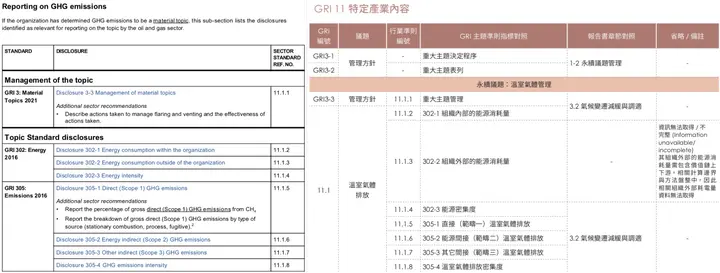

GRI plans to release 40 Sector Standards. As of August 2021, 4 Sector Standards have been released: Oil and Gas, Coal, Agriculture, Aquaculture and Fishing, and Mining. Using GRI 11: Oil and Gas Sector 2021 as an example, there are 22 sector topics, each linked to one or more GRI Topic Standards. When organizations identify a sector topic as material, they must disclose according to the sector topic requirements. For example, Formosa Petrochemical identified Sector Topic 11.1 Greenhouse Gas Emissions as a material topic and responds to GRI 302 Energy and GRI 305 Emissions in their report.

GRI 11: Oil and Gas Sector 2021

GRI 11: Oil and Gas Sector 2021 (left); GRI 11: Oil and Gas Sector 2021 Sector Topics linked to UN Sustainable Development Goals (right)

GRI 11: Oil and Gas Sector 2021 Sector Topics and Formosa Petrochemical Disclosure

GRI 11: Oil and Gas Sector 2021 Sector Topic 11.1 Greenhouse Gas Emissions is a material topic for Formosa Petrochemical's 2021 Sustainability Report, which responds to GRI 302 Energy and GRI 305 Emissions as required by the sector topic.

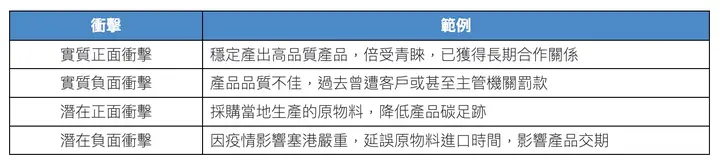

2. Identifying Actual and Potential Impacts — Positive/Negative Impacts Across Three Dimensions

This step identifies how operational activities and value chains actually and potentially impact the economy, environment, and people (including human rights). Actual impacts refer to events that have already occurred, while potential impacts are risks that have not yet materialized. Organizations must also identify both "positive" and "negative" impacts on the economy, environment, and people.

Organizations can incorporate sustainability topics from Sector Standards into their identification process, considering what impacts each topic may bring, and seeking input from experts and stakeholders to help comprehensively identify operational impacts.

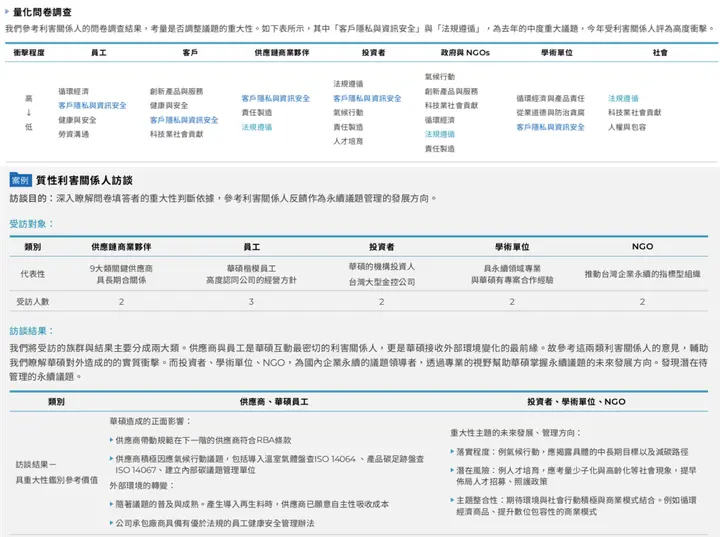

ASUS Sustainability Report (2021) Stakeholder Impact Survey

Surveying stakeholders on sustainability topic impact levels through questionnaires, while conducting in-depth interviews with key stakeholders and experts to integrate diverse perspectives.

All operational activities may bring both positive (benefits) and negative impacts. Taking renewable energy as an example, besides reducing greenhouse gas emissions and air pollution, surplus green electricity can be fed into local power systems, allowing local communities to enjoy clean energy, bringing positive environmental benefits. However, if renewable energy plants are built in environmentally sensitive areas causing ecological disasters, this creates negative environmental impacts. Organizations must note that positive benefits and negative impacts cannot offset each other and must be separately assessed in the next step.

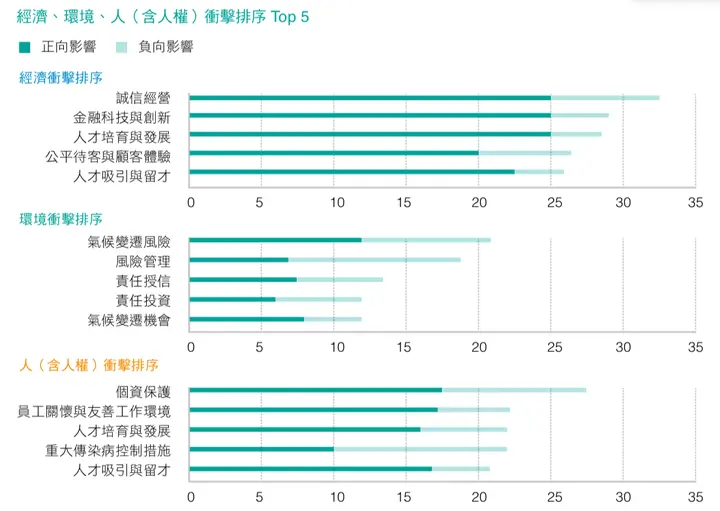

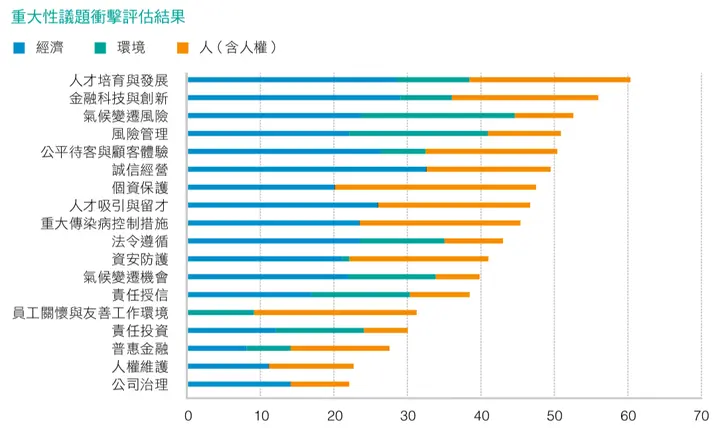

E.SUN Financial Holdings Sustainability Report (2021) Economic, Environmental, People Positive/Negative Impact Ranking

Identifying positive and negative impacts of sustainability topics, totaling and ranking overall impact significance.

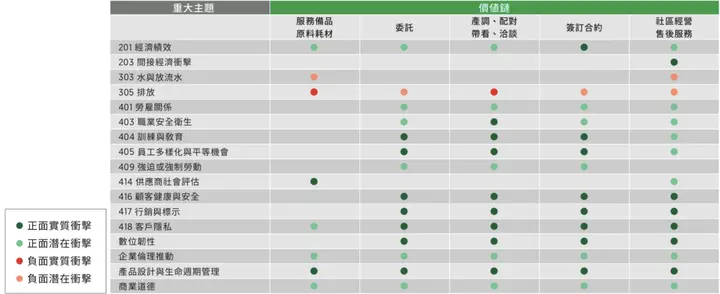

Sinyi Realty Sustainability Report (2021) Value Chain Positive/Negative Actual and Potential Impacts

Identifying positive and negative actual and potential impacts brought by value chain activities.

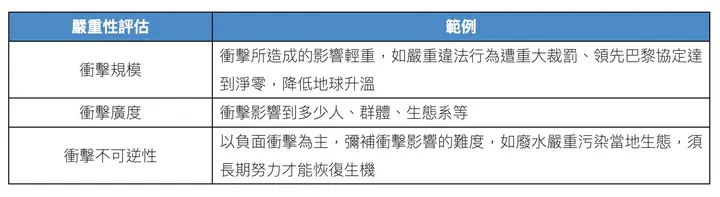

3. Assessing Impact Significance — Severity and Likelihood

Assess the significance of actual and potential positive/negative impacts identified in the previous step, considering the severity and likelihood of impacts on the economy, environment, and people (including human rights). Severity is assessed based on scale, scope, and irremediability, while likelihood is evaluated by probability or frequency of occurrence.

Since some negative impacts may have low probability of occurrence but cause severe consequences when they do occur, when assessing negative impacts with high severity, impact severity should take precedence even if likelihood is low. For example, nuclear plant radiation leaks are unlikely to occur, but once they do, they cause catastrophic damage to humans and ecosystems. Consulting experts and stakeholders can improve opinion diversity and ensure organizational operations align with stakeholder well-being.

E.SUN Financial Holdings Sustainability Report (2021) Impact Assessment Method

Quantifying positive/negative impact severity and likelihood on a 1-5 scale.

Formosa Petrochemical Sustainability Report (2021) Financial Impact Severity and Likelihood

Identifying financial impact severity and likelihood.

4. Prioritizing Impacts and Reporting Disclosure — Determining Material Topics

After assessing impact significance, it is recommended to separately rank positive and negative impact significance and define topics with impacts above a certain threshold as material topics for reporting disclosure. It is advisable to cross-reference with GRI Sector Standards to check for any overlooked sector topics equally important to the organization, consult experts and stakeholders, and have senior management review and approve before disclosing management approaches for material topic impacts in sustainability reports.

Six Corporate ESG Report Materiality Analysis Examples

GRI 3: Material Topics 2021 does not mandate specific formats for materiality matrices, so organizations meeting the impact assessment methodology described above comply with the new materiality analysis requirements. Below are materiality analysis processes and matrix presentations from 5 leading Taiwanese companies and 1 multinational corporation. Four of these companies have also adopted the Double Materiality principle from the Draft European Sustainability Reporting Standards (ESRS), assessing both impacts on the organization from sustainability topics and impacts from the organization on external stakeholders, aligning with international sustainability reporting standards.

Further reading: EU Releases First ESRS Sustainability Reporting Standards, Combining Sustainability and Financial Features

(Right image source: Why Companies Should Assess Double Materiality)

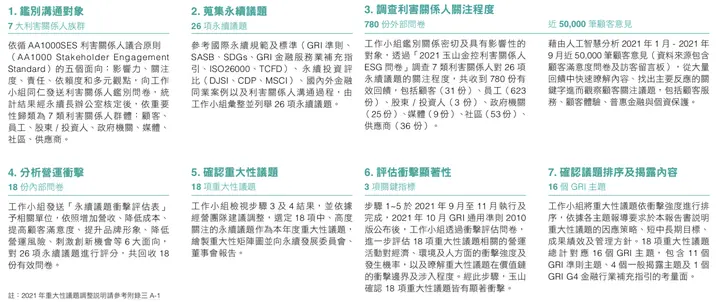

【E.SUN Financial Holdings】Screening Medium-High Concern Topics for Further Significant Impact Assessment

Identified 26 sustainability topics and used "Stakeholder Concern Level" and "Operational Impact Analysis" to screen 18 medium-high concern topics. Further assessed the 18 topics' impact severity on economy, environment, and people (human rights), likelihood, and value chain influence, confirming all 18 topics have significant impacts on E.SUN Financial Holdings.

E.SUN Financial Holdings Sustainability Report (2021)

E.SUN Financial Holdings Sustainability Report (2021) Materiality Assessment Process

E.SUN Financial Holdings Sustainability Report (2021) Materiality Topic Impact Assessment Results

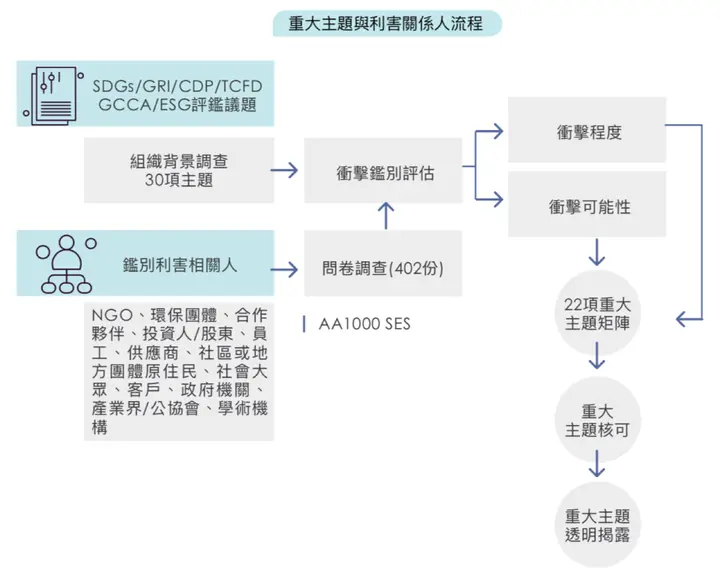

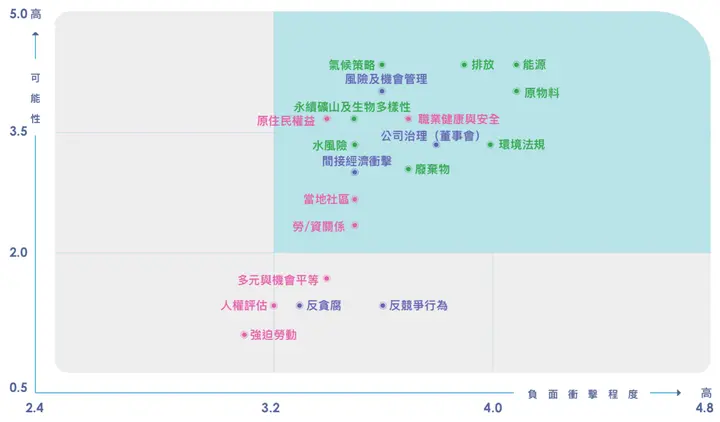

【Asia Cement】Partnering with External Experts for Positive/Negative Impact Assessment

Identified 30 actual and potential impacts on economy, environment, and people, including human rights impacts. Conducted stakeholder surveys and had the Corporate Sustainability Committee perform impact analysis, while seeking external expert assessment of potential positive and negative impacts on economy, environment, and people, ultimately determining 22 material topics.

Asia Cement Sustainability Report (2021)

Asia Cement Sustainability Report (2021) Materiality Assessment Process

Asia Cement Sustainability Report (2021) Negative and Positive Impact Ranking

Asia Cement Sustainability Report (2021) Negative Impact Severity and Likelihood Matrix

Asia Cement Sustainability Report (2021) Positive Impact Severity and Likelihood Matrix

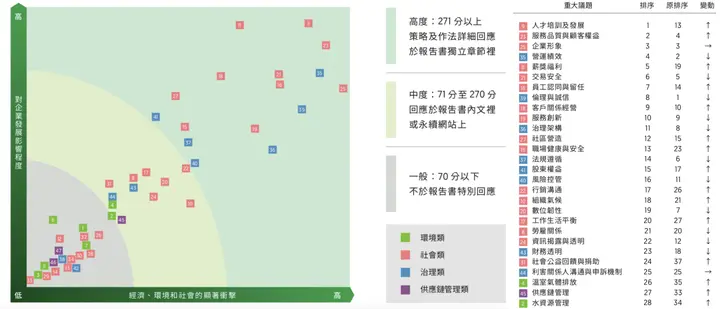

【Sinyi Realty】Incorporating SASB Material Topics for Double Materiality Assessment and Core SDGs Selection

Identified 48 sustainability topics and analyzed "Stakeholder Concern Level." Internal experts and senior management assessed each topic's "Significant Impact on Economy, Environment, and Society" and "Impact on Corporate Development," consolidating 28 material concern topics. Topics were integrated with GRI Topic Standards, SASB Material Topics, and Sinyi-defined topics, resulting in 17 material topics. Additionally, Sinyi Realty assessed value chain impacts on 17 SDGs and selected 10 core SDGs with corresponding management measures.

Sinyi Realty Sustainability Report (2021)

Sinyi Realty Sustainability Report (2021) Materiality Assessment Process

Sinyi Realty Sustainability Report (2021) Materiality Matrix

【ASUS】In-Depth Stakeholder Interviews with Double Materiality for Material Topic Selection

Identified 16 sustainability topics, conducted impact questionnaire surveys and in-depth interviews with stakeholders, and used double materiality analysis to assess the impact of sustainability topics on ASUS and the impact of sustainability topics on external economy, society, and people, ultimately selecting 6 highly material topics with management approaches and targets tracked quarterly.

ASUS Sustainability Report (2021)

ASUS Sustainability Report (2021) Materiality Assessment Process

ASUS Sustainability Report (2021) Materiality Matrix

Using double materiality principle to assess ASUS's "Impact on Economy, Environment, and People" and "Impact of Sustainability Topics on ASUS."

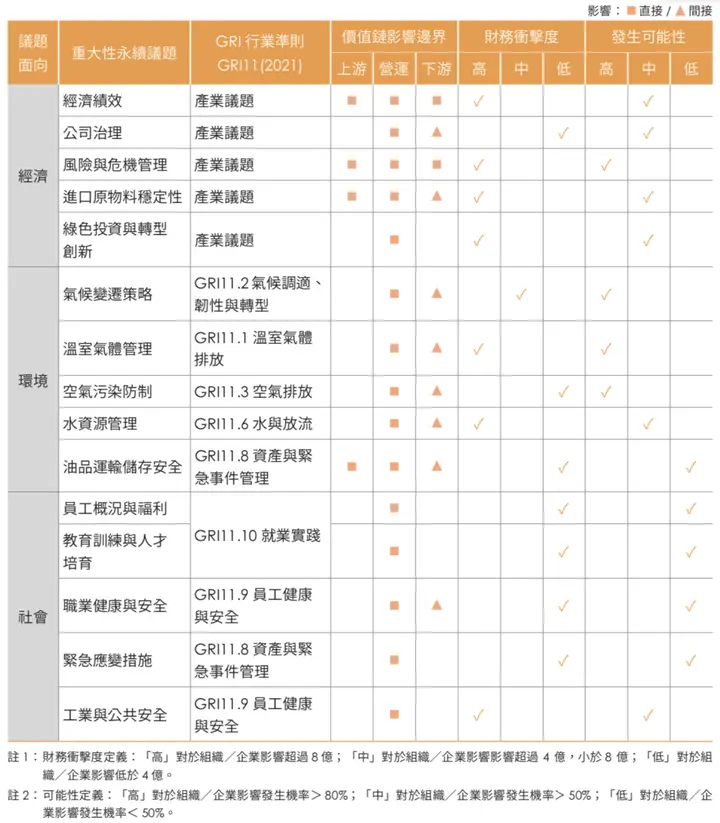

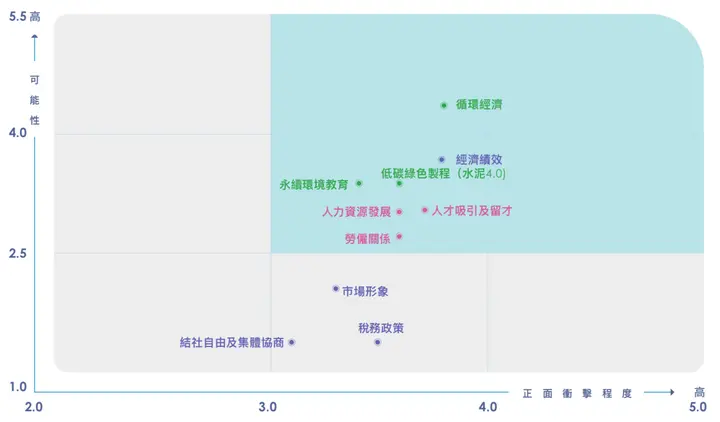

【Formosa Petrochemical】Double Materiality Analysis for Impact Significance and Likelihood with Sector Standards Adoption

After identifying 30 sustainability topics, analyzed "Stakeholder Concern Level" and "Impact on Company Operations" dimensions to screen 15 medium-high topics. Further examined topic impact significance and likelihood through double materiality analysis and cross-referenced with GRI Sector Standards to establish 15 material topics.

Formosa Petrochemical Sustainability Report (2021) Materiality Assessment Process

Formosa Petrochemical Sustainability Report (2021) Materiality Matrix

Materiality matrix presented with "Topic Impact on Company" and "Stakeholder Concern Level."

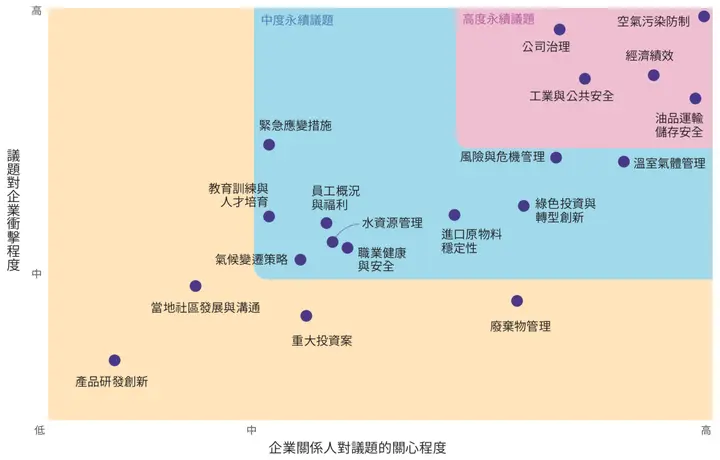

【Philip Morris International】Double Materiality Analysis with Third-Party, Emphasizing Stakeholder Input

Philip Morris International (PMI), a global tobacco industry leader, despite the significant harm tobacco products cause to the environment and human health, has many aspects of its materiality assessment approach worth learning from. Organizations can study PMI's assessment process and presentation methods to consider which steps can be integrated into their own materiality processes.

PMI collaborated with external third parties on materiality analysis, referencing international standards and local operational analysis results to identify 22 sustainability topics, inviting stakeholders to rank topics by importance. External experts were consulted to assess PMI's impacts on value chain, environment, and society, while analyzing financial value impacts from ESG risks and opportunities. Ultimately, 9 material topics were selected, including 3 topics that may not significantly impact the company but were highly concerned by stakeholders: Materials and product eco-design, Socioeconomic well-being of tobacco-farming communities, and Post-consumer waste.

Philip Morris International Sustainability Materiality Report (2021)

Philip Morris International Sustainability Materiality Report (2021) Materiality Assessment Process

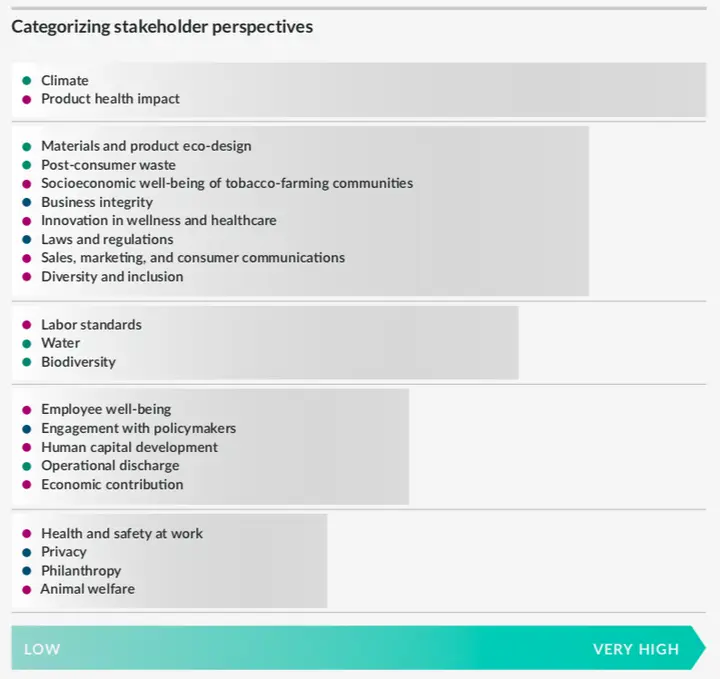

Philip Morris International Sustainability Materiality Report (2021) Stakeholder Concern Level

Chart clearly presents stakeholder ranking of top 10 most important sustainability topics.

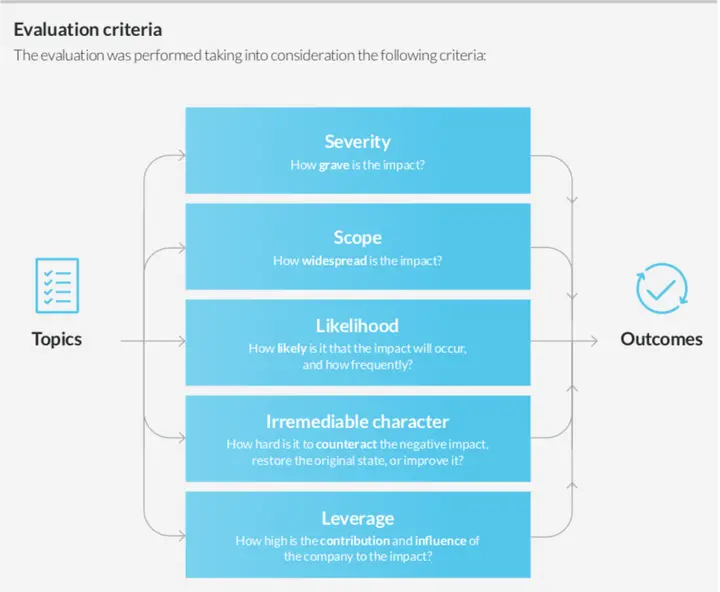

Philip Morris International Sustainability Materiality Report (2021) Impact Assessment Criteria

Chart clearly shows PMI assessing value chain impacts using severity, scope, likelihood, irremediability, and impact weighting.

Philip Morris International Sustainability Materiality Report (2021) Supply Chain and External Impact Significance

Using severity, scope, likelihood, irremediability, and impact weighting to assess value chain impacts for all sustainability topics, presenting results by icon size (left) and ranking impact significance (right).

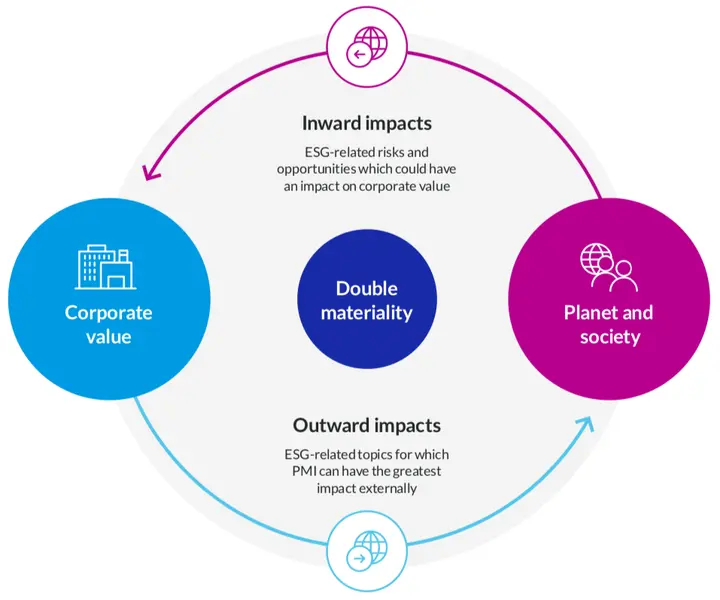

Philip Morris International Sustainability Materiality Report (2021) Double Materiality Principle

Chart simply explains double materiality principle, helping report readers understand.

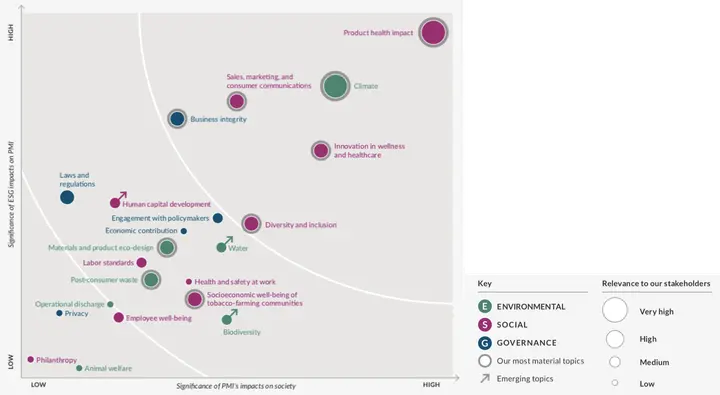

Philip Morris International Sustainability Materiality Report (2021) Materiality Matrix

Using icon size to represent stakeholder concern level, with gray circles indicating final material topics. Comparing with previous materiality analysis results, arrows show topic movement direction.

All corporate examples above were compiled using keyword searches in the "Sustaihub ESG Big Data Database," containing 10,000+ domestic and international corporate sustainability reports, helping companies quickly find industry peer and benchmark examples through keywords. Additionally, the "Sustaihub Syber Sustainability Management System" has launched the latest GRI 2021 Universal Standards, helping cross-reference GRI old and new indicators to keep companies up-to-date with the latest GRI Standards. Departmental staff can directly use the "Syber Sustainability Management System" for collaborative sustainability report editing, saving time and manpower costs spent on collecting cross-departmental data through Excel, Word, and email exchanges, enabling more efficient information consolidation, sustainability report production, and related business decisions.

Apply for a trial now to experience Sustaihub's ESG Big Data Database and Syber Sustainability Management System convenient services, making sustainability report writing no longer a hassle.